Freeport-McMoRan reported sharply

lower first-quarter 2009 earnings, in

comparison with first-quarter 2008, but

expects improved results during the

remainder of the year. The company also

reported that the first truck-load of copper

cathodes departed from its newly

operational, 57.75%-owned-and-operated

Tenke Fungurume project in the

Democratic Republic of the Congo (DRC)

on April 22, headed for South Africa. The

trip was described as a test run and was

expected to take 20 to 30 days.

Freeport’s net earnings for the quarter

totaled $43 million, down from $1.1 billion

during the first quarter of 2008 due

to sharply lower copper prices. That comparison

does not look good, but it could

have been worse. Freeport’s unit cost/lb

of copper produced dropped to $0.66/lb

during first quarter 2009, down from

$1.06/lb during first quarter 2008.

Revised operating plans and delayed capital

spending contributed to the lower

unit copper cost, as did sharply higher

gold production at Freeport’s Grasberg

operations in Indonesia, where gold is

accounted as a by-product. Mining at

Grasberg has moved into a higher-grade

gold area of the mine, and as a result, the

mine’s first-quarter 2009 gold production

jumped to 545,000 oz from

280,000 oz in 2008. The 2009 total was

sufficient to fully off-set the mine’s quarterly

operating costs.

Freeport is currently forecasting that

its company-wide, full-year 2009 consolidated

sales will total 3.9 billion lb of

copper, 2.3 million oz of gold and 50

million lb of molybdenum. Capital expenditures

are budgeted at about $1.3 billion

for 2009, down from $2.7 billion in

2008.

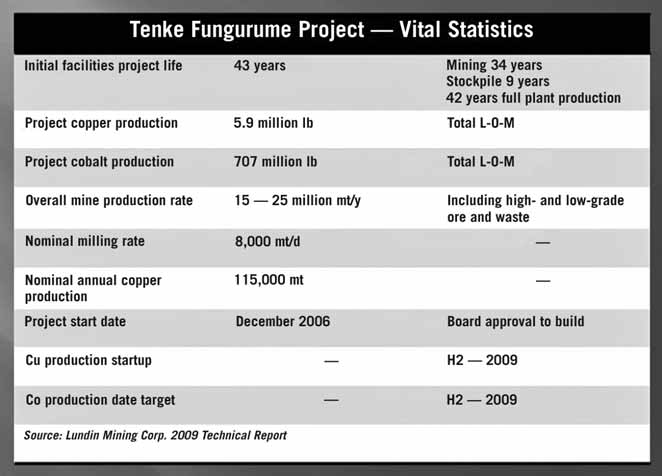

Regarding Tenke Fungurume, Freeport

reported that the project produced

its first copper cathode in late March and

is scheduled to ramp up to full capacity

of about 250 million lb/y of copper and

18 million lb/y of cobalt in the second

half of the year. The initial project is

based on mining and processing ore

reserves totaling about 119 million mt at

average grades of 2.6% copper and

0.35% cobalt.

Over the past year, the DRC government

has been reviewing mining contracts

within the country. The government

has also had to deal with violence in the

DRC’s eastern provinces, a change of parliament

and economic challenges resulting

from lower copper prices; and, in part

because of these distractions, the issue

of mining contracts has not been fully

resolved. Freeport believes its existing

contracts are fair and equitable, comply

with Congolese law, and are enforceable

without modifications. The mining contract

review process has not affected the

Tenke Fungurume development schedule

or production plans.

As featured in Womp 2009 Vol 04 - www.womp-int.com