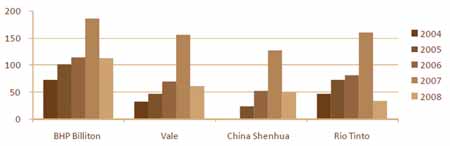

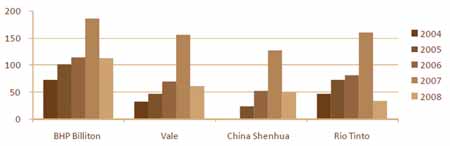

Top Four mining company market capitalization at the end of 2008, showing the drastic drop in value over the

previous boom years. Source: Review of Global Trends in the Mining Industry—2009, PricewaterhouseCoopers.

Measuring Mining’s Financial Loss from 2008

The market capitalization of the top 100 companies declined marginally from $20.2 billion on June 30, 2007, to $18.1 billion a year later. But by the end of November 2008, the market capitalization of the top 100 had plummeted to $4.1 billion as the global financial crisis worsened and investors fled this high-risk sector, according the annual PricewaterhouseCoopers (PwC) Junior Mine, a review of trends in the TSX-V mining industry.

According to the survey, the market capitalization of the mining sector fell 27% to $29.4 billion during the year ended June 30, compared with a decline of just 5% for the TSX-V as a whole. Moreover, the share of the TSXV market capitalization represented by mining companies dropped from 65% to 50% over the year as investors shunned higher risk exploration companies, which make up the majority of mining listings on the TSX-V.

“But if the first half of 2008 was challenging, the worst was yet to come,” said Paul Murphy, PwC Canada’s mining leader. “By September 30, the mining sector’s market capitalization had plummeted to $15.3 billion and, by November 30, to $7.9 billion, a 73% decline in the five months to the end of November 2008.”

Even the production companies among the top 100 recorded a negative EBITDA of $170.8 million for the year ending June 30, 2008, compared with a gain of $59.5 million during the same period in 2007. Sources of financing also began to dry up, leaving companies with limited cash to finance their exploration and development projects. Overall cash was down $443 million and liabilities increased $1.1 billion. In the year ended June 30, 2008, cash from share issuance dropped to $2.23 billion from $2.97 billion in 2007. Despite this decline, spending rose slightly with $202 million ($184 million in 2007) expensed on exploration and $1.23 billion ($1.20 billion in 2007) capitalized on properties, plants and equipment as the cost of doing business rose.

In terms of representation on the TSX-V, mining’s significance remained intact, with the number of companies falling only slightly to 44% of the 2,395 listed companies from 47% in 2007. In fact, the number of mining listings actually rose from 1,057 on June 30 to 1,085 on November 30. “This reinforces the notion that market capitalization among the sector did not decline because the TSX-V was losing mining companies, but because the listed companies were collectively losing share value,” said Murphy.

The report contends the global financial crisis of 2008 shattered the junior mining industry in Canada and around the world. There could be no clearer indicator of this devastation, it notes, than the market capitalization of mining companies on the TSX-V, which fell from $40 billion on June 30, 2007, to $7.9 billion on November 30, 2008, a decline of 80%. Most of this loss happened between June and November, 2008 as investors bailed out of equities, especially high-risk ones, and engaged in tax-loss selling.

Production companies also suffered from lower commodity prices in the latter half of 2008 that further squeezed profit margins already reduced by the high cost of labor, equipment and energy. Financing from both the debt and equity markets dried up, making it virtually impossible for explorers and developers to raise money for their projects. Companies with proven resources have had better success raising financing, but they have had to accept far more stringent terms such as larger hedging obligations.

The report notes that until confidence in the market returns and investors are willing to shoulder risk again, many projects will remain dormant. Some companies without proven resources will disappear altogether as they run out of money to cover even the most basic administration.

“Other juniors will become takeover targets, although even majors with enough cash for purchases appear to be taking a wait-and-see approach while their own survival continues to be jeopardized by a commodity bear market,” said Murphy.