Strike Clouds PotashCorp Outlook

The Allan, Cory and Patience Lake mines supply about 30% of PotashCorp’s potash production and account for about 6% of world potash supply. All three mines are underground operations that mine potash at depths of about 1,000 m. In 2007, PotashCorp’s Canadian mines produced 9.2 million mt of potash.

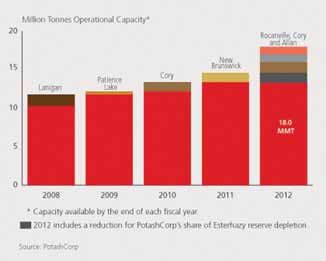

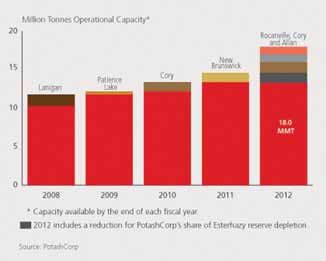

PotashCorp’s current expansion plans call for an increase in capacity to 18 million mt/y by the end of 2012. The most recently announced plan to add 2.7 million mt/y of capacity will be achieved through a debottlenecking project at Allan and increases in the scope of projects currently in progress at Cory and Rocanville.

The Allan debottlenecking project will add 1 million mt/y of production capacity and raise the mine’s total capacity to 3 million mt/y. Construction and ramp-up are scheduled for completion by the end of 2012. The project has an estimated cost of $350 million and follows a 400,000-mt/y expansion completed at Allan in 2007.

At Cory, the new expansion project will add 1 million mt/y to a 1.2-million-mt/y debottlenecking and expansion project initiated in 2007. The initial project is scheduled for completion in 2010, while construction and ramp-up of the new project is planned for completion by the end of 2012. The new project has an estimated cost of $220 million and will raise the mine’s annual capacity to 3 million mt/y. At Rocanville, an additional 700,000 mt/y of capacity will be incorporated into a 2-million-mt/y mine and mill expansion project announced in 2007. With an additional investment of $1 billion, the combined project now is expected to add 2.7 million mt/y of production capacity at a cost of $2.8 billion and raise Rocanville’s total capacity to 5.7 million mt/y. Construction is scheduled for completion at the end of 2012, with ramp-up over the following two years.

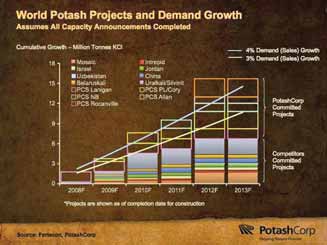

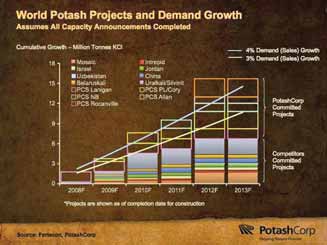

PotashCorp estimates that the three expansion projects will cost approximately 60% less than current costs for comparable greenfield capacity. The projects also will add production much more quickly than would be the case with production from a new mine.

The newly announced PotashCorp projects at Allan, Cory and Rocanville are a continuation of a long-term expansion program that has included projects completed at Rocanville in 2005, Allan and Esterhazy in 2007, and Lanigan in 2008, as well as in-progress construction projects scheduled for completion at Patience Lake in 2008, Cory in 2010, and New Brunswick in 2011.

On July 24, 2008, PotashCorp reported record first-half 2008 earnings of $1.5 billion, more than triple the $483.7 million the company earned in the first half of 2007 and also more than its full-year earnings record of $1.1 billion set in 2007. In announcing these results, PotashCorp reported that the global need for increased food production continues to fuel strong fertilizer demand.

“The resulting tight fertilizer supply/ demand fundamentals impacted all three nutrients (potash, nitrogen and phosphate) in the second quarter, and this was clearly evident in higher product prices. Potash inventories were reduced to historically low levels around the world. For example, reported North American producer inventories at the end of June were 41% below the previous five-year average, an extremely low level given upcoming summer maintenance shutdowns. Global demand remains unsatisfied, even without considering the protracted contract settlements that left China approximately 3 million mt short of previously expected 2008 potash requirements.”

In the phosphate and nitrogen markets, global supply tightened during the first quarter of 2008, when China introduced a 35% tax on phosphate and nitrogen exports to protect its domestic supply. Then, the tax was raised to 135% for the period April 20 to September 30, 2008. The May 2008 earthquake in Sichuan province, China, also impacted phosphate supply. The province produces 11% of China’s phosphate rock and a significant amount of related downstream fertilizer, feed, and industrial products. In nitrogen, higher global costs for oil and natural gas have supported higher product prices generally, and the Chinese export tax immediately and significantly drove world urea prices higher.