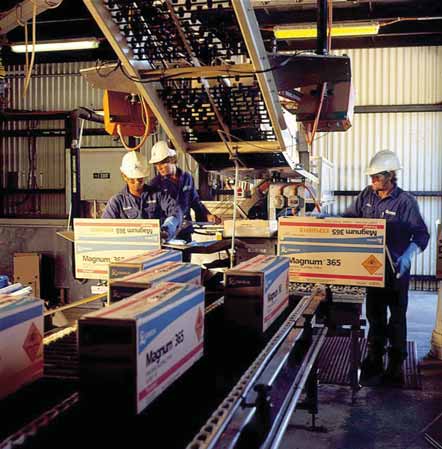

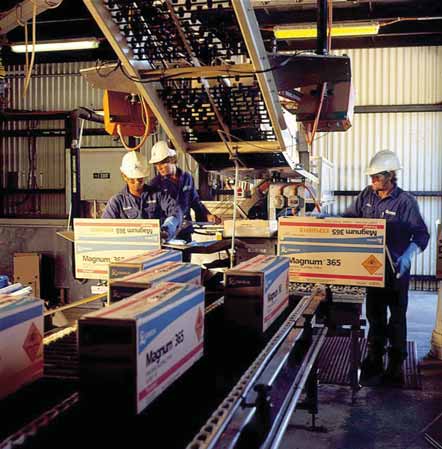

The rising cost of petroleum-based products, ranging from fuel oil to plastics, is only one element in an

array of factors currently pushing mine blasting costs upward. (Photo courtesy Orica Mining Services)

Explosive Situations

What’s new in the blasting marketplace and what’s happening at, and to, the largest

explosives suppliers—and why the price of ANFO isn’t likely to drop anytime soon

ByRussell A. Carter, Managing Editor

Although the “perfect storm” analogy is probably overused to describe the convergence of trends that magnify the impact of an event, it seems like an appropriate description for price increases in the D&B sector, particularly in blasting where the rising price of petroleum— and every downstream-market item associated with it—along with higher natural gas prices and competition from other industries for basic explosives components such as ammonia, have contributed to a sizable spike in the cost of blasting consumables.

With the price of a barrel of oil climbing higher on an almost daily basis and natural gas prices up by 75% so far in 2008, the scope of these cost increases includes everything from a tank of diesel fuel on a bulk delivery truck to the plastic sleeving used on some pre-packaged explosives.

The overall effect of these cost increases on the mining industry’s economic big picture is difficult to quantify. At a strategic level, higher mining costs could prevent a company from converting mineral resources into reserves. On an operational basis, scattered examples give some indication of the impact: Barrick Gold noted in its 1Q 2008 financial report that a $10/barrel increase in market crude oil prices causes its gold total cash costs to increase by about $4/oz. And, according to a recent Reuters news report, Newmont Mining said it spent $70 million on explosives in 2007, and expects to pay 16% more in 2008.

For the past several years, sales of ammonium nitrate-base explosives (blasting agents and oxidizers) in the United States alone have been running at slightly more than 3 million mt/y. Worldwide, sales of these products account for 60% or more of the larger explosives manufacturers’ revenues. So, clearly, the price of ANFO is high on the list of many mine operators’ budget concerns.

The price of ammonia, which is extracted from natural gas and is a primary component of ammonium nitrate, has been rising in concert with higher natural gas prices. The price of a ton of ammonia more than doubled earlier this year over 2007 levels before subsiding slightly in late spring. It takes roughly 1 ton of ammonia to make 2 tons of ammonium nitrate; thus, a $100 rise in the price of ammonia, for example, translates into a $50 increase for ammonium nitrate, and this cost increase is passed on to end users. To make matters worse, demand for ammonium nitrate for fertilizer has been steadily increasing from the agricultural sector, driving up the cost and diminishing its availability for explosives applications.

There doesn’t appear to be any price relief on the horizon for ammonium nitrate-based explosives. During a presentation given in March 2008, Phillipe Etienne, CEO of Australia-based Orica Mining Services, noted that with ammonia prices on a long-term rising trend, sharply increased shipping costs, and other supply/demand-related factors in play, ammonium nitrate prices must rise significantly to justify new production capacity. The alternative, he explained, is a global undersupply.

Even in the Asia Pacific region, where ammonium nitrate has been relatively easy to obtain from suppliers in Russia and China, exports have diminished from China in particular as the government recently assigned higher export taxes to the chemical. Orica is moving ahead with construction of a 300,000-mt/y ammonium nitrate plant in Bontang, Indonesia, at a cost of approximately $550 million, and also is looking at setting up another plant in Latin America, possibly in Peru.

Conversely, Dyno Nobel announced in December 2007 that, after spending about A$280 million on a 330,000-mt/y ammonium nitrate plant project located in Queensland, Australia, it was suspending further work pending an evaluation of options that include either restarting the project after ensuring that it would meet the company’s financial criteria, or selling the asset.

No Substitute for Blasting

Despite these hurdles, business has been

brisk for explosives manufacturers—simply

because for mine operators there is no

substitute for the vast rock-breaking

power of a production blast. Orica, considered

to be the world’s largest supplier

of commercial explosives and blasting

systems, reported a 13% increase in profits

for the first half it its 2008 fiscal year;

and Dyno Nobel, the largest explosives

supplier in North America, reaped a

20.4% rise in net profits during fiscal

year 2007 compared with 2006, amounting

to $101.9 million. Sales continue to

be robust in the global coal and hardrock

mining markets, although in North

America the bottom has dropped out of

the construction materials (quarry) market

due to a severe slump in homebuilding

and related construction activities.

However, explosives manufacturers are facing their own set of economic challenges, one of which is the continuing consolidation of the global mining industry. Mega-mining companies such as BHP Billiton, Rio Tinto and Vale can apply considerable downward pricing pressure to vendors through their integrated procurement systems, to the point that one executive at a multinational explosives supplier joked to E&MJ that he suspected that at least one of the larger companies was attempting to fund its latest acquisition by means of vendor price cuts.

“What it mainly comes down to,” said the executive, who preferred to remain anonymous, “is that we have to deal with the different objectives of a mine’s operating and procurement departments. The procurement people look only at price. The operations people are more concerned with overall cost.”

Yet, when it involves ammonia-based products, price-pressured suppliers have a few options of their own, particularly in the current market where agricultural demand will soak up available stock— and often at a higher price. Just recently, for example, Dyno Nobel cut a deal with Koch Nitrogen Co. to market all of of the UAN (urea ammonium nitrate) produced at Dyno Nobel’s Cheyenne, Wyoming, USA, manufacturing facility. Koch, in turn, will supply Dyno Nobel with the ammonia necessary for the production of approximately 290,000 tons of UAN each year.

Dyno Nobel said the agreement gives it a reliable source of ammonia to meet the growing demand for fertilizer from the agricultural sector, while the Cheyenne facility, which is currently undergoing an $87.8-million expansion that will enable it to produce 200,000 t/y of ammonium nitrate solution, will provide flexibility to swing production between ammonium nitrate for commercial explosives—mostly for use in the mines of the booming Powder River Coal Basin in northeastern Wyoming—as well as for fertilizer, which will generate significant additional revenue. In fact, as detailed later in this article, Dyno Nobel was recently acquired by an Australian fertilizer manufacturer.

New regional markets are also opening up for explosives manufacturers. China and several former CIS countries, according to Orica’s Etienne, are expected to become a $2.5-billion-per-year explosives market, with the rest of the Asia Pacific region, excluding China and Australia, representing another potential $600-million in sales. Africa is another emerging market: In September 2007, the Dyno Nobel group acquired a 50% joint venture holding in Sasol Dyno Nobel, South Africa, in order to take advantage of rising demand for better blast initiation products in the region as underground mines migrate from cap and fuse products to safer and more accurate non-electric detonator technology. Earlier in 2007, the company acquired 29.9% of Fabchem China Ltd., an explosives company listed on the Singapore Stock Exchange and the largest supplier of explosive boosters in China.

Sales Blast Upward for

Electronic Systems

Based on steadily increasing demand,

both Orica and Dyno Nobel, as well as

competitors Davey Bickford and Austin

Powder, continue to actively advance

their respective electronic blast initiation

systems. The EBS systems are rapidly

gaining acceptance for the advantages

they offer, including:

• Improved fragmentation leading to

higher productivity,

• “Tailored” muckpiles,

• Predictable vibration, enabling larger

blasts,

• Steeper highwalls in coal mining,

• Blast pattern expansion, and

• Less overbreak in tunneling applications.

In addition to its top-of-the-line i-kon EBS, Orica has introduced the Uni Tronic 500 EBS as a lower-cost alternative. According to Orica, the system is designed to provide accurate and flexible timing sequencing for surface blasting applications. The Uni Tronic detonator will directly initiate detonator-sensitive packaged explosives and Pentex or other cast boosters. The Uni Tronic technology, which Orica purchased from South Africa-based Sasol, comprises programmable electronic detonators and hardware to identify, test, program and fire the detonators. Each detonator has a unique identity code written into its memory during manufacture. This code is represented in the form a barcode printed on a flag-tag attached to the wire near the connector. A handheld laser scanner is used to read this barcode and a firing time is assigned to the detonator’s ID code in the scanner memory, using either an auto-adding increment or the numerical keypad on the scanner.

All detonator identity codes and assigned times that are stored in the scanner’s memory are downloaded to the blast box via an infrared port. Each detonator is then powered up and programmed with its firing time according to its ID code. The blast box reports back the details of any detonators that are not communicating properly with it. Once all detonators have been programmed and all detonators have confirmed their presence, the blast can be fired.

With average annual unit sales increases of 77% over the past five years for its EBS products, Orica is intent upon expanding production. The company will open a new, $50-million EBS manufacturing facility in Brownsburg, Québec, Canada, later this year and has plans to expand the facility in the future. It is also currently field-testing a new electronic tunneling blasting system called eDev, which is scheduled for market introduction in late 2008.

Dyno Nobel’s new products include the Digishot electronic initiation platform, recently introduced to the U.S. market where it reportedly is selling well. The system is designed to provide better control of vibration, crusher throughput, highwall stability and various other operating efficiencies. Delay timing can be completed with auto-programming to save time and reduce errors or a manual programmable mode can be used to accommodate almost any delay scheme. Screen menus lead the blaster through all delay and firing operations for up to 15 detonators per blasthole.

The company now also offers Smartshot, which features precise programmable delay timing. Hook-up, according to Dyno Nobel, is easy: the male connector of one unit simply snaps into the female of the next, and so on, along a row. The Smartshot String Starter is connected between the blast and the systems receiver unit, or Bench Box, to interface two-wire with four-wire communication. It also assists in identifying faults in the setup. The Smartshot End Plug is connected to the last detonator in each string to indicate the end of a string to the control equipment.

The Smartshot Tagger is a hand-held unit that tests and assigns timing to individual detonators (or strings of detonators), and defines the hole configuration. The Bench Box receives a radio frequency signal from the Base Station and passes it on to the detonators in order to initiate the blast. If preferred, the system can be hard-wired instead. A connection box, stored inside the Bench Box, has terminals to attach the twowire lead to the String Starters.

The Smartshot Base Station is used to initiate the blast. A password protected Smart Key must be docked in the Base Station in order to arm and fire the shot.

Corporate Structure Shift

Both Orica and Dyno Nobel are currently

entering or engaged in organizational

transitions of various sorts. In July,

Orica announced that it was demerging

its consumer products division and will

separately raise A$900 million in a

rights issue to reduce its debt and fund

further growth in its mining services and

chemicals businesses. Following the

demerger, Orica’s remaining business

will be focused on mining services, representing

about 90% of the company’s

earnings, and its chemicals businesses.

This follows closely upon the company’s recently launched global rebranding program, which has already begun in Latin America, North America, Australia and New Zealand and was scheduled to start in Europe, the Middle East and Africa in early August.

Under the program, Orica’s existing bulk product brands will be renamed as follows:

| Existing Brands | New Brands/Application |

| Energan Fortan | Open Cut Heavy ANFO |

| Powergel Fortis | Open Cut Pumped Emulsion blends |

| Handibulk | Centra Quarry and Construction |

| Powerbulk | Subtek Underground Mining |

| Powerbulk | Civec Tunneling and Underground Construction |

According to the company, customers will experience no changes to product or pricing.

Orica also said its packaged emulsion explosives will undergo name changes to provide more consistent branding conventions around the world. Powergel, its primary brand for packaged explosives, will be changed to Senatel, which will be a line of detonator- sensitive packaged explosives.

Orica’s current Buster product will change to Powerfrag, effectively extending the Powerfrag range to include cartridge diameters from 25 mm up to 80 mm. The product formulation will remain the same.

The company’s suite of specialized packaged blasting products will retain their current product names, while moving from Powergel to Senatel branding. For example, Powergel Pyromex will be named Senatel Pyromex. The same will apply to other specialty packaged Powergel products.

In June, Incitec Pivot, an Australian fertilizer company, completed its acquisition of Dyno Nobel. The transaction was valued at $2.25 billion.

Driving the acquisition was the Australian company’s objective of reducing its reliance on sales to the Australian agri market. The purchase, which was unanimously approved by Dyno Nobel’s board of directors, is a natural fit, according to Incitec CEO and Managing Director Julian Segal, because nitrogen-based chemical manufacturing is at the core of both companies businesses. Joining of the two companies’ assets, said Segal, would also increase Incitec’s global clout, enabling it to fund larger projects, facilitate re-entry into resource-rich countries, and create “critical mass” in the merged company’s corporate and manufacturing capabilities.

Incitec Pivot, prior to the takeover bid, had acquired 13% of Dyno Nobel’s shares in 2007 and had indicated it would increase its stake. Investors anticipated a bid after Dyno Nobel’s share price fell sharply in December 2007 following suspension of the Moranbah, Queensland, plant project. Dyno Nobel was previously purchased from Nordic private equity firm Industri Kapital in 2005 by a consortium led by Macquarie Bank, which then sold much of Dyno’s assets to Orica. Interestingly, Orica itself sold a 56% stake in Incitec in 2006.