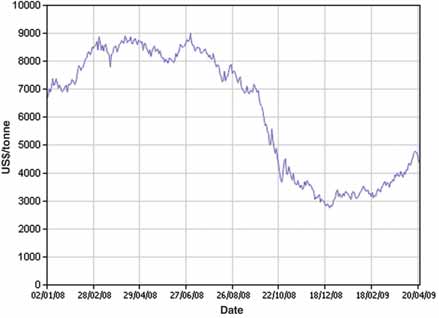

Copper prices 2008-2009.

Executives Express Moderate Optimism at Copper Summit

Sorting through what happened in 2008, experts agree that the world copper market

is back on track and expect to see a steady improvement

By Oscar Martínez Bruna, Latin America-based Editor

The industry reacted quickly. Mining companies that were posting record profits earlier in the year reverted to austerity mode, idling higher cost operations, and announcing layoffs for the first time in several years. Copper production volumes were reduced to match an expected drop in demand. Many of the copper development projects were postponed.

Those measures along with an expected increase in consumption from Chile’s largest trading partner, China, have allowed the industry to breathe a sigh of relief. Already this year, copper is trading at more than $2/lb, which is a more than 50% improvement since the beginning of the year.

Against that backdrop, many Copper producers, analysts, financiers and traders gathered in Santiago, Chile, during early April for CRU’s 8th World Copper Conference. CRU Events are internationally renowned as first class conferences within the global metals and mining sectors. At this year’s conference, there was a general consensus indicating that the copper industry would tend to return to a more stable state in terms of prices and market conditions.

The conference was officially opened by the Chilean Minister of Mines, Santiago González, who compared the performance of 2008 with a less optimistic 2009. However, according to González, the larger mining companies are keeping their portfolio of investments in Chile, in spite of the current crisis. “The Chilean government had the vision to save during the good times, allowing for a different scenario in the near future,” González said.

Even some of those who were not very optimistic agree that the fundamentals for long-term improvement are sound. Bart Melek, vice president and global commodity strategist from BMO Capital Markets, thinks that demand will be poor and that the copper market should correct itself in the medium/long term. “However, the price correction is unlikely to test recent lows as financial conditions are improving and secondary supplies are sliding due to relatively low prices,” Melek said. “BMO also sees fairly strong strategic buying of the metal from China to rebuild stocks depleted over the last several years [copper will be needed for China’s aggressive infrastructure program as well] and to hedge its foreign reserves against possible unfavorable currency moves in the future.”

As the market rebounds during the next three years, copper production is expected to grow in South America (Chile, Peru and Argentina) and Africa (Congo and Zambia) from the development of new projects. In turn, Asia will continue to be the largest consumer as copper refineries expand in China and India.

The Cyclical Nature of

the Copper Business

Sharing the leading copper miner’s vision

for the future, José Pablo Arellano, president

and CEO of Codelco, explained how

the copper mining industry had to change

in a quick and sudden manner last year.

“In terms of copper prices and stocks in metal, we understand that they are cyclic,

and they change accordingly,” Arellano

said. “If we look further, and analyze the

copper prices and stocks over the last 50

or 60 years, we can see something that we

all understand. We will see that the cycle

we are experiencing now is not new. In

fact, we have gone through cycles similar

or even worse than this one in the past.

The difference now is that we all are more

prepared to deal with these kinds of situations,

and we could consider that as a relative

strength for our industry.”

Reviewing the trends of prices and stocks, Arellano showed how the market follows the basic supply-demand fundamentals, where prices drop as stocks accumulate. “However, the level of stock accumulated now is comparatively lower than in previous cycles,” Arellano said. “Considering the production, consumption and refined copper balance worldwide, unlike the situation experienced in 2004, which was characterized by a positive differential evidenced by a lower production and a higher consumption trend, this year the balance shows the opposite. The difference is that this time the miners responded very quickly compared with previous cycles.”

Codelco does not feel that the current price drop will be an obstacle for the company’s investment plan for this year, estimated at $2 billion for mines and expansion projects. According to Arellano, the urbanization in emerging countries is going to encourage copper production in the medium and long term, and China will maintain a significant demand on a sustained growing basis.

One problem Codelco faces is a steady drop in the average ore head grades, Arellano explained, but the company has been investing in efficiency improvements and technology. “In the past, the copper industry was pro-cyclical and now there is a modern counter-cyclical approach being applied to attenuate the crisis,” Arellano said. Codelco’s current reserves and resources are estimated at more than 70 years, based on 2009 production levels.

According to BHP, the cost curve of world copper production as an average for 2008 shows that power costs for cathode production are higher than power costs involved in concentrate production. “This would be evidenced if we look at a typical cost structure of Chilean copper operations that includes the three main cost items in a typical copper operation; i.e. labor, consumables and power,” Hernández said.

Also, Hernández explained that Chilean copper production is approaching maturity. Through the years, the head grade has continued to decline, the hauls have become longer, and the secondary enrichment and leachable material is mostly depleted—the latter is applicable to primary ores.

“Maturing operations also require a significant capital investment to sustain production levels and/or to stay in business,” Hernández said. “This translates into larger plant capacity, increased fleet size and more investment in infrastructure items such as power and water.”

In areas where Chilean production is approaching maturity, however, the business is solid and well established, and operations primarily focus on cost control for the short term. “The Chilean mining industry is competitive and should keep a meaningful copper market share for many years,” Hernández said.

Consumption: Structurally

Vulnerable?

Jon Barnes, principal consultant on copper

manufacturing from CRU, believes that

copper has been overtaken by events. He

thinks that the message from the last 12

months is very clear: “Don’t take copper

demand for granted,” Barnes said.

“There’s no evidence that things will go

better for the rest of the year.” He actually

projected a 15% to 20% fall in consumption

this year and encouraged marginal

producers to halt work to limit supply.

The world copper industry, according to Barnes, should put some pressure on the appropriate authorities to modify some laws and improve the energy efficiency in the copper market. This would provide an extra support to the copper demand and would also be beneficial for the environment.

He suggested looking for demand accelerators to raise intensity of copper use. “Some examples of these accelerators would be to encourage power utilities to invest to expand and strengthen their distribution networks counter-cyclically, intensify lobbying efforts for governments and legislators to enact higher efficiency standards for buildings, appliances, automobiles etc.,” Barnes said. He also gave some new ideas to expand the market by finding new uses for copper. As an example, the pharmaceutical use of antimicrobial copper. Copper’s antimicrobial properties have been exploited for a long time, and now they are being considered for healthcare, since copper has the intrinsic ability to kill a variety of potentially harmful pathogens.

A demand recovery is too late to save 2009, as it has dropped to a 20% decrease from a 15% decrease. Barnes’ forecast for the period 2010-2012 is much more positive though. Apparently, the short term outlook is very challenging, but industrialization will make the future look brighter in the long run.

Total world sulphuric acid is approximately 200 million metric tons per year (mt/y), and China has the highest global supply/ demand for sulphuric acid. In turn, mine heap leaching demand for sulphuric acid is very high in South America. “For the smelting process, we generate 3 tons of sulphuric acid per ton of copper produced. As for the leaching or electro-winning process, we need 4 tons of acid to produce one ton of metal.”

A virtual integration between mining and smelting companies could be a new and different approach, and they would have the opportunity to work together to ensure the stability of their inputs and outputs. “It would be very beneficial to have more integration between concentrate producers and sulfuric acid producers,” Targhetta said.

“Worldwide sulphuric acid production fell to 195.8 million mt in 2008 vs. 200 million mt,” said Joanne Peacock, research manager-sulphur and sulphuric acid for British Sulphur Consultants. “The supply of sulphuric acid from copper smelting represents the largest involuntary source; and copper producers do not have, or have few in-house, sources for sulphuric acid. Lower acid prices are likely to prevail in the short to medium term, helping copper producers to keep that operating cost relatively low.”

Captive acid production from the copper industry will continue to outweigh copper industry demand for sulphuric acid. “The main components of domestic demand in developed economies deteriorated significantly at the end of 2008, and weakness in demand exacerbated involuntary [captive] stock increases,” Peacock said. “There will be more supply than internal demand.” Despite growth in copper leaching, smelting remains the dominant technology for copper production.

Identifying Hidden

Opportunities

Ultimately, those who invest during a down

market reap the greatest rewards. Marcelo

Awad, CEO, Antofagasta Minerals S.A.,

explained that his company has continued

doing business even in poor market conditions,

building a solid base with a clear

strategy. The company has continued to

develop itself even when copper prices

have been below the current levels.

Antofagasta Minerals has kept a strong position by maintaining financial solidarity, paying its taxes, generating shareholder confidence through dividends, and achieving high standards with competent people in stimulating environments. “We feel confident because we own very good and solid assets such as Los Pelambres, El Tesoro, and the Esperanza,” Awad said. He explained that the company is defined by three strategic pillars: security by strengthening the business base, particularly during bad times; and organic and sustainable growth of the base business. “The company expects to grow beyond the base business.”

Antofagasta Minerals is still looking for future opportunities in Chile. “Our main assets are located in Chile, and we keep looking for projects at different stages of development,” Awad said. “Additionally, the company is analyzing new opportunities throughout the world, primarily early stage copper projects.” If a real opportunity presents itself, they will buy an operating mine.

According to Awad, the successful performance of Antofagasta Minerals is based on exploiting the cycles of the mining industry, a medium- and long-term vision, building a solid position for exploiting boom cycles, maintaining financial strength in low cycles, keeping operational efficiency for maintaining competitive costs, and having support and confidence of all the stakeholders. He thinks that generating opportunities during a crisis depends on the necessity and willingness of all stakeholders, on the confidence among participants to improve the decision making process, and agile processes to materialize opportunities and develop for the next phase of the cycle.

Antofagasta Minerals believes that Chile has been able to maintain a sustained stability for the mining business, and this has created safe conditions for their investments and operations.

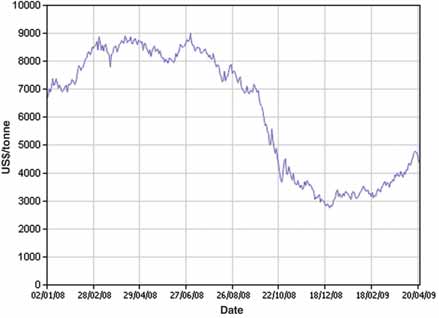

“Chile’s copper industry is still competitive worldwide and is well positioned to deal with the crisis,” Zuñiga said. “Its response to the new market conditions is that of a mature, consolidated industry whose growth is based on great geological wealth and a cultural and institutional environments that favors investment.”

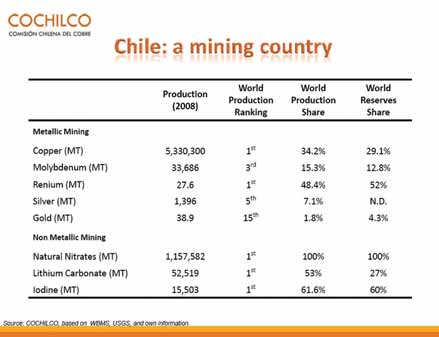

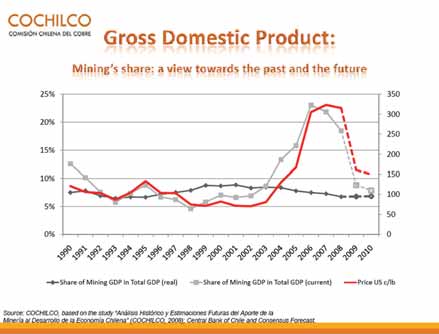

The geological and structural factors demonstrated by a mature Chilean mining sector are helping to mitigate the impact of the crisis on industry’s contribution to the national economy. “When looking at Chile’s gross domestic product, it quickly becomes apparent that mining’s share of total GDP is directly related to the current price of copper,” Zuñiga said.

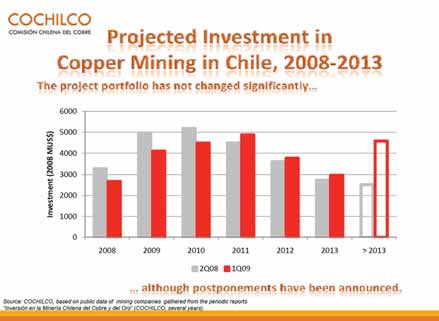

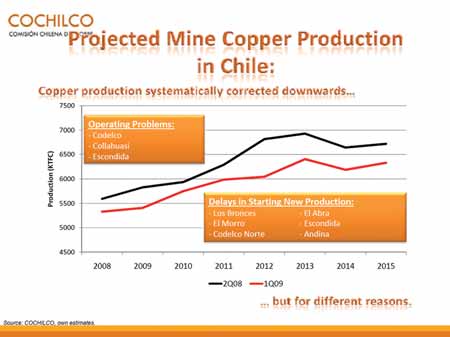

The evolution of expenditures for copper exploration in Chile and the world indicates that Chile will be the less affected by a scarcity of financing for exploration activities. “As for the projected investment in Chile for the period 2008-2013, the project portfolio has not changed significantly, although some postponements have been announced,” Zuñiga said.

Mine production costs for Chilean operations show little risk of closing with projected price scenarios, Zuñiga said. Chile’s relative position in world production costs reaffirms the Chilean copper industry’s high level of competitiveness.

“The drop in copper prices will without a doubt have an impact on mining’s contribution to the national economy of Chile,” Zuñiga said. “However, macroeconomic variables will return to their historical trends, so the mining industry will continue to be a pillar of the economy.”

Copper Price Components

In February, the China trade factor

increased, as trade data indicated that net

imports exceeded expectations, according

to Jim Southwood, president, CRU Price

Risk Management. “This carried through

into March, as it became known that China

had contracted a large volume of metal for

delivery in H1 2009. Based upon expectations

around Chinese import levels over the

next few months, CRU PRM believes that

Chinese buying will continue to add

$300/mt to the price this month,”

Southwood said. “The supply/demand/

inventory component is not likely to change

this month, since stocks have, temporarily,

stopped rising. The U.S. dollar has been a

bit weaker against both the euro and the

Chilean peso, so the estimated currency

impact will be larger at $265/mt.” With

fuel prices higher than in March, they think

that the energy factor will rise to $110/mt

this month. In total, fundamental factors

should add $50/mt to the April average.

The World Bank reported that the current financial crisis is having dramatic, instantaneous effects on production and trade in virtually every country. “The financing climate changed dramatically after September 2008 as confidence sunk,” Timmer said. “High volatility and low equity prices have affected investor confidence.”

Timmer was not optimistic when talking about the Chilean export overview for 2009. He said that Chile’s export revenues will collapse this year and announced a sharp fall in growth in developing countries. He also said that, even if growth turns positive again, the level of GDP will remain well below previous levels for a while.

“Developing countries definitely need some support to mitigate the impact of the financial crisis on the most vulnerable societies, avoid balance-of-payment crises, alleviate fiscal pressures, and restore growth dynamics,” Timmer said.

In spite of the postponements announced by large companies such as BHP Billiton or Anglo American, the copper mining industry still shows some optimism in the medium-long term. Chile has proven to be a strong solid economy, attractive for foreign investors and able to resist a world financial crisis and low copper prices thanks to a rational policy of public expenditure, along with politic stability, clear investment policies and regulations.

The forecast for the copper industry in 2009 will certainly be influenced by the evolution of the world crisis, whose effects still may be noted throughout this year. In the specific case of commodities, China will trigger the recovery.

CRU’S 9th WORLD COPPER CONFERENCE

April 6 - 8, 2010

Grand Hyatt, Santiago, Chile

www.worldcopperconference.com

E-mail: sabine.sebode@crugroup.com

Tel: +44 20 7903 2167