Metallica Resources has released details

of a technical report issued by consulting

firm Pincock Allen & Holt (PAH) following

a review conducted by PAH of the

feasibility study provided to Metallica by

Xstrata Copper for the El Morro coppergold

project in Chile. The El Morro project

is operated under a joint venture

agreement between Xstrata Copper

(70%) and Metallica (30%). The main

points of the review included:

• An initial capital investment estimate

considered accurate to within 15% of

$2.52 billion, including a contingency

for price escalation of 13%.

• The project economic model, which is

based on the capital cost and operating

parameters set forth in the feasibility

study and recreated and reviewed by

PAH, shows a positive after tax internal

rate of return of 14.7% and a Net

Present Value of $1.09 billion when

discounted at a rate of 8% and using

long-term prices of $2.80/lb for copper

and $625/oz for gold. Project payback

occurs at 4.7 years.

• Operating costs are estimated at

$10.55/mt of ore and a mine-site cash

cost of $0.76/lb copper, after gold

credits and production taxes at a longterm

gold price of $625/oz. The operating

costs are considered to be accurate

to within 15%.

• Average annual metal production during

the first five years has been projected

to be 203,000 mt/y of copper

and 302,000 oz/y of gold. The average

annual LOM production over the currently

estimated 14-year mine life is

projected to be 172,000 mt/y copper

and 313,000 oz/y gold.

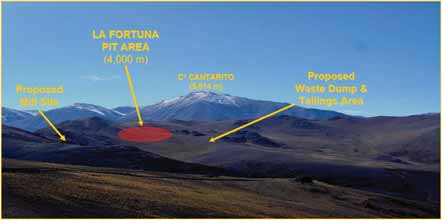

• The feasibility study was based on the

La Fortuna copper-gold deposit which

contains proven and probable ore

reserves totaling 450 million mt averaging

0.58% copper and 0.46 g/t gold

with an average waste-to-ore ratio of

3.65:1. Average metallurgical recoveries

are estimated at 88.5% for copper

and 69% for gold.

• The ore reserves are contained within a

larger economically constrained “mineral

resource pit” consisting of measured

and indicated resources totaling

558 million mt averaging 0.55% copper

and 0.49 g/t gold, and inferred

resources totaling 62 million mt averaging

0.34% copper and 0.18 g/t gold

at a 0.3% copper-equivalent cut-off

and based on metals prices of $1.25/lb

copper and $500/oz gold.

Xstrata has also reported to Metallica

that additional resources occurring outside

the mineral resource pit include

indicated resources totaling 52 million

mt averaging 0.57% copper and 0.61 g/t

gold, and inferred resources totaling 234

million mt averaging 0.51% copper and

0.48 g/t gold at a cut-off 0.3% copper

equivalent. These additional resources

were not included in the review by PAH,

according to Metallica, because they are

not integral to the feasibility study ore

reserve.

Based on its review of the feasibility

study, PAH recommended that the joint

venture partners initiate detail engineering

design work to optimize the project in

areas such as water use, metallurgical

processing, tailings disposal and possibly

others. The report also recommended rerunning

the pit optimization to develop a

mine plan based on the most recent

resource estimate completed in October

2007. The current resource estimate

used for the feasibility study was completed

in July 2007.

As featured in Womp 08 Vol 5 - www.womp-int.com