Polymet Mining, owner of the large North-

Met polymetallic deposit in northeastern

Minnesota, USA, is hoping that a logjam in

the state’s natural-resource regulatory

bureaucracy will break early in 2008,

allowing the Vancouver, B.C.-based company

to move forward with draft Environmental

Impact Statement preparation and

to eventually obtain permits leading to an

anticipated startup of production sometime

in the first half of 2009—making it

the first nonferrous metal mine in modern

times to obtain official approval from this

upper Midwestern state.

The company, which plans to spend an

estimated $380 million to get the project

up and running, plus an additional $72

million in sustaining capital over the

course of a projected 20-year mine life,

began the permitting process in 2004 and

initially expected the state’s Department of

Natural Resources and the U.S. Army

Corps of Engineers to complete their evaluation

of its operating plans in November

2007. However, the agencies were unable

to meet that target and said they needed

another few months of study time.

During a conference call with analysts

and investors in early November following

the extension, company executives expressed

confidence that the evaluation

would be completed in January 2008 and

downplayed any concerns that the regulators

were deliberately prolonging the

process or encountering unanticipated

problems. LaTisha Gietzen, vice-president

of public, government, and environmental

affairs for PolyMet, said that during a

meeting with Minnesota Governor Tim

Pawlenty, the company had been assured

of the state’s interest and support for the

project. Chief Financial Officer Douglas

Newby noted that the agencies had been

previously engaged in similar studies for

two other large projects and that “we had

the [misfortune] to be third on the list.”

Concurrently with the extension, Polymet

said that in the latter half of 2007 it

had focused on improving certain environmental

aspects of the project. The company

modified its proposed mining schedule

to allow waste rock backfilling in minedout

portions of the pit, and eliminated

plans for an overburden stockpile to reduce

impact on nearby wetlands. In addition,

mine-site water will be collected, treated,

and pumped to the plant site where it will

be used as process water, resulting in zero

surface water discharge and a reduced

requirement for makeup water.

PolyMet’s project is located just south

of the northeastern end of the famous

Mesabi Iron Range. The project comprises

the NorthMet orebody—containing copper,

nickel, cobalt, platinum, palladium and

gold with traces of zinc and silver—and a

large former taconite processing complex

situated 6 miles to the west of the deposit

and connected by a private railroad. The

orebody is in the center of a trend of polymetallic

nonferrous metal deposits on the

northwestern contact of the Duluth Complex,

a mineral belt that is believed to be

one of the three largest known concentrations

of nickel in the world, behind the

Norilsk district in Siberia and the Sudbury

Basin in Ontario, Canada.

Nickel Poses a Processing Pitfall

U.S. Steel first discovered NorthMet in the

late 1960s, initially targeting high-grade

mineralization at depth before moving up

dip into lower-grade material that outcropped.

However, prior to the autocatalyst

market and significant industrial demand

for platinum group metals, the only metals

of relevance were copper and nickel—and

nickel contamination of copper concentrate

made the economics of existing flotation

technology unattractive. U.S. Steel,

after conducting widely spaced drilling

along the deposit’s 3-mile strike length,

ultimately sold an automatically renewable

20-year lease for it to PolyMet in 1989.

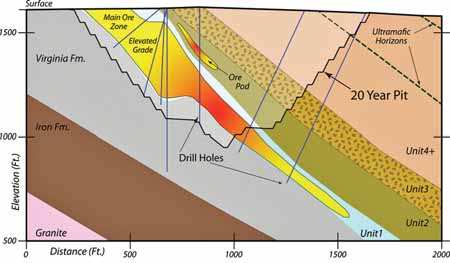

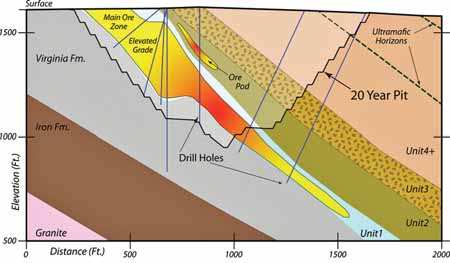

Cross-sectional view of the NorthMet deposit.

Cross-sectional view of the NorthMet deposit.

Proven and probable reserves as of the

September 2007 update totaled 275 million

t (within the measured and inferred

resource) grading 0.90% Cu equivalent.

Infill drilling has been ongoing and

Polymet expects to release another update

in 1Q 2008 that it says will expand its

resource figure and convert more resource

tons to reserves.

On September 6, 2007, Polymet

announced that it had signed a project

labor agreement with 15 construction

trade unions defining ground rules for

working conditions, schedules, overtime

and safety during the project’s construction

phase. In addition, NorthMet’s location

near the Iron Range allows Polymet to

exploit the advantages of an established

regional infrastructure and a large, experienced

local mine labor pool, said company

officials.

URS Corp., Denver, Colorado is lead

contractor for project EPCM. Construction

will comprise four phases, beginning with

refurbishment of the existing Erie plant

facilities; followed by construction of the

mine and a new hydrometallurgical plant;

reactivation of some existing mine infrastructure;

and implementation of environmental

safeguards.

Key to the project’s viability was

Polymet’s purchase in 2005 of the nearby,

inactive LTV Steel Mining Co. Erie ore processing

facilities from iron ore producer

Cleveland Cliffs. Assets acquired in that

transaction—which cost Polymet about $8

million in cash and stock—included crushing,

milling and flotation facilities, spare

parts, plant and mine shops and other

buildings, and tailings impoundments. At

the time of the announcement, PolyMet

President and CEO William Murray said,

“Acquisition of this large complex provides

PolyMet with about 80%-85% of the physical

plant assets needed to develop the

NorthMet project. This acquisition will

save nearly $200 million in capital development

costs.”

In December 2006, Polymet closed an

additional purchase from Cleveland Cliffs

that included a railroad connection linking

the mine development site and the Erie

plant, plus a 120-railcar fleet, locomotive

fueling and maintenance facilities, water

rights and pipelines, administrative office

facilities at the site, and approximately

6,000 acres to the east and west of and

contiguous to PolyMet’s existing tailing

facilities—adding extra tailings storage

capacity should the company choose to

expand its production in the future. These

assets cost Polymet another $15 million

and 2 million shares, giving Cleveland

Cliffs ownership of about 7.7% of Polymet’s

issued stock.

The Erie plant, built in the 1950s for

about $350 million, is an enormous facility—

the main concentrator building alone

is one-quarter mile long—that was originally

designed to process 100,000 t/d of

tough taconite ore. It includes a railcar

dumper building; dual primary, secondary,

tertiary and quaternary crushing lines; a

large number of rod and ball mills; and a

large magnetic separation section that will

be superseded by a new flotation circuit.

Joseph Scipioni, Polymet’s COO, is confident

that the plant, which has been idle

since 2001, can be restarted without

major mechanical difficulty. But as

Scipioni, who formerly was plant manager

at U. S. Steel Corp.’s taconite plant in

Keewatin, said last fall, “Since we only

plan to run the plant at one-third of its

capacity, we’ll have plenty of spare parts

available no matter what.” An existing pellet

plant on site is being demolished.

Polymet is installing a new flotation circuit

inside the existing plant building and

also plans to construct a new hydrometallurgical

plant. It will sell a bulk concentrate

from the flotation section to fund construction

and commissioning of the hydromet

plant which, when completed, will produce

copper cathode, nickel-cobalt-zinc hydroxides

or purified hydroxides of each metal, a

gold/PGM precipitate for toll smelting, and

synthetic gypsum which will be a by-product

of the pressure leaching technology

employed by the plant.

The project’s DFS projected a mining

rate of 81,000 t/d of rock over the life of

mine, with 32,000 t/d of ore delivered to

the mill via the rail link. Mining costs presented

in the DFS are $1.14/t of rock

mined and $3.13/t of ore, but Polymet

executives feel that these early-estimate

figures are probably on the high side. The

project staff has been examining opportunities

for mining plan optimization and,

according to the company, has been able

come up with improvements that streamline

pit scheduling, lower unit mining

costs, reduce the overall strip ratio and

extend reserve life. Mine preparation,

including prestripping, will be handled by

a contractor; Polymet will take over for fullscale

operations, employing two large shovels

and seven or eight 240-ton-capacity

haul trucks. The final operational mine

plan will be completed in parallel with the

final stages of the permitting process.

Ore from the mine, after arriving at the

plant by rail, will be unloaded into the

coarse crusher dump pocket and subjected

to four-stage crushing—using only about

one-fourth of the facility’s total crushing

capacity—down to a product sized at 80%

minus 0.5 in. followed by rod and ball mill

grinding to a coarse sandy texture of 100-

125 µm P80. Prior to commissioning of the

hydrometallurgical plant, Polymet plans to

sell concentrates, either as a bulk product

or as separate Ni and Cu concentrates with

precious metal values present in both products.

During the time it is selling the bulk

concentrate, it will additionally process the

flotation product through a scavenging circuit

after the cleaner stage, following by

regrinding, to remove more gangue material

and produce a higher-grade concentrate.

One of the company’s current objectives,

according to David Dreisinger, a Polymet

director and metallurgical processing consultant,

is to increase copper content in

the concentrate to more than 20% with

less than 0.3% Ni content.

Once the plant is operational, the company

will process all concentrate using the

Platsol process, which employs chlorideassisted

pressure leaching to allow extraction of precious metals concurrently with

the copper, nickel and cobalt. Platsol processing

requires a conventionally designed

autoclave operating at a moderately high

temperature of 225°C and employing 30-

60 g/L of H2SO4, and 10 g/L NaCl.

At full production, Polymet intends to

produce about 72 million lb/y cathode copper,

15 million lb/y of nickel, 700,000 lb/y

of cobalt and more than 100,000 oz/y of

combined precious metals.

Concentrating on the Complex

When compared with the world’s largest

nickel/copper sulphide districts, various

sources rank the Duluth Complex as third

largest in nickel content, second in copper

and second in PGM content. There are

presently 13 known nickel/copper sulphide

deposits in the Duluth Complex that combined,

could host a theoretical resource of

4.4 billion tons of copper/nickel ore averaging

0.66% Cu and 0.20% Ni using a

cutoff grade of 0.50% Cu equivalent. Not

surprisingly, its economic potential has

attracted a number of players.

The NorthMet project is by far the most

advanced of its type in the area, but other

companies are avidly pursuing exploration

and development of additional polymetallic

deposits throughout the Complex. Franconia

Minerals Corp., an Alberta, Canada,

company with its head office in Spokane,

Washington, USA, holds more than 15,000

acres in the area and is focusing on its

Birch Lake copper-nickel-PGM deposit

located in the north-central part of the mineral

belt. According to the company’s latest

figures, Birch Lake contains resources of

more than 100 million t grading 0.59%

Cu, 0.19% Ni and 0.14 g/t Au, 0.65 g/t Pd

and 0.32 g/t Pt. The company’s Maturi

deposit, 3 miles to the north of Birch Lake,

contains another 83.1 million t of similar

but lower-grade mineralization, and its

Spruce Road property is estimated to contain

124 million t of underground-minable

and 376 million t of surface-minable

inferred resources. Pre-feasibility studies

are presently aimed at evaluating the viability

of separate mines at Birch Lake and

Maturi that would feed a single processing

complex built near the Birch Lake deposit.

Another company active in the area is

Ontario, Canada-based Duluth Metals,

which reports that current estimated

resources at its Nokomis deposit in the

western portion of its Maturi Extension

properties in the Duluth Complex consists

of 347 million t of indicated resources

grading 0.62% Cu, 0.20% Ni, and 0.52

g/t of platinum+palladium+gold (total precious

metals, or TPM), plus an additional

108 million t of inferred resources grading

0.64% Cu, 0.18% Ni, and 0.70 g/t of

TPM. In mid-January 2008, the company

announced it had acquired a Platsol technology

license from the process patent

owner, International PGM Technologies

Ltd., for future processing of these metals

extracted from its properties along the

Complex.

As featured in Womp 08 Vol 1 - www.womp-int.com