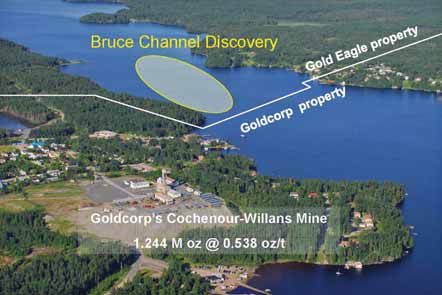

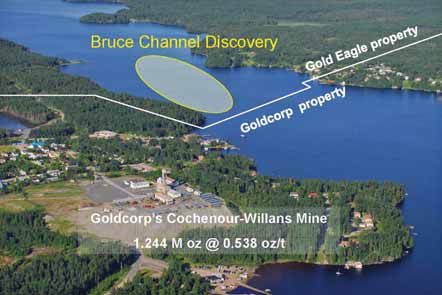

Goldcorp's July purchase of Gold Eagle is aimed at acquiring the Bruce Channel gold prospect,

situated adjacent to Goldcorp's Red Lake mine. (Photo courtesy of Gold Eagle)

Goldcorp Pays C$1.5 Billion for Red Lake Discovery

The agreement was subject to a favorable vote of two-thirds of Gold Eagle’s shareholders. At the time of the announcement, Goldcorp already owned 4.7% of Gold Eagle’s outstanding shares.

Closure of the transaction would secure for Goldcorp full control of 8 km of strike length in the heart of the Red Lake district. Nearly 200 drill holes have defined the Bruce Channel deposit, which remains open in all directions and at depth. Underground exploration will require sinking of a vertical shaft.

Announcement of Goldcorp’s planned acquisition of Gold Eagle followed a recent Gold Eagle drilling update of the Bruce Channel discovery. The mineralized envelope at Bruce Channel now extends a minimum of 1,450 m vertically and has horizontal dimensions of about 800 m by 450 m. Drilling is continuing to intersect multiple high-grade zones, with visible gold, and recent intercepts have included 4.5 m grading 13.13 g/mt gold and 0.3 m grading 225 g/mt gold, the Gold Eagle statement said.