While the huge greenfield Tenke Fungurume

copper project in the Democratic

Republic of Congo has been center stage

for some time, the brownfield Kamoto project

in the Kolwezi district, about 220 km

northwest of Lubumbashi, has also been

attracting attention lately as the Kamoto

Joint Venture is close to starting refined

metal production.

Key mine components were ordered a

year ago, the construction team build-up

began in January 2007, and extraction

commenced at the Kamoto underground

and T17 open-pit mines in April. The 7.5-

million-mt/y-capacity concentrator restarted

in July and commissioning of the Luilu metallurgical

plant got under way in September.

Copper and cobalt output should

start in the final quarter of 2007. Total

reserves and resources (excluding inferred)

are stated as 162 million mt at 3.5% copper

and 0.38% cobalt, sufficient to support

a mine life of at least 40 years at anticipated

production rates. The average site cash

costs, net of cobalt credits, are estimated at

$0.20/lb copper, placing Kamoto close to

the lower end of the global mine cost curve.

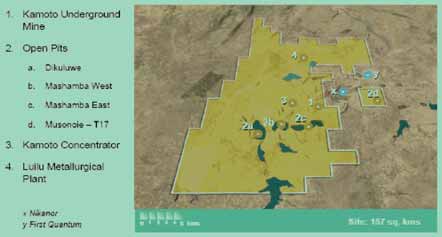

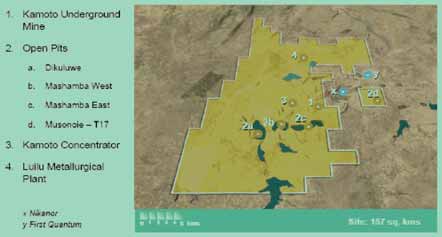

The Kamoto/Dima mining complex is

one of a number of substantial copper

operations that state-owned Gécamines

was obliged to close. It comprises the

Kamoto underground mine; the Dikuluwe,

Mashamba East, Mashamba West and

Musonoie-T17 oxide open pits; the Kamoto

concentrator and the Luilu metallurgical

plant as well as the related mineral properties.

As the region’s political situation improved

Gécamines sought to refurbish and

rehabilitate the facilities, signing the

Kamoto Joint Venture Agreement with

Kinross-Forrest Ltd (KFL) to hold, redevelop,

rehabilitate and operate the Kamoto JV

Assets. The Kamoto JV received the

approval of the Conseil des Ministres du

Government de Transition of the DRC (the

Congolese Government) on July 15, 2005.

The JV required that a feasibility study

be delivered by KFL to Gécamines within

eight months after the Kamoto JV has

received all required regulatory approvals.

This feasibility study, delivered in April

2006, projected a discounted rate of return

on total capital invested to achieve a minimum

of 150,000 mt of sulphide ore

processed each month of not less than

20%. As per the JV terms, this enabled KFL

and Gécamines to establish a DRC company

to hold the Kamoto JV Assets. This is the

Kamoto Copper Co. (KCC), initially 75%

owned by KFL and 25% by Gécamines.

KCC has a service agreement with Kamoto

Operating Ltd. (KOL) whereby KOL purchases

the equipment and materials for the

project and was also to market and sell the

production. Subsequently, Bermuda-based

Katanga Mining Ltd. acquired KFL in

stages, completing the deal and listing on

the Toronto Stock Exchange in July 2006.

Katanga Mining, headed by Arthur

Ditto, former president of Kinross Gold

Corp., has offices in London, England.

Katanga reports that capital investment in

Phase 1 of the project, to first production,

is $172 million. Phase 2, covering bringing

roaster 1 online through 2008-2009 will

require $97 million, and Phase 3, involving

a second roaster and a dewatering program,

will absorb $105 million. The final phase,

costing $50 million, will take the operation

to full rate production of 150,000 mt copper

and 8,000 mt cobalt in 2011.

At the Kamoto underground mine, twin

6.5 x 6-m ramp declines provide access for

trackless mining equipment and the shaft

system can hoist 11,000 mt/d. Katanga

Mining ordered a fleet of drilling, bolting,

loading and haulage machines from Atlas

Copco, including four Rocket Boomer 282

drifting rigs, four Boltec H235 machines,

four Scooptram ST1520 LHDs and six

Minetruck MT5010 haulers.

Work on the concentrator has involved

South Africa’s Multotec in refurbishing the

flotation plant. First, Multotec Zambia completed

a detailed plant audit at the concentrator,

making recommendations to the

project manager Hatch as to how the rehabilitation

should be carried out. The resulting

supply contract included design of the

level control system and delivery of the wetted

parts of the new flotation mechanisms.

A field service team assembled a prototype

of the Wemco 120 unit in the concentrator

to assist KOL personnel in setting up the

rehabilitation process and later a Multotec

commissioning team worked with operational

and engineering personnel from the

concentrator. Multotec will also train plant

personnel on general inspection and maintenance

issues on the flotation cells.

However, the target firm decided to

review the strategic options open to it and in

early October, having completed the review,

Katanga Mining announced it had signed a

term sheet for a $150-million one-year loan

facility with Glencore International AG. The

loan bears interest at LIBOR plus 4%

payable upon maturity. During the one-year

term, the loan is convertible at the option of

Glencore into 9,157,509 (fixed number)

common shares of the company. Katanga

has the right to repay the loan at any time.

The agreement also includes a ten-year offtake

contract with Glencore for all the copper

and cobalt production.

As featured in Womp 07 Vol 8 - www.womp-int.com