On January 8, 2008, Goldcorp provided

production and cost guidance for 2009

and said that development projects are

expected to increase its gold production by

50% to 3.5 million oz over the next five

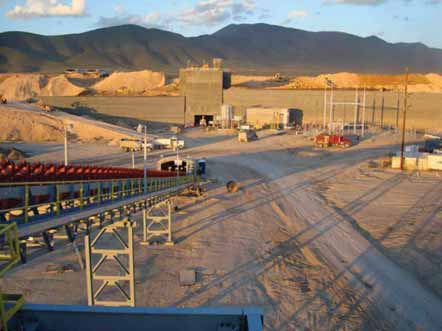

years. Startup of the sulphide mill circuit

at the company’s Peñasquito operations in

Mexico at the end of 2009 will be the primary

driver of this production growth.

During 2009, Goldcorp expects to produce

approximately 2.3 million oz of gold

at a total cash cost of about $365/oz on a

by-product basis and $400/oz on a coproduct

basis. Forecast production increases

at most of Goldcorp’s mines during the

year are expected to be offset by significant

planned declines at Alumbrera in Argentina

and El Sauzal in Mexico. Assumptions

used to forecast total cash costs for 2009

included a by-product silver price of

$10/oz; a by-product copper price of

$1.75/lb; an oil price of $65/bbl; and the

Canadian dollar and Mexican peso at

$1.20 and $12.50, respectively, to the

U.S. dollar.

In addition to Peñasquito, Goldcorp

capital spending during 2009 will target

construction of the large Pueblo Viejo project

in the Dominican Republic and completion

of the Red Lake underground development

program in Ontario. Spending at

some other longer-term growth projects,

including shaft construction projects at

Éléonore in Quebec and Cochenour at Red

Lake, is being temporarily deferred while

the Pueblo Viejo and Red Lake underground

projects are being developed. At

Porcupine, Ontario, plans for an open-pit

and potential underground operation at

Hollinger will also be deferred.

Goldcorp is forecasting total capital

expenditures for 2009 of approximately

$1.4 billion, including $530 million for

Peñasquito and $430 million for Pueblo

Viejo. Exploration expenditures in 2009

are projected at about $95 million, with

efforts focused on replacing reserves

mined throughout the year.

In another development, Vancouver,

B.C.-based Terrane Metals Corp. reported

that its board of directors had approved a

modified project execution plan for its Mt.

Milligan copper-gold project located 155

km northwest of Prince George in central

British Columbia, Canada. The 12-month

modified plan—which Terrane said is supported

by Goldcorp, its majority shareholder

(59%)—will advance the project

through the completion of key pre-construction-

related activities.

In July 2008, Terrane and Goldcorp

entered into an agreement which grants

Goldcorp an option to convert its equity

interest in Terrane into a participating joint

venture interest in the Mt. Milligan project.

The plan, according to Terrane, is based

on a review of the project execution plan to

begin construction in Q3 2009 of an openpit

mine and 60,000-tpd copper flotation

process plant with forecast average annual

production in the first six years of 265,100

oz gold and 97 million lb copper. The

review was undertaken in response to the

on-going liquidity crisis in global credit and

equity markets where traditional sources of

financing required by the plan are not readily

accessible at this time.

Terrane noted that the key objectives of

the modified plan are to reduce project

implementation risk, minimize on-going

and near-term capital expenditures and to

better position the project for a timely production

decision when financial markets

improve. The modified plan calls for work

to continue on fundamental pre-construction-

related activities including basic and

detailed engineering and design, permitting

and the Environmental Assessment

Review process. In addition, it contemplates

a Q4 2009 update of the Feasibility

Study Report to reflect then-current operating

and capital costs. The project will not

proceed to construction in Q3 2009 as set

forth in the original plan.

The modified plan is funded through a

credit facility guaranteed by Goldcorp and a

current working capital balance of $4.4 million.

The company previously announced

financial commitments to consultants and

suppliers of long lead-time equipment were

under review and that it has received the

cooperation of these parties in considering

the restructuring of existing commitments

and/or delaying others pending completion

of the modified plan.

As featured in Womp 09 Vol 01 - www.womp-int.com