Analyzing the Risk of Bankable Feasibility

Studies in Today’s Mining Supercycle

Feasibility studies are the industry’s main tool for determining both project cost and

schedule certainty. The author describes the process and major factors that project

owners should consider for achieving realistic results.

By Dave Evans

The mining feasibility study is a measure of mineral development progress and economic viability. It is often followed by an announcement to state something like “DSE Mining Ltd. is pleased to announce the receipt of a definitive feasibility study for their DSE deposit.” The press release will go onto say that the capital cost estimate is $XYZ, with a confidence level of +/-15%. There may also be provisional statements about either net present value (NPV) or return on investment (ROI). In many instances there remains uncertainty about development conditions, the confidence level around the capital cost and the overall value of the project.

In the business of quantitative risk analysis to test and value the strategies of natural resource projects, the following will usually be stated in one fashion or another: “We have to have cost certainty for this project before we have authorization for expenditure [AFE].” This is a natural target for a mining development; and, also speaks to modern corporate social responsibility for transparency, defensibility and accountability measures. But after AFE, mining companies will often say, “cost is not the issue now; we have to have startup and ramp-up on schedule.” So, feasibility studies are about achieving both cost and schedule certainty.

So, how do project owners ensure that feasibility output is accurate, precise and will lead to, among many needs, a validated development strategy, a successful financing, a sound construction plan and confidence in go forward decision-making?

All projects, not just marginal or constrained projects, should submit to a formal risk assessment, and preferably quantitative risk analysis, to fully define and measure exposures, weaknesses and potential losses. Further, the output should critically define and communicate a level of confidence in the feasibility estimate and development schedule.

Tying the project uncertainties together for due diligence is a task for risk analysis. A comprehensive quantitative risk analysis will measure and integrate the risks impacting direct and indirect cost variables along with schedule assessments to determine the overall risk-based cost of a mining project. The need to assess uncertainty following the feasibility study is discussed in detail by Shillabeer and Gypton (2003) and Poos (2004). Each article recommends an independent review and/or analysis to determine the accuracy and/or precision of the feasibility study.

Quantitative Risk Analysis

Process and Output

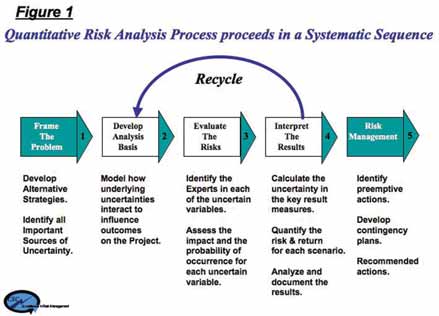

The risk analysis, or risk assessment

process, is usually a four to six step

process that employs the input of “project

experts.” CSC uses a five step process (See

Figure 1). Experts are those project people

who have good knowledge of the variables

to be assessed, and, who have credibility

with senior management. A framing session

is used to roll out and define the

assumptions, decisions and risks, followed

by assessment sessions for range estimates

and probability designations.

Model Development & Software for Risk Analysis—Software used includes the Microsoft Office set and the off-the-shelf program @Risk. The “project-specific risk model” is built on an Excel base. Each project has a “fit for purpose model” based on a deterministic influence diagram.

The independent risk facilitator is the ‘process manager’ whose main task is to ensure that assessment input is grounded, unbiased and translates accurately and readily into the deterministic risk model.

Questions are posed to continuously test scope, strategies, plans and changes. Care is taken when there are divergent opinions from experts on preproject experiences or current project directions. These differences may point to significant project risks that require a review of strategic options or specified risk management during execution.

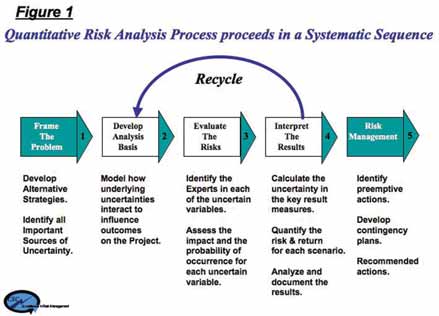

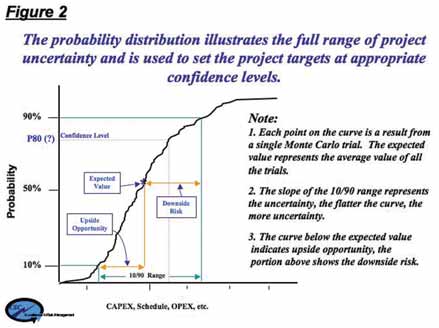

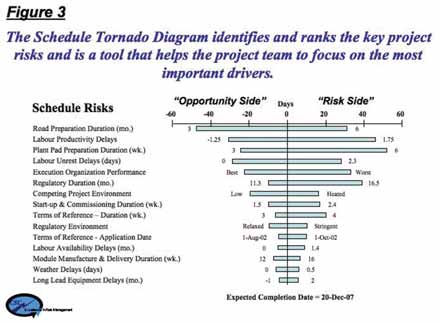

The key outputs for quantitative risk analysis are the probability distribution diagram and the tornado diagram. An example of each (See Figure 2 and Figure 3) is shown below. The slope of probability curve is the overall risk attached to the project and the tornado diagram ranks and values the risks in order of importance.

Things We’ve Learned

About Risk Analysis

CSC often hears comments about risk

analysis and the company’s usual

responses are provided below. The

responses should give E&MJ readers a

good idea about expectations when committing

to or entering into quantitative

risk assessment.

• It’s too early (too late) for risk analysis.

An early application of risk analysis will

test the options to clarify assumptions,

identify and rank key decisions and

quantify uncertainties for each strategy.

Risk analysis can be used at

key milestones to update or

re-qualify an execution plan

and/or a risk management

plan.

• The project is too big (too

small) for risk analysis. Risk

and decision analysis can be

applied to projects of all

scopes and sizes.

• Risk analysis takes too long. A comprehensive

quantitative risk analysis can

normally be completed in two to four

weeks, sometimes more quickly.

•We have a fixed price, lump sum

estimate and contract. A fixed price,

lump sum estimate is the lowest cost

you’ll pay for this project. Any scope

change will increase the final cost.

And, any schedule overage will

increase some direct charges and

most of the indirect charges on final

cost.

•We have a +/- 15% AFE Estimate, a reimbursable

contract, a fully dedicated

Level 4 Schedule and fully resourced

project execution plan. What can go

wrong? All estimates are wrong and

things change, for better or worse, but

they change. All schedules are optimistic

by design and usually fail when

things change. Unqualified assumptions,

undone decisions and a poor understanding

of project uncertainties and

the potential impacts will lead to critical

path and other execution failures.

•We’ve calculated a contingency of x%

and this is more than adequate.

Contingency is a decision based on

understanding the variances and covariances

in a base estimate and schedule.

Was this decision based on a

grounded, accountable and defensible

appreciation and understanding of the

project uncertainties; or, is it someone’s

unqualified “rule of thumb?”

•We’ve made all the key decisions and

nothing can go wrong. Even a wellplanned

project can get off track.

Impacts arising or stemming from

changing conditions and unforeseen

circumstances and events have a way of

creeping into projects. A comprehensive

risk and decision process will flush

out and value all the key project drivers

and uncertainties.

• The EPC constructor carried out a range

estimate. Range estimating is not risk

analysis. Range estimating is constrained

to a fixed probability distribution

around individual cost categories

in an estimate and does not include or

acknowledge the impacts arising from

future project conditions and external

variance uncertainties.

• The project drivers are political, social,

environmental, productivity and event

driven risks. You can’t measure these

impacts. Modern risk analysis provisions

for or incorporates all internal and

external risk factors identified by the

project experts. Conditioning (soft) variables

are used to measure Projects in

uncertain “environments” to assess and

forecast future performance impacts on

project cost, schedule and value.

• Risk analysis is expensive. Cost and

schedule over-runs are more expensive.

Our experience is that comprehensive

project risk analysis is highly cost effective

and adds measurably to project

value. The cost of quantitative risk

analysis is paid back many times over

when the project follows a risk management

plan based on quantitative risk

analysis output.

With any mineral development or construction cost estimate, schedule or plan there are only a finite number of things that can go right. But there are an infinite number of things that can go wrong. A fully framed and rigorous quantitative risk analysis will provide a clear and measured understanding of the risks and opportunities for better due diligence, decision-making and for optimally valued outcomes. And in the end, it is not so much about quantification (although most of the important decisions will be made around risk-based numbers) but about getting to reliable probabilistic data and information through rigorous process.

The risk assessment process should be lead by qualified independent facilitators who ask all the “hard questions”. In particular, those questions that the Project Team may not or do not want to be tested or assessed, “Don’t go there!” doesn’t work in risk assessment.

The same list of uncertainties and risks keeps reappearing in development and construction projects. This list includes Organization Performance, Competing Project Environment, Labor Productivity, Materials Rates and Availability, Long Lead Items, Regulatory Delays, Late Drawings and Reworks. These impacts tend to occur equally on cost and on schedule, but going long in schedule tends to have the most impact on project value through additional field labour charges, indirect charges of the extended duration and, the big hitter, production delays.

Quantitative risk analysis will ground the strategy and execution plan with defensible risk management measures. Owners and project teams will gain confidence that risk-based mitigation responses and actions will overcome constraints, delays, interferences and changes to preserve and/or enhance project value.

References

1. “Highlighting project risk following

completion of the feasibility study,”

Shillabeer, J., and Gypton, C., Proceedings

of Mining Risk Management

Conference, Sydney, NSW, September,

2003.

2. “Feasibility study does not mean

feasible,” Poos, S. R., in Pincock

Perspectives, Issue No. 57 – August,

2004.

Dave Evans, Ph. D., P. Geo, is a retiring Senior Partner with CSC Project Management Services in Calgary, Alberta, Canada (www.cscproject.com). He specializes in risk and decision analysis, strategic planning and risk management applications for energy and mining projects and for mine closure and decommissioning. He also has extensive experience in risk assessment for political environmental and social risks.