Agnico-Eagle Mines reported that as of

December 31, 2007, its proven and probable

gold reserves hit a record of 16.7 million

oz, an increase of 33% over the year

end 2006 level. The company said the

strong growth in gold reserves of 4.5 million

oz—prior to considering 2007 gold

production—resulted from successful definition

drilling at its development projects,

which converted 1.6 million oz to reserves,

along with the acquisition of the Meadowbank

project in northern Canada as part of

its takeover of Cumberland Resources.

Gold resources also continued to grow

to record levels, according to the company,

with indicated mineral resources now

standing at 2.8 million oz and inferred

mineral resources at 4.7 million oz.

Considering the growth in gold reserves

and resources at several key projects, company

officials are optimistic that the company’s

target range of 18–20 million oz

may be surpassed within the next two years

as promising results continue to be

encountered outside of the current gold

reserve and resource envelopes.

At a recent investors’ conference, Vice-

Chairman and CEO Sean Boyd said that

the company’s current projects also have

the potential to increase gold production

fivefold by 2010 to 1.4 million oz, and further

drilling could result in several 5-million-

oz gold deposits. Gold production for

2008 is forecast at 360,000 oz, a 50%

increase over last year’s output.

Some of the more recent exploration

successes include the northwest quadrant

of the company’s Pinos Altos property in

Mexico, where the initial inferred resource

estimate on the Creston Colorado zone is

7.7 million mt, grading 1.4 g/mt gold, or

400,000 oz. A scoping study for a standalone

operation is under way there.

Deep drilling at the Kittila property in

Finland confirmed the depth extension of

the main Suuri deposit to approximately

1,000 m—approximately 350 m below the

current reserves and resources.

These results have not been incorporated

into the current resource estimates,

according to the company.

The company’s exploration budget for

2008 is more than $65 million—highest

in the company’s history—which will

include approximately 270 km of drilling

using 25 drill rigs.

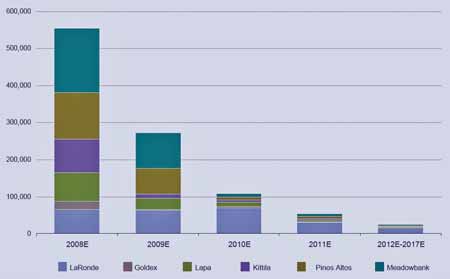

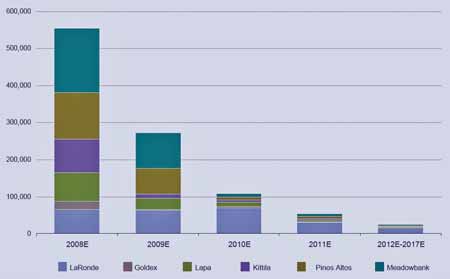

Agnico-Eagle’s project capital investment spending

will decline significantly after 2008 as new

Agnico-Eagle’s project capital investment spending

will decline significantly after 2008 as new

mines are brought to the

production phase. The company’s current projects have the potential,

when

completed, to increase gold production fivefold

by 2010.

• At Goldex, also located in Quebec, proven

and probable gold reserves stand at 1.7

million oz from 22.9 million mt grading

2.3 g/t. The mine is forecast to produce

average annual output of 175,000 oz with

total cash costs expected at $230/oz.

Shaft sinking is finished and the processing

plant is scheduled for completion in

the first quarter of 2008. The company

has invested $160 million to date in this

project, with another $23 million to come

before completion in April 2008.

• The Lapa property, 11 km east of the

LaRonde mine, contains probable gold

reserves of 1.2 million oz in 3.9 million

mt grading 9.1 g/t, and is expected to

produce average production of 125,000

oz/y at estimated total cash costs of

$300/oz. Shaft sinking has been completed

and level development is under

way at the $165-million project.

• At the $190-million Kittila mine project

in Finland, exploration is ongoing to convert

a large gold resource to reserves. The

deposit is open on strike and at depth,

with current probable reserves of 2.6

million oz contained in 16 million mt

grading 5.1 g/t. After anticipated completion

in September 2008, the mine is

targeted to produce 150,000 oz/y with

estimated total cash costs of $300/oz.

• The company’s Pinos Altos project in

Mexico contains probable gold reserves

of 2.2 million oz gold and 65.7 million

oz of silver in 20 million mt at 3.5 g/t

gold and 102.3 g/t silver. Construction is

scheduled to start in the first quarter of

this year, with a total project capital costs

estimated at $230 million. Annual output

will be an estimated 190,000 oz at

total cash costs of $210/oz. A $14-million

exploration program is under way

there, and drilling from an underground

decline will also begin in the first quarter

of 2008.

• The Meadowbank project is anticipated

to produce 435,000 oz/y of gold during

its first four years of production at an

approximate cash cost of $240/oz; average

life-of-mine production will be

around 360,000 oz/y with cash costs of

$300/oz. The company has spent $110

million to date, with another $280 million

required before completion in January

2010.

As featured in Womp 08 Vol 2 - www.womp-int.com