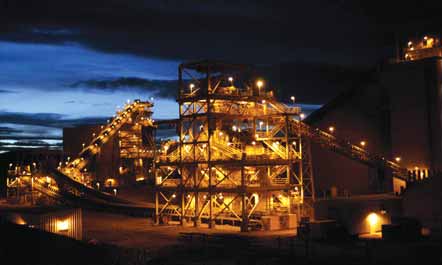

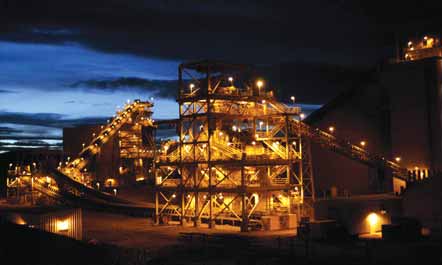

AngloGold Ashanti will pay Golden Cycle Gold Corp. shareholders about $149 million to acquire full

ownership of the Cripple Creek & Victor Gold Mining Co. gold mine, plant and property in Colorado.

AngloGold Ashanti to Acquire 100% of Colorado Gold Mine

Gold production at CC&V during 2007 is estimated at 282,746 oz, down from an original budget of approximately 308,000 oz due to decreased gold recovery attributed to higher ore stacking levels on the valley leach facility. CC&V production as of November 25, 2007, was reported to be 32,110 oz which brought the total to 248,747 oz for the year to date. Daily gold production averaged 1,065 oz. The inventory of recoverable gold on the valley leach facility included approximately 630,000 troy oz as of November 25, 2007. This inventory had an estimated value of approximately $504 million at a gold price of $800/oz.

In 2007, CC&V began a $6-million exploration program to expand near-surface gold ore resources at the mining property to meet the requirements of its mine life extension plan (MLE). The MLE pre-feasibility study was completed in first-quarter 2007 with the decision taken shortly thereafter to proceed to the full feasibility study, which CC&V expects to complete during 2008. The expanded exploration program will be an integral part of the full feasibility study.

The pre-feasibility study was conducted by CC&V internally to examine the possibility of extending the mine life at the Cresson mine beyond 2012. According to the company, the pre-feasibility study is predicated on realizing positive results from CC&V’s exploration program. During 2006 the property’s reserve addition potential was reportedly corroborated by two independently derived pre-resource (strategic) resource models based on existing district data. These models were used to determine the range of options studied, and if achieved, would extend mine life even beyond that of the currently contemplated MLE project.

CC&V said it studied the possibility of extending the mine life for various periods and amounts of gold production. CC&V believes its ongoing exploration program will convert portions of its year-end 2006 mineral resources to reportable reserve status following additional in-fill drilling and metallurgical work during 2007 and 2008, and produce additional mineral resources for later follow-up.

The study examined three scenarios: no mining beyond filling its existing valley leach facility; mining additional ore of 94 metric tons mt; and mining additional ore of 212 mt. The options requiring additional mining would load ore on a new valley leach facility. Initial design indicates the new valley leach facility could be expanded beyond the 212-mt capacity required by the maximum case in the study. Options involve extending the mine life to between 2016 and 2022, with gold production estimated to end between 2024 and 2030.

The extension scenarios could enable the mine to produce between 1.39 and 3.08 million additional ounces of gold, estimated to add revenues of approximately $764.5 million to $1.694 billion at a gold bullion price of $550/oz. The incremental project capital cost for the extension scenarios is estimated to be between $148 million for the 94-mt case and $281 million for the 212-mt case, excluding current budgeted items in the base case of $29.6 million and feasibility study and exploration costs of approximately $21 million. Cash costs vary from an estimate of $256/oz in the base case and $272/oz in the 94-mt case to $292/oz in the $212-mt case. LOM project operating cost is estimated by the study to be $33/oz of recoverable gold placed.