BHP Billiton Reports on Another Record Year

Base metals were BHP’s leading revenue- generating product group during the year, with revenues of $14.774 billion, up a respectable 16.9% from a year earlier. However, the company’s petroleum products group reported a much larger percentage gain, up 62.2% on the back of high oil prices to $9.547 billion, in second place among the company’s revenue generating product groups just ahead of iron ore, which gained a 71.2% to $9.455 billion. Stainless steel materials were the only BHP product group reporting significantly lower revenue, down 26.3% to $5.088 billion, mainly due to lower LME nickel prices.

New production records among individual commodities have become commonplace for BHP. In copper, the company set a third consecutive annual production record as a result of the continued ramp up of the Escondida Sulphide Leach project and the new Spence mine, both in Chile, and the Pinto Valley project in the United States. These projects contributed 244,300 mt of new copper production during the year, while company- wide attributable production of copper in concentrates rose to 818,000 mt from 752,600 mt in fiscal 2007 and attributable production of copper cathodes rose to 557,500 mt from 497,500 mt.

Total copper production at Escondida (57.5% owned by BHP) is expected to decline by 10% to 15% during the coming year as a result of lower ore grade. However, Escondida has longer-term opportunities for production expansion, and the Pampa Escondida prospect, which is close to existing infrastructure and processing facilities, is generating impressive exploration results. Drilling to date at Pampa Escondida suggests that it contains at least 1 billion mt of porphyry style mineralization. The drilling program is being ramped up from 11 drill rigs in June 2008 to 25 drill rigs by June 2009, and some 320,000 m of drilling are planned for the coming year. Over the next five years, an estimated total of $327 million (BHP’s share, $188 million) will be invested in drilling, assaying, and metallurgical testwork across the entire Escondida lease.

Molybdenum produced as a by-product of BHP’s copper operations totaled 2,542 mt during fiscal 2008, up from 2,268 mt a year earlier.

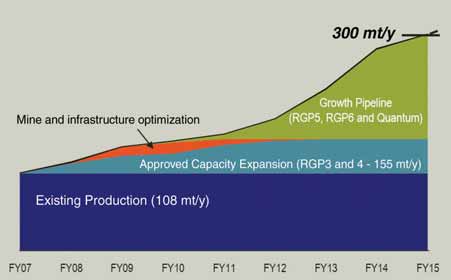

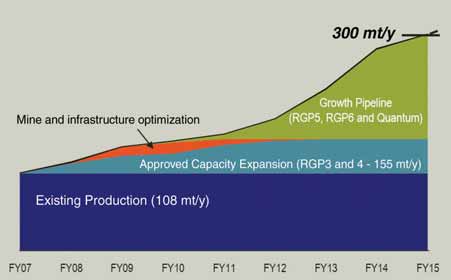

In iron ore, BHP’s 85%-owned Western Australia iron ore operations set an annual production record for the eighth consecutive year, and an expansion project at its 50%-owned Samarco operations in Brazil delivered its first production during the fiscal fourth quarter. Iron ore production attributable to BHP during the year rose to 112.3 million mt from 99.4 million mt in fiscal 2007. Ongoing expansion in Western Australia is expected to result in another production record during the coming year.

BHP produces manganese ore and alloys at 60%-owned operations in Australia and South Africa. Attributable ore production rose to 6.6 million mt during fiscal 2008 from 6 million mt, and attributable alloy production rose to 775,000 mt from 732,000 mt. These gains were achieved despite a mandatory 10% reduction in power consumption at its South African operations.

In alumina, annual production records were set at all three BHP operations: Worsley, 86% owned; Suriname, 45% owned; and Alumar, 36% owned. Alumina production attributable to BHP totaled 4.6 million mt, up from 4.5 million mt in fiscal 2007. An expansion project currently in progress at Alumar is expected to increase total production at the refinery to 3.5 million mt/y of alumina by mid-2009, up from 2.1 million mt/y currently.

BHP’s production of petroleum products, including crude oil and condensate, natural gas, and natural gas liquids, rose to 129.5 million barrels of oil equivilant in fiscal 2008, up from 116.2 million barrels in fiscal 2007.

Regarding the world’s macro economic outlook, BHP expects short-term economic growth to slow as the developed economies experience further weakening over the coming quarters. However, the company expects emerging market economies to remain relatively strong as a result of continued domestic infrastructure investment and regional trade, while long-term growth in these economies will remain robust as they continue to industrialize.