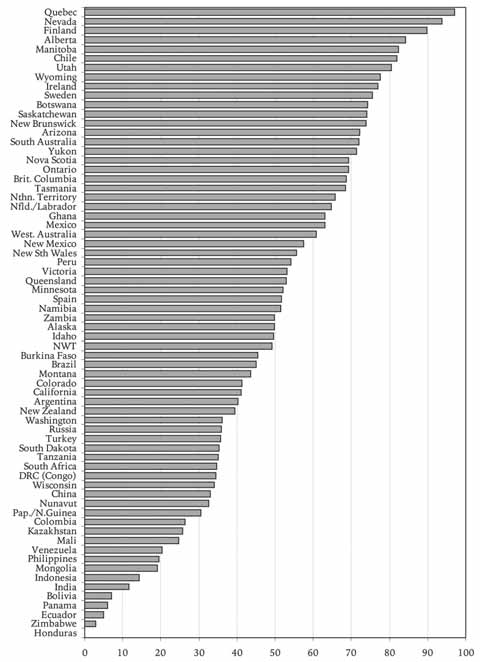

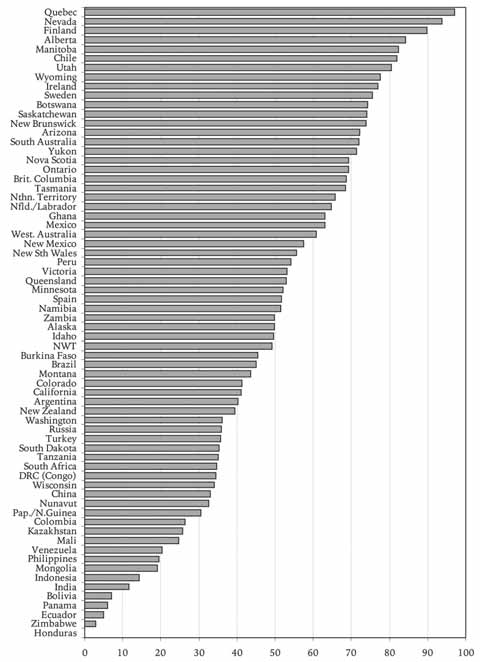

The Fraser Institute’s ranking of nations/provinces/states having the best policy environment for mining investment is

shown on this chart, with Quebec taking the top position in the most recent survey.

Quebec Stakes Claim to Best Policy for Mining

Quebec topped the annual world-wide survey, jumping up from the number seven spot last year. Nevada, a perennial favorite of the mining industry, moved up to number two from last year’s number three spot. British Columbia has resumed its upward path in the survey. British Columbia had seen steady improvement until last year when its score in the survey stalled but this year it moved up to the 19th spot from 30th in last year’s survey.

The survey represents the opinions of 372 mining executives and managers worldwide on the policy and mineral endowment of 68 jurisdictions on all continents except Antarctica. Manitoba, which was viewed with much optimism by the mining industry after being ranked number one last year, fell to number five. Alberta, last year’s runner up, dropped to number four. The biggest surprise was Finland, which rocketed from number 29 last year to the number three spot.

“Quebec has always been viewed in a good light by the mining industry, primarily due to its favorable geology,” said Fred McMahon, coordinator of the survey and the Institute’s director of Trade and Globalization Studies. “But Quebec’s government also provides a favorable policy environment to go along with strong mineral potential. Mining companies feel Quebec’s stable policies provide them with the certainty that reduces risk for long-term projects. Year after year, the survey bears out that above all, mineral exploration companies value stability and certainty when it comes to government policy.”

Other jurisdictions rounding out the top 10 are Chile, Utah, Wyoming, Ireland and Sweden.

The bottom ranked jurisdiction was Honduras, which scored zero in every category and did not receive a single response indicating the country does anything to encourage investment. Zimbabwe, which was the lowest ranked jurisdiction last year, had the same score but was supplanted by Honduras at the bottom. Other low-ranking scorers were Ecuador, Panama, Bolivia, India, Indonesia and Mongolia.

“Once again the results of the mining survey reinforce the importance of having a stable, predictable, transparent policy environment in order to attract investment, as well as ensuring good social, environmental and economic outcomes,” McMahon said. “If the policy structure is opaque, unstable, and unpredictable–the things that most vex the mining industry– then the process can be easily politicized and good projects opposed by special interests may be rejected while bad projects with powerful supporters may be approved.”

The overall rankings are based on the survey’s Policy Potential Index, a composite index that measures government policies including uncertainty concerning the administration, interpretation, and enforcement of existing regulations; environmental regulations; regulatory duplication and inconsistencies; taxation; uncertainty concerning native land claims and protected areas; infrastructure; socioeconomic agreements; political stability; labor issues; geological database; and security.

After placing five provinces in the top 10 last year, only Quebec, Alberta and Manitoba made the grade this year with New Brunswick falling to 13th from 6th and Saskatchewan dropping to 12th from 10th. This is the third consecutive year that Saskatchewan has fallen in the mining survey.

Ontario also showed signs of recovery, moving up slightly to 18th from 20th. Nova Scotia had no change, ranking 17th again while Newfoundland was the lowest ranked province at 22nd, the same ranking as it had last year. The Northwest Territories continued to improve, moving up to 37th from 41st, while the Yukon Territory fell to 16th from 11th and Nunavut dropped to 54th from 39th.

Perhaps the most significant change internationally was the return of Chile among the top 10 where it is ranked 6th. The results of last year’s survey dropped Chile to 27th spot, perhaps due to labor problems the industry was experiencing at the time. This survey shows that the industry’s long-term faith in Chile has not yet been shaken.

Last year’s survey showed Australia as being a preferred locale, but that has changed for 2007/2008 as the states of South Australia, Queensland and Tasmania all dropped out of the top 10.

“Mining is fully international business and these results reinforce the idea that jurisdictions must be prepared to compete on an international basis to attract mining investment,” McMahon said.

The 2007/2008 survey was released February 28 and is available at www.fraserinstitute.org

In related news, The Fraser Institute announced the creation of its new Global Center for Mining Studies to conduct research into public policy and the economic, environmental and social impacts of mining. The center will examine issues related to best practices in developing projects to the benefit of the local economy.