An Atlas Copco Rocket Boomer E2 at work in Lundin Mining Corp.’s Zinkruvan mine in Sweden.

The company is anticipating a 33% increase in copper ore production by 2010 to 1.2 million mt/y.

Lundin’s Triple Play Covers Expansion, Silver Sales

The major announcement, on October 5, covered board approval for two major expansion plans: one involving development of the copper orebody at the Zinkgruvan mine in Sweden and the other mining of the major zinc orebody, Lombador, at the Somincor Neves-Corvo operation in Portugal.

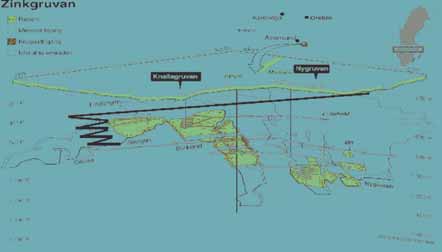

At Zinkgruvan, the copper resource— discovered on the hanging wall of the Burkland zinc orebody while the mine was owned by North Ltd.—is expected to contribute to a 33% increase in ore production to 1.2 million mt/y by 2010, when copper concentrate production should start. At full capacity, annual copper production will be about 7,200 mt in concentrate over at least a 12-year period, Lundin said. Development work will include driving a ramp from surface to the 350-m level, installing a dedicated underground ore bin and crushing system for the copper ore and adding a copper processing line in the mill. This work is not expected to affect current production rates. The ramp development will have the added benefit of facilitating access to lead-zinc orebodies to be developed in the western zone of the mine. Capital expenditure is budgeted at $37 million, of which about $22 million is required to achieve first copper production.

At Neves-Corvo, the intended expansion is much larger, increasing zinc ore production from 400,000 mt/y to perhaps 2.4 million mt/y and increasing contained lead as well as zinc output. This operation was initially based on five orebodies within an anticlinal structure, of which one, Graça, has been pretty much worked out and two, Neves and Corvo, currently yield most of the ore hoisted. Of the other two, Zambujal and Lombador, the latter could not conveniently supply the present hoisting shaft. However, contractors have been definition drilling within the Lombador orebody during 2006-7. This surface drilling program has focused on the Lombador zinc zone, a continuous zone of zinc mineralization contained within the much larger Lombador massive sulphide lens. This zone has so far been intersected by 21 drill holes covering an area which extends at least 620 m along the dip of the deposit, from 600 m below surface to 1,000 m below surface. The lowermost underground development at Neves Corvo is currently 700 m below surface. The zone extends at least 300 m along strike. In addition to the zinc mineralization, several of the holes drilled into this zone have encountered copper mineralization below the zinc mineralization. Lundin reports that internal continuity of the zone is proving to be excellent. Both the massive sulphide lens and the zinc zone remain open at depth. Ongoing drilling will continue to search for the limits of the Lombador zinc zone, and to test for high grade Zn/Cu mineralization within the Lombador sulphide lens.

These results have encouraged Lundin to start a feasibility study in the final quarter of 2007, with completion expected in second half 2008. This would presage the start of mining during 2011, leading to full-scale operation at Lombador yielding 130,000 mt zinc, 20,000 mt lead and 300,000 oz silver annually. Production would be maintained for at least 10 years and the additional output will make Neves- Corvo Europe’s largest zinc mine, Lundin said. The project includes sinking a new vertical shaft to about 1,000 m, constructing a new process plant and building associated infrastructures. Total capital expenditure is estimated at $250 million, of which $180 million is required to achieve first zinc production from Lombador, and will be financed by internal cash-flow.

Meanwhile, Lundin had announced on October 1 the regulatory approval and closure of its agreement with Silverstone Resources Corp. to deliver the silver production from both the Neves-Corvo and Aljustrel mines in Portugal to Silverstone. The former currently produces about 500,000 oz/y silver in copper concentrate while Aljustrel is expected to yield approximately 1.2 million oz/y silver in lead concentrate. Lundin will receive an upfront payment along with almost 20 million Silverstone common shares and will thereafter receive cash payments for the silver on delivery.

Joao Carrelo, executive vice-president and COO said, “The closing of the agreement to sell our silver production to Silverstone, which is a by-product for Lundin Mining, will allow us to focus on and develop our core metals. As the Aljustrel mine prepares to commence production in late 2007 management is considering alternatives that would significantly augment production by including additional resources into the mine plan.”

Toronto-listed Silverstone’s sales are presently all generated by purchasing byproduct silver from operating base metal mines, including Cozamin in Mexico. The firm also has a 90% earned interest in four silver-gold properties in Mexico and is exploring these. Lundin already has a similar silver sales agreement with Silver Wheaton for Zinkgruvan production.