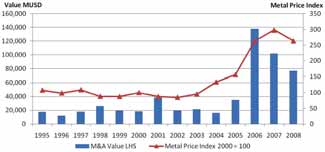

Source: Raw Materials Group, 2009

Commodities Slump Cures Mining’s M&A Mania

2008, stated RMG, was characterized more by the deals that failed than by “visionary formations of strong new entities.” Topping the list of deals that did not pan out was BHP Billiton’s hostile takeover bid for Rio Tinto. The protracted battle ended after over a year of bitter fighting. BHP Billiton claimed plunging commodity prices and the global recession made the transaction impossible, but there remains lingering doubt that the deal—almost monopolizing global iron ore and in particular threatening European supply—would have been given the regulatory green light. The final winner in this might be the Chinese. Chinalco, currently offering Rio Tinto $19.5 billion for sizable shares of various iron ore, copper, bauxite, alumina and other holdings (see lead news story), could decide to take advantage of Rio's difficult position and buy a majority share. In doing so, it could become the first Chinese entry among the top 10 mining companies in the world.

Although the level of M&A activity has recently plummeted, it is still higher than in the years prior to 2005, when the last commodity boom took off. In the decade before that, annual M&A spending in the mining industry hovered around a meager $20 billion. Conversely, counting Chinalco’s purchase of its interest in Rio Tinto, just four deals initiated in 2008 were pegged at more than $5 billion each. These include Russian oligarch Prokhorov's Rusal purchase of a 25% stake in Norilsk, the merger between Australia’s Zinifex and Oxiana and the Anglo American iron ore deal with Brazilian tycoon Eike Batista.

Within specific metals sectors, RMG notes that iron ore prices have remained steady at levels higher than those of most other metals, and that has been reflected in an elevated level of M&A activity in iron ore; about 20% of all deals occurred in this sector. This trend is most likely to continue into 2009 with prices expected to remain relatively high despite a predicted drop from on-going benchmark negotiations. Gold was the second most attractive target based on strong price performance from the yellow metal. Maintenance of profitable performance among the gold miners will drive a continuing high level of M&A activity in this sector.

RMG’s Magnus Ericsson and Martin Jansson predict that the trend toward increased consolidation throughout the global mining industry will subside this year, but could increase in iron ore and perhaps gold as well. Funds available for M&A transactions will be scarce at most companies in 2009—but those with available cash could possibly make some exciting deals.

Source: Raw Materials Group, 2009