A uranium miner operates an LHD by remote control at Cameco’s Rabbit Lake mine.

Energy Demand Spurs Uranium Mining

Uranium miners overcome obstacles while trying to increase production

By Steve Fiscor, Editor-in-Chief

The International Energy Agency predicts that electricity demand will increase 100% of 2005 value by 2030 and will reach 260% by 2050. New nuclear power plant construction is under way, according to the Nuclear Energy Agency. The NEA recently reported that plants are being constructed in Finland, France, and the Slovak Republic. The Organization for Economic Cooperation and Development reported that the Pacific region has 13 new units committed. The U.S. Nuclear Regulatory Commission has received applications for the construction of five new units.

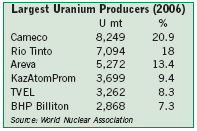

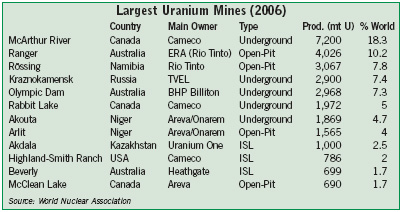

Over half the world’s production of uranium comes from mines in Canada (25%), Australia (19%) and Kazakhstan (13%), according to 2006 statistics from the World Nuclear Association. Most of the uranium is mined by underground methods (41%), with the remainder coming from open-pit (24%), in situ leach (26%) and by-product (9%). The largest uranium miners are: Cameco (Canada), Rio Tinto (England), Areva (France), KazAtomProm (Kazakhstan), TVEL (Russia) and BHP Billiton (Australia).

Cameco Battles Water Inflows, Boosts Production

Based in Saskatoon, Cameco is the world’s

largest uranium producer. It operates several

mines in Canada and the U.S. In a

recent report to stockholders, Cameco said

it expects reported uranium sales for 2008

to total 31- to 33-million lb U3O8. Cameco’s

share of uranium production for

2008 is projected to total about 21 million

lb of U3O8.

At the beginning of the year, the company announced its Rabbit Lake operation had resumed normal mining activities, well ahead of schedule, after sealing off the source of a water inflow. In late November 2007, the Eagle Point underground mine experienced increased water inflow and mining was suspended. The mine constructed and poured four concrete bulkheads in the first two weeks following the start of this event and has since been grout sealing these bulkheads and the surrounding rock while waiting for the concrete to cure.

An old exploration drill hole was identified as the potential source. Site crews confirmed the inflow source by injecting a dye into the drill hole. They successfully plugged the hole by installing an inflatable packer. Cameco plans to install a permanent plug and grout a substantial length of the drill hole to replace the packer. The mine was grouting the four bulkheads as an added precautionary measure. Cameco produces about 4 million lb of uranium at the Rabbit Lake operation annually.

During December, Cameco announced expansion plans for its U.S. operations, Power Resources and Crow Butte Resources (now known as Cameco Resources). Cameco Resources will target overall production increases of 70% from its in situ recovery (ISR) operations at Crow Butte, Nebraska, and the Smith Ranch- Highland mine in Wyoming. These operations and related projects combined have more than 50 million lb of proven and probable reserves. The current combined production of Cameco Resources makes it the largest U.S. uranium producer, with production of 2.1 million lb in the first three quarters of 2007. Cameco plans to increase the combined production at its Crow Butte and Smith Ranch-Highland ISR operations to 4.6 million lb U3O8 annually by 2011.

Site crews at Cigar Lake continue to make progress on the remediation plan following a rock fall that caused a flood of the underground development in October 2006. Construction is about 60% complete.

McArthur River/Key Lake (Cameco 70%:Areva 30%) experienced startup delays following a scheduled maintenance shutdown, but the mine still managed to meet its targeted annual production. Cameco has applied to increase the annual licensed production capacity at the McArthur River mine and the Key Lake mill to 22 million lb U3O8 from the current 18.7 million lb. This application had been undergoing an environmental assessment (EA), which has been temporarily halted as the company develops and implements a plan to reduce selenium and molybdenum discharges in the mill effluent. It expects to complete the first phase of this plan in the first part of 2008.

At McArthur River, tunneling of the north exploration drift continues. This development is intended to follow up on surface exploration drilling results from 2005 and 2006. The north exploration development will continue into 2008, followed by an underground diamond-drilling program to delineate targets previously identified from the surface.

Areva Signs Historic Deal with Chinese

During November, Qian Zhimin, chairman,

China Guangdong Nuclear Power Corp.

(CGNPC) and Anne Lauvergeon, CEO,

Areva, signed a historic agreement for the

nuclear power industry. The record contract,

worth €8 billion, is unprecedented in

the world nuclear market.

Through a series of agreements, Areva, in conjunction with CGNPC, will build two new generation EPR reactors and will provide all the materials and services required to operate them. Under the agreement, CGNPC will buy 35% of the production of UraMin (a subsidiary of Areva). The EPR will be built in Taishan in Guangdong province. Following Finland and France, China will be home to the third and fourth EPRs to be built in the world.

Areva produces 6,000 mt/y, representing around 15% of world production. The French company operates mines in Niger, Canada and Kazakhstan. To maintain its market position and replace its reserves, the company continues to explore for uranium, mostly in Canada, Niger and Central Asia.

Areva operates two companies, Somair and Cominak, which mine uranium from sedimentary deposits located on the western border of the Air mountains in northern Niger. Somair (Société des Mines de l'Air) produces 1,300 mt/y uranium The ore grade from the open-pit mines is 2 kg/mt. Due to the depth of the deposit (250 m), Cominak (Compagnie Minière d'Akouta) operates underground mines. The average grade ranges from 4.5 to 5 kg/mt. Cominak produces close to 2,000 mt of uranium in concentrates annually.

Areva Resources Canada Inc. is the second largest uranium producer in Canada. It operates three mining sites: Cluff Lake (undergoing reclamation), McClean Lake (in operation) and Midwest (under development), in which it holds 100%, 70% and 69.16% of the shares respectively. Areava also owns part of McArthur River mine and the Cigar Lake project. Located a short distance from the McClean site, the Midwest deposit contains 10,000 mt of uranium in high-grade reserves.

Areva Resources Canada started to produce uranium concentrates at the McClean Lake site in 1999. The mill was originally licensed to produce 3,000 mt of concentrates per year. In 2005, the licensed capacity was increased to process ore from the Cigar Lake and Midwest mines, when production starts at these sites. Because of the high grade of the ore processed, extraordinary precautions have been taken to protect the workers and the environment. The mill and the waste storage area are remarkable engineering achievements. The site’s environmental protection system was designed in accordance with ISO 14001 standards.

Ranger Increases Production; Grade Declines at Rössing

Rio Tinto produced 12.6 million lb uranium

in 2007 and 3.5 million lb during the

fourth quarter. The company recently

reported that its fourth quarter uranium

production was 13% higher than the prior

quarter but 14% lower than the 2006

comparative period. Rio Tinto owns 68% of

Energy Resources of Australia (ERA) and

69% of the Rössing mine.

Annual production at ERA’s Ranger mine for 2007 grew to 11.7 million lb uranium from 10.4 million lb in 2006, a 13% increase. This is also the second highest annual production on record for the Ranger mine. Exceptionally heavy rainfall at the Ranger mine in the first quarter of 2007 resulted in an elevated water level in the operational pit, preventing access to higher grade ore. The successful implementation of various water disposal strategies, along with the optimization of the mine plan throughout the year made higher grade ore available for processing. Although there was an improvement of 8% on the previous quarter, lower grades at Rössing reduced full year production to 6.7 million lb uranium from 8 million lb in 2006, a 16% decrease.

ERA reported drummed production of 5,412 mt of U3O8 for 2007 and 1,553 mt during the fourth quarter, which was 14% higher than the third quarter. This is due largely, according to ERA, to the higher mill head grade. This was a result of the higher grade ore mined in the bottom of the pit. Ore milled was 1% higher than in the third quarter of 2007.

Ore mined was 9% higher than in the third quarter of 2007 as a result of improved access due to the lowering of water levels in the pit. The pit was essentially emptied of water in November. Mining is now focused on stockpiling sufficient ore to lessen the impact on future production should the wet season be unusually heavy.

ERA did meet all delivery commitments by the end of 2007 resulting in sales of 5,324 mt (2006: 5,760 mt). If the region experiences a reasonable wet season, production should be restored to more normal levels in 2008. Rio Tinto’s average realized sales price of U3O8 for the 2007 was $25.06/lb (2006: $18.36/lb).

KazAtomProm Strikes Deal with Japanese

Last year, the National Atomic Company of

Kazakhstan (KazAtomProm) celebrated its

10-year anniversary. The company produced 6,637 mt of uranium in 2007 compared

with 5,281 mt of uranium in 2006;

representing a 25.7% increase. In 2008

the group plans to produce around 9,600

mt of uranium.

Last year the company had to reduce its total output by 1,000 due to a lack of sulfuric acid. The commissioning of the 1- million-mt Balkhash sulphuric acid plant has been delayed from May 2007 until the second quarter of 2008. Sulphuric acid is the main chemical component used to retrieve uranium by ISL.

During December, an agreement was signed between KazAtomProm and three Japanese companies—Kansai Electric Power Co., Inc., Nuclear Fuel Industries, Ltd., and Sumitomo Corp. The parties confirmed their intent to cooperate in the field of nuclear fuel fabrication for nuclear power reactors operated by the Kansai Electric Power Co., Inc. As part of the agreement, KazAtomProm’s Ulba metallurgical plant will produce and export components of nuclear fuel which will be used for manufacturing fuel assemblies to be supplied to the Kansai-operated nuclear power plants in Japan. The Ulba metallurgical plant is a joint venture between KazAtom- Prom (51%) and Cameco (49%).

KazAtomProm also signed an agreement with Cameco that provides for increase of projected uranium production from 2,000 mt/y to 4,000 mt/y at the Inkai deposit.

TVEL’s Priargunsky Industrial Mining and Chemical Union (PIMCU) is the largest uranium mining enterprise in Russia. It is the major diversified mineral mining entity in Krasnokamensk region. PIMCU mines and reprocesses U3O8 in the Streltsovsky ore field. The mines use traditional underground methods at three deposits and reprocesses ore at a hydrometallurgical plant. For the last five years its annual output amounts up to 3,000 mt/y.

During March 2007, PIMCU held a ceremony to commission the Glubinny mining complex. The new complex with production capability of 71 cubic meters per hour will mine uranium ore continuously. The size of the deposit is estimated to be 10,800 mt uranium. The construction of the mining complex at Glubinny site started in spring 2006.

PIMCU’s short-term plans include modernization of existing ore mining capacities, construction of a new mine on the Argunskoye deposit and setting up a new sulfuric acid plant. TVEL continues to delineate ore bodies and believes the deposit will support profitable production for the next 30 years with annual output of 3,200 mt/y to 3,500 mt/y uranium.

BHP Billiton’s Olympic Dam

In addition to containing the fourth largest

known copper deposit in the world,

Olympic Dam (570 km northwest of

Adelaide) is the world’s single largest

known uranium ore body, the tenth largest

gold reserve and one of the largest known

silver deposits. Its also Australia’s largest

underground mine. When it began producing

copper in 1988 it had an annual output

of 45,000 mt. Today, the mine produces

more than 200,000 mt of copper

each year along with uranium, gold and silver

as by-products. In 2006, Olympic Dam

plans to mine close to 10 million mt of ore.

In its latest quarterly report (December 2007), BHP Billiton said that it had experienced lower production from Olympic Dam than expected. Olympic Dam achieved an all time high in total material mined and ore hoisted during the last half of 2007, but its production was impacted by unplanned smelter interruptions and lower grades. The build up of underground stockpiles is progressing according to the development program in place to allow for increased ore hoisting.

BHP Billiton is undertaking a two year prefeasibility study into the expansion of Olympic Dam, which includes the examination of a broad range of alternatives. It is likely to see the advent of open-pit operations in addition to the existing underground mine, and will become one of the largest of its type in the world. An Environmental Impact Statement is being prepared for the Australian and South Australian Governments.

A major drilling program is also underway to improve ore body definition, establish its lateral extent and to test it at depth by drilling more than 2,000 m below the surface. BHP Billiton is making a major investment in the study phase to collect and model data, carry out mining, processing and infrastructure engineering studies and prepare the way toward the execution stage.