Venezuelan government actions relating

to gold mining from late April through the

end of June 2008 were at best confusing.

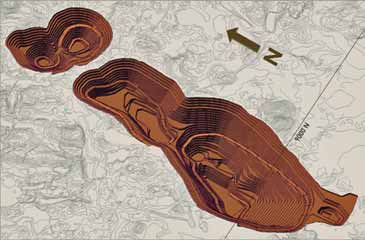

Crystallex International and Gold

Reserve, which separately hold the

neighboring, long-running Crystallex and

Brisas gold development projects in

Venezuela’s Imataca Forest Reserve, were

told in late April that a ban had been

placed on surface mining in the reserve.

Subsequently, on June 24, the companies

announced separately that they had

met jointly with representatives of the

Ministry of Environment (MinAmb), who

outlined conditions which, if satisfied,

might lead to issuance of permits for the

companies to proceed with their projects.

The Gold Reserve statement said that

Vice Minister of Environmental Planning

and Administration, Ing. Merly Garcia,

had requested that Crystallex and Gold

Reserve submit individual proposals to

the Ministry regarding further optimizing

enhancements to the social projects and

programs in the area, enhancing mitigation

plans to deal with the effects of current

mine plans, and improving mine

closure remediation plans, including remediation

of the past environmental

damage caused by the artisan miners

who had worked in the vicinity of the

project areas.

Doug Belanger, president of Gold

Reserve, stated, “We believe it is premature

to predict the outcome of this initiative

by the government. Although we

are enthusiastic with MinAmb’s initiative,

we are also trying to reconcile

Environmental Minister Ortega’s statements

related to the potential banning of

open-pit mining in the Imataca Forest

Reserve. The company is also closely following

any changes in mining policies

and/or the legal framework in Venezuela

as has been stated in recent years by the

Ministry of Basic Industries and Mines to

determine any potential impact on the

Brisas project.”

The Crystallex statement said, “It is

too early for Crystallex to forecast how

this issue will be resolved, but it is

encouraged by the support from the

Venezuelan Government and National

Assembly. Crystallex welcomes the

opportunity offered by MinAmb to help

create additional solutions to the extensive

environmental damage that already

exists due to illegal mining in the Las

Cristinas area, and to improve the project

in order to respond to issues raised

by MinAmb.”

Meanwhile, Hecla Mining, which in

recent years has been Venezuela’s

largest gold miner, was first hampered

by striking workers demanding that its

operations be nationalized. Then, on

June 19, the company said it was selling

its Venezuelan subsidiaries to Rusoro

Mining for $25 million, consisting of

$20 million in cash and 4,273,504

shares of Rusoro common stock. Closure

of the sale was announced on July 10.

The assets included the Isidora mine,

the La Camorra mill and exploration

properties.

Rusoro is based in Vancouver, British

Columbia, and has its primary assets in

Venezuela. It acquired these assets from

Gold Fields, South Africa, in December

2007. The assets include the Choco 10

mine, which will produce about 120,000

oz of gold in 2008, and four advanced

gold exploration projects, including properties

in the immediate vicinity of the La

Camorra mill. Gold Fields now owns

about 36% of Rusoro’s shares and is the

company’s largest shareholder.

On July 10, immediately following

closure of the purchase, Rusoro said it

and the Venezuelan government had

agreed to establish a 50:50 “mixed

enterprise” between Rusoro and a government-

owned company to develop the

former Hecla assets. The mixed enterprise

is expected to be formalized within

six months after definitive terms for the

enterprise are established.

In a statement announcing the sale of

its Venezuelan properties, Hecla President

and CEO Phil Baker said the sale

was part of a strategy to reduce financing

recently raised to acquire its 100%

interest in the Greens Creek mine in

Alaska. “Our operations in Venezuela

were very important to Hecla in the early

2000s, during a time when precious

metals prices were depressed. But more

recently that operation has become a much smaller proportion of our company’s

value, as revenues from our U.S. silver

properties grew. In fact, in 2007, the

La Camorra unit contributed just 3% of

our annual gross profit,” Baker said.

The sale of La Camorra unit is expected

to reduce Hecla’s 2008 gold production

to about 70,000 oz (from earlier

guidance of 115,000 oz), with the

majority of that production coming as a

by-product from the Greens Creek mine.

Baker said, “2008 is a transition year for

Hecla as we see a reduction in gold production

but an increase in silver production.

And while we will not own a primary

gold mine, we will continue to consider

gold properties in politically secure

countries that leverage our expertise as

an underground miner.”

As featured in Womp 08 Vol 6 - www.womp-int.com