Survey Predicts Record Prices and Static Mine Production Levels for Gold

Part of the reason that the consultancy warns against “irrational exuberance” is their concern over the rapidly widening gap between mine production and jewelry demand, as this could jump from less than 100 metric tons (mt) to around 500 mt this year, with the report suggesting that longer-term equilibrium prices could be closer to the $600 mark.

The Gold Survey sets out how during 2007 it was the interplay between investors and the jewelry sector that largely determined the course that prices took. Investment was seen as the chief instigator of the rally from September onwards as capital flowed into areas such as exchange traded funds (ETFs), allocated metal accounts and the futures markets. GFMS believes that the nature of many of these destinations was useful in highlighting one of the key drivers behind this increase, namely a desire for wealth preservation, with Klapwijk adding “we’ve seen confidence in banks take a severe hit. And more than a few have questioned the solidity of conventional assets in the face of a U.S. recession, resurgent inflation and so on.” Other supportive factors that the report highlights included dollar weakness, lower interest rates, geopolitical turmoil and rising oil prices.

One perhaps surprising statistic was that GFMS’ measure of western investment, implied net investment, fell markedly last year. This decline the report chiefly ascribes to the heavy profit taking and stop loss selling, chiefly in the over-the-counter (OTC) market, that was witnessed in the first half and, in particular, the second quarter. Klapwijk commented, “much of the blame for this lies at the door of the rally failing at $700 several times, events such as June’s bond market crisis and talk of higher central bank sales.”

GFMS believes that the main reason the price remained static, rather than actively falling, in the first half last year was in turn the resilience of the jewelry sector. This was thought to have shrugged off high prices due to robust GDP growth in many developing world countries, stable prices, especially in local currency terms, and anticipatory buying in advance of an expected return of price strength. The possibility of higher future prices in conjunction with subdued local prices also affected the physical market as GFMS believe that these were some of the key reasons why scrap supply fell last year, as potential sellers held back. It was also apparent that much of the loosely held stock had been shaken out during the April-May 2006 price spike.

Producer de-hedging also had a material impact on prices as this rose somewhat unexpectedly and reached a record level. Klapwijk added, “timing was important here—the majority of this de-hedging was seen in the first half last year, or just when investors bailing out could have put the price into a tailspin.”

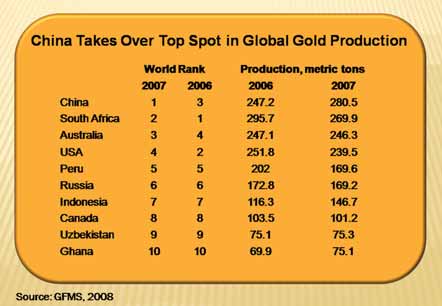

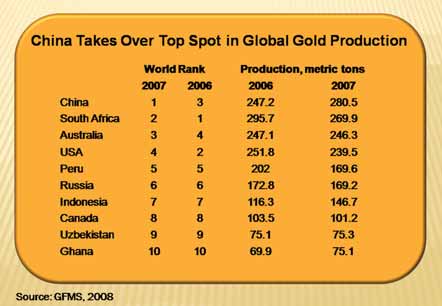

Global mine production fell by 0.4% in 2007 to an 11-year low. Africa saw the heaviest regional drop at 29 mt (chiefly due to South Africa). In South Africa, the decline in production was primarily due to the lower grades of mined ore. Temporary mine closures, enforced while heightened safety controls were implemented, further hampered production towards the end of the year. Elsewhere in the region, poor weather, labor disputes and processing difficulties served to dampen results. North American production fell for the seventh consecutive year, while Latin America also registered a near-23-mt decline despite strong gains in Brazil, Mexico and Guatemala. Production in the CIS declined modestly, driven primarily by a fall in Russian output, while Australia broadly maintained 2006 levels.

Strong growth was seen in Asia from China, Indonesia, Papua New Guinea and the Philippines. Of note was the fact that China posted a 33-mt rise to become the top global performer, overtaking South Africa’s century-long position as the world’s leading gold producer. Klapwijk said that China is expected to consolidate its lead in 2008, “primarily as a result of further declines expected in South Africa due to its ongoing power supply issues.”

Total cash costs increased by a steep 25% from 2006 levels. These rises were greatest in Australia, where total cash costs for the year increased by $91/oz last year. However, despite the significant cost hikes, average global cash margins actually expanded to $300/oz, due to the escalating gold price. Cost inflation was exacerbated by the willingness of producers to undertake development work and waste stripping activities at a time when healthy margins would be maintained. Consequently, temporary lulls in production were seen at many operations worldwide. GFMS forecasts that global mine production in 2008 will remain broadly in line with the level recorded in 2007.

The 2008 Gold Survey is the 41st edition of GFMS’ annual survey of the world gold market. The publication can be ordered from GFMS (E-mail: sales@ gfms.co.uk; Web site: www.gfms.co.uk; Online shop: http://shop.gfms.co.uk)