North American M&A Activity Doubles in 2007

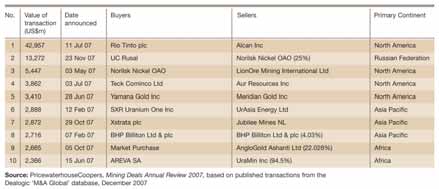

“Mining Deals 2007,” the PwC study, reports that globally, mining M&A activity reached unprecedented levels in 2007, kicking off a new era of super-consolidation. The number of deals in 2007 jumped 69% over the prior year to 1,732 with deal value rising 18% to $158.9 billion over the same time period. Both the number of deals and the deal value reached in 2007 are more than double the totals reached in 2005.

North America remained the primary focus for mining deal activity in 2007, accounting for 40% of global transactions and 49% of global deal value. Of the five largest deals in 2007, four were located in North America, accounting for 72% of U.S. deal value. Over 90% of North American mining deal value was in the diversified, base metals and other segments of the market with deals involving gold mining companies falling off.

“A limited talent base of employees with key skills, exploration costs at an alltime high, and the desire to diversify both across geographies and commodities are driving forces behind the increase in M&A activity both in North American and globally,” said Steve Ralbovsky, U.S. mining leader, PricewaterhouseCoopers. “And, with high commodity prices and strong optimism about the industry’s long-term growth and profitability, M&A activity will likely continue at a strong pace throughout 2008. However, given the downturn in the U.S. economy, M&A activity in North America may not sustain its current levels.”

Asia Pacific, Africa and South America all experienced a significant increase in deal volume in 2007, rising 72%, 81%, and 51%, respectively. Asia Pacific recorded the largest increase in deal value, rising 216% over the prior year to $35.3 billion in 2007. Intense competition for Australian mining assets lay behind much of the deal growth in the Asia Pacific region.

The report finds little evidence of a slowdown in global deal activity as a result of the credit crunch. The number of mining deals announced in the fourth quarter of 2007 was more than double the level recorded in Q4 2006, and the latest heavyweight moves by the biggest players has kicked 2008 mining deal-making off to an unprecedented start.

Looking ahead, economic slowdown in the U.S., continuing financial market uncertainty and fears of actual recession will inevitably cast a cloud of uncertainty over the period ahead. However, the report concludes that while instabilities are likely to deliver a bumpier deal-making ride, the fundamentals for M&A activity in mining remain strong. Indeed, 2008 looks set to be a landmark, if not a record, deal year for the industry.

For more information and to access the full report, visit: www.pwc.com/miningdeals