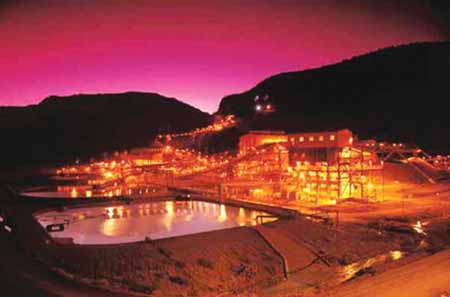

The first underground production from the

world’s largest diamond mine, Western

Australia’s massive Argyle project, is now

expected to come on stream early, by

December 2010.

That is 25 weeks ahead of schedule

and under budget, as the mine pushes

ahead with its A$1.86-billion expansion

to take its open-pit output into an historic

underground block caving mining

operation.

Mine owners are also pushing to bring

the underground mining timeframes back

even further to a possible six-month jump

start, to mid-2010.

The update on Argyle’s future—which

will also include planning from 2011 to

take Argyle through to at least 2025—

was detailed in mid-October at the 2008

Paydirt World Diamond Conference in

Perth by Argyle Diamonds’ Underground

Project Director, Ed Tota.

“Construction overall is 24% complete

and we have expended nearly $670

million of the anticipated $1.8 billion

cost,” Tota said. “Work to date includes

completion of 20 of the 34 km of tunnels,

or about 60% of that total scope of

work.”

Tota said that in preparation for the

underground move, Argyle had commenced

a major transition as “we are

coming in with a huge highly automated

underground mine which will totally

replace all current open-pit throughput

through the processing plant. But we are

in a huge rush to get up and running as

soon as possible to replace lower grade

throughput from the Northern Bowl openpit.”

Argyle’s underground is being developed

around a current 60-million-mt ore

reserve, with anticipated annual production

of 9.5 million mt/y via conveyor lift

to surface.

This is expected to produce 20– to

25–million carats a year for at least seven

years—levels equivalent to current openpit

yields.

Argyle’s move below surface will

result in one of the largest block caving

operations in the world, a 280-m-high

cave with a floor footprint measuring 500

m by 170 m. The first undercut blast was

achieved in early October this year which

is 13 weeks ahead of schedule and represents

the official start of the extraction

of the block cave.

“Our focus is very much on ensuring

the transition creates a safe, low cost

underground operation at Argyle including

maximizing high grade underground

ore throughput as early as possible,” Tota

said. “In achieving that, we also want to

set up an operating structure that will

facilitate a viable Argyle mine beyond

2018. This will include the commencement

from 2011 of a pre-feasibility study

to push Argyle much deeper to mine the

remaining 200 million carats in the current

resource. Our objective is to take

Argyle through to at least 2025.”

Argyle is the world’s largest supplier

of diamonds, accounting for a quarter of

global yearly outputs. It has historically

produced 25– to 30–million carats over a

range of colors each year from open-pit

mining in the East Kimberly region of

Western Australia

The mine has so far produced more

than 600 million carats, of which 90%

has been taken up by the gemstone

market.

Argyle was the first mine in Australia

to establish a fly-in fly-out schedule for a

remote mine and has held the record for

the longest employee commute in the

country.

In other news from the conference, a

prominent diamond analyst predicted

that there may be an easing in global

demand for diamonds to “slow growth”

levels of around 2%–3% per year in a

market where prices have risen at least

10% this year.

Johannesburg-based James Allan,

managing director of boutique finance

house Allan Hochreiter, said rough diamond

prices had climbed anywhere

between 5% and 25% through calendar

2008. This has been driven by supply

shortfalls as output at Australia’s Argyle

diamond mine had eased 6 million carats

currently in 2008 compared with 2007.

Canada’s production is down 2 million

carats, and Russia and Botswana’s output

have eased 1 million carats each,

Allan said.

“The total supply of diamonds worldwide

for calendar 2008 is expected to be

around 138 million carats—and that has

certainly come off the 148 million carat

supply evident in 2007,” he said.

“However, in terms of supply growth in

dollar values, the application of an average

13% price increase is boosting diamond supply value from $12.6 billion to

$14.3 billion in 2008. This is being supported

by diamond jewelry sales—particularly

in the United States which

accounts for half the world’s diamond

jewelry sales—but understandably, there

is some nervousness about the key buying

period coming up between Thanksgiving

and Christmas,” he said. “However, there

will be some gradual increases in supply

over the next four years.”

This may see some price decline from

next year ranging from 10% to 20% in

2009 as production levels rise and market

demand remains low around current

growth rates compared to 8.5% in recent

years. About $76 billion worth of diamonds

are sold at the retail level each

year.

In South Africa, a trial mining program

is about to commence on a diamond

project owned by Melbourne,

Australia-based Tawana Resources Ltd.

Tawana Resources’ Managing

Director, Wolf Marx, said the company

was only awaiting the installation of a

final crusher before the schedule could

commence. Tawana is planning for the

trial mining ahead of an anticipated

move to a full-scale 500,000-mt/y operation

for its flagship Kareevlei Wes kimberlite

project in South Africa. Marx said

that, pending success with the trial program,

first commercial diamond production

is expected to commence in 2009 at

a time of “healthy demand fundamentals”

for the gemstone.

The company’s move to producer status

comes on the back of a revaluation by

market tender in August of Tawana’s diamond

samples from Kareevlei. The revaluation

rated the project’s carats, from the

initial two kimberlite pipes targeted for

maiden mining, at $169 a carat and

grades of between 8.5 and 11 carats per

hundred mt.

“Kareevlei Wes is our most advanced

project, we have completed a lot of

drilling and bulk sampling on the cluster

of five kimberlites and now have a project

unusual in a worldwide context as an

estimated 80% of its stones are gem

quality,” Marx said.

Tawana has an initial 12-year mining

right at Kareevlei Wes and will take its

trial mining extraction from the KV01

and KV02 pipes.The company’s economic

modeling on the project has estimated

a production cost at full-scale from

Kareevlei Wes of $8 per mt.

”The trial mining will enable Tawana

to evolve a JORC-standard resource for

Kareevlei Wes as we need to mine at

least 2,000 carats to undertake a revised

valuation for the pipes,” Marx said. “In

the trial, we will make two small open

cuts into both pipes to extract a total of

20,000 mt of material which should be

sufficient to give Tawana the grades and

carats necessary to complete the JORC

statement.”

Marx said Tawana was advantaged in

generating its initial cash flow that diamonds

as a commodity did not suffer the

wide price swings as hits such metals as

nickel and zinc, particularly at mine

start-up.

As featured in Womp 08 Vol 9 - www.womp-int.com