Mineral Process Plant Delivery: Strategies for a Whole World Market

Consequently, process technology suppliers such as Metso Minerals, Outotec, and FLSmidth Minerals have, similar to Sandvik (See p. 60), spent a lot of time and money to build up a broad scope of supply and wide spread of design and manufacturing facilities. And, particularly recently, they have been learning to harness worldwide supply sources without sacrificing quality control. It’s a complicated and sometimes nerve-fraying exercise in global matrix management.

Finland-based Metso Minerals has been operating on a new organizational basis in 2007. The business area offers a very wide range of equipment for comminution, flotation, pyro processing, materials handling and recycling systems, manufactured at various facilities around the world. There are now three business lines—Construction, Mining and Recycling—which market the equipment as well as process technology services. The three will normally operate separately in each market, albeit sharing premises where appropriate. Metso Minerals has also established a Strategic Marketing unit in Tampere, Finland, that works with all three lines.

According to the company’s interim results for the second quarter and first half of 2007, Metso Minerals' order intake continued to grow at a healthy 27% pace.

Significant mining sector orders announced in July and booked in the second quarter backlog included an approximately €47 million order comprising two SAG mills, four ball mills and two VERTIMILL grinding mills for Gold Reserve Inc’s Brisas gold-copper project in Venezuela. The delivery will be completed by the end of 2009. Additionally, Metso Minerals will supply apron feeders, a primary gyratory crusher and cone crushers to Gold Reserve. The order includes start-up and commissioning services, as well as initial spare parts for the project.

For a bauxite yard expansion at Companhia Brasileira de Alumínio (CBA) in São Paulo, Brazil, Metso will supply two bridge reclaimers, one stacker and six belt conveyors valued at approximately €12 million, with delivery to be completed within the first quarter of 2009. And a pure silica quartz crushing, washing and screening system for Elkem Solar’s processing plant in Kristiansand, Norway, is be delivered during the first quarter of 2008. The value of this order is approximately €6 million.

Metso’s own investments this year include the expansion of mobile crusher assembly capacity in Bawal, India, while in Tampere a new assembly line for mobile crushers was introduced early in the year; a crusher pilot plant and test laboratory are currently under construction.

Outotec, also a Finnish firm, has an even wider range of process equipment and technology for the minerals industry— more out of ore, as the latest brochure puts it. The company said it has expertise covering most metals and the entire value chain from minerals to metals. Having initially focused on developing process control and flotation equipment for the parent company’s operations, the then Outokumpu Technology greatly expanded its mineral processing technology range by acquiring companies including Carpco, based in the United States, Morgårdshammar in Sweden and Supaflo in Australia. It also developed, but later sold to fellow Finnish firm Larox, a filtration equipment range. Absorbing Outokumpu’s saleable proprietary hydrometallurgical and pyrometallurgical technology considerably extended Outokumpu Technology’s scope as did the acquisition of aluminum production technology and the Lurgi process technology operation in Germany.

Outokumpu spun off the division as an independent company at the start of 2007, and on April 24, it was renamed Outotec. In June 2007, Outotec signed a collaboration agreement with Australia’s Intec (see E&MJ, July/August 2007, p. 8). Outotec has 30 offices in key mineral industry markets as well as representatives in others.

Meanwhile, the acquired business activities have remained in place, albeit clearly identified as Outotec operations. This strategy has retained expertise while providing a base for marketing the complete Outotec range—to very good effect: since late May the boom in mining and metallurgical investment has continued to keep Outotec’s order intake very healthy. The company had made 10 major announcements concerning new business by August 21.

These covered; an agreement with OAO TNK Kazchrome to design and deliver a second chromite pellet plant for Kazchrome’s Donskoy chrome mine in Kazakhstan that, together with Outotec’s earlier delivery of a similar plant in 2005, will create the world’s largest production unit for chromite pellets when completed in mid-2009; four aluminum technology orders from Chinese aluminum smelters; delivery of the world’s largest sulfuric acid plant project at Ras Az Zawr, Kingdom of Saudi Arabia for The Saudi Arabian Mining Co. (Ma’aden); design and delivery of two alumina calciners for the ZAO Komi Aluminium Sosnogorsk alumina refinery in the Republic of Komi, Russia; supply of an alumina calcination plant for CBA in Alumínio (SP), Brazil; supply of a new green anode plant and spent anode crushing facility for the Dubai Aluminium Co. and Mubadala Development Co. PJSC of Abu Dhabi joint venture aluminum smelter in Abu Dhabi; a third pelletizing and sinter plant order from Samancor Chrome’s facility in Middelburg, South Africa; and a contract awarded by Tata Steel for the design and basic engineering of an iron ore sinter plant, supply of proprietary equipment and provision of supervisory services for Tata Steel’s new Kalinganagar steel plant project in India. On August 21, Outotec announced the award of a contract by Talvivaara Project Ltd. (See p. 38, 40).

Outotec in Physical Separation

One business that Outotec bought incorporated

a whole new range of mineral processing

techniques into the company.

Carpco, based in Jacksonville, Florida,

USA, close to the mineral sands operations

on the Atlantic coast, had its roots in processing

this type of material but moved

into other industrial minerals applications

as well. It is now called Outotec (USA) Inc.

Minerals Processing, Physical Separation

and is a physical separation technology

center, working with others in Australia and

South Africa.

A full line of gravity, magnetic and electrostatic separation technologies has been built up with equipment ranging in size from laboratory scale to industrial units. Outotec focuses especially on integrating physical separation technology to improve separation and recovery efficiency and claims that many iron ore, mineral sands and glass sands facilities around the world are benefiting from this distinct approach, which is backed up by an experienced team of process development experts, installation and commissioning engineers.

The main customers are still industrial minerals firms producing glass sands, kaolin, calcium carbonate, talc, refractory raw materials and abrasives. However, iron ore, base and precious metals also have significant uses for spirals, the Floatex density separator and magnetic technologies while spirals and Floatex can also be used for fine coal cleaning. Two more recent and growing sources of demand are applications in recycling, where physical separation techniques can be used to separate plastics from metals etc., and in manufacturing sand suitable for use in boosting flows to oil and gas wells by hydrofracting.

In May, Outotec signed a particularly welcome contract with Sierra Rutile, a subsidiary of Titanium Resources Group Ltd., for the design and expansion of Sierra Rutile’s land-based processing plants in Sierra Leone, which remained inactive during the civil war in the West African country. Outotec is working closely with Sierra Rutile Ltd. and is responsible for implementation of the entire expansion project. The new addition will utilize concentrate from two existing dredges and concentrators. The material will first be upgraded using Outotec Spirals and a FLOATEX Density Separator, and then dried. The dried ore will be sent to the new mineral separation plant for production of final products using advanced HE Rare- Earth Roll Magnetic Separators and eForce High-tension Electrostatic Separators.

Outotec’s laboratories in Jacksonville and Perth, Australia, were involved in the extensive testing program and flowsheet design. The expanded plant, with a design capacity of approximately 300,000 mt/y rutile and 70,000 mt/y ilmenite, is scheduled for completion in early 2008.

FL Smidth: Equalized in Minerals and Cement

Denmark’s FL Smidth has substantially

expanded its role in the mineral processing

market by buying Koch in 2006, then

Rahco and the GLV Process business this

year (E&MJ, June 2007 pp. 74–76). By

making this last acquisition, finalized in

August 2007, Smidth achieved one of the

main strategic initiatives defined by CEO

Jørgen Huno Rasmussen in 2004—to

become the preferred partner and leading

supplier of solutions and services to the

global cement and minerals industries.

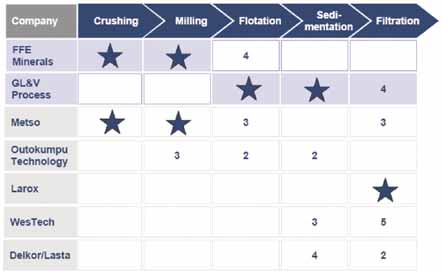

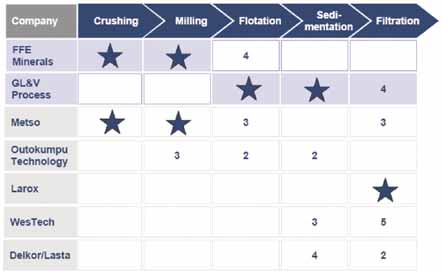

One goal was to expand the niche minerals business to reach a comparable level to cement, so the company would become less dependent on the cyclical developments in the cement industry. Others were to grow the aftermarket business, strengthen the group’s position as a technology leader, and optimize cost structures. Commenting on the GLV Process purchase, Smidth said it fulfilled these goals effectively at a stroke. The integrated FLSmidth Minerals operates in Denmark and in the U.S., where it remains headquartered at Bethlehem, Pennsylvania, as well as in South Africa and elsewhere. The business assesses its relative market position as shown in the accompanying chart.

Sandvik Expands

Rock and mineral processing is not one of

Sandvik’s main business lines but at

Svedala and elsewhere the company is a

significant manufacturer of crushing and

screening equipment for both the construction

business segment and for mining.

The mining-class equipment is produced

for the Surface Mining segment, which

also includes Sandvik’s substantial

Materials Handling product range. The

mining crushing and screening team

reports to the Materials Handling headquarters

in Leoben, Austria.

In July, Sandvik announced it is introducing a range of primary gyratory crushers. In the past, as readers may remember, Svedala produced gyratory crushers which were similar in design to Hydrocone crushers but this range stayed with Metso Minerals when it acquired Svedala, while the Hydrocone range was divested to Sandvik. Up until now Sandvik has covered the “gap” through a strategic alliance with FFE Minerals, offering FFE gyratory crushers— for instance at Aitik—as well as grinding mills where appropriate. The new Sandvik primary gyratory machines will support processing of iron ore, copper ore and other mined materials as well as primary crushing in large quarries.

Although Sandvik does have extensive in-house experience in the design and manufacture of primary gyratory crushers, the new models are a result of a co-operation with Earthtechnica of Japan, a joint company of Kawasaki Heavy Industries and Kobe Steel. The crushers bring a unique combination of leading mechanical designs and control systems to the market. The fundamental designs are well proven in operations globally, with numerous installations made throughout Africa, Asia and Australia in the last decade. All five crusher sizes will also include the Automatic Setting Regulation, (ASRi). This unique Sandvik feature has been fitted to more than 20 primary gyratory crushers over the years.

Sandvik said its strategy is to combine two proven and efficient technologies to boost customer productivity, also leveraging its presence at mine sites and its global logistics capabilities to give customers outstanding support also in primary crushing. Christian Ottergren, vice-president of mining, crushing and screening for Sandvik, said: “Over the last years our primary focus in mining has been on cone crushers for secondary and tertiary crushing. It is a logical step to expand our leading position into primary gyratory crushers combining proven mechanical designs with modern technology and automation.” The Sandvik range will not be marketed in regions where the Kawasaki machines are well-established, such as eastern Asia, Australia and southern Africa.

Derbyshire, U.K.-based Extec Screen & Crushers, although mainly serving the quarry and aggregate sectors, has also been successful in mining—in Indian iron ore and Russian coal, for instance. An IC13 with Krupp Hazemag impactor and Caterpillar engine is working for the Siberian Coal Energy Co. (SUEK).

On the materials handling front (which, similar to mining-class crushing equipment, is part of the Surface Mining segment) the company introduced HM150 formed rollers at bauma, featuring a new design and manufactured with a sophisticated process. This creates a more straightforward product with superior characteristics, according to Sandvik, which also featured the HX410, an electrostatic dust binding device for transfer points in bulk conveying systems developed and widely used in Europe. It offers a guaranteed dust suppression rate of more than 90%, and has now been launched in Australia and South Africa by Sandvik Mining and Construction.

Metso Minerals at Aljustrel

Samuel Strohmayr, joined Pirites

Alentejanes, the former Eurozinc unit

now part of Lundin Mining, as process

plant director in October 2006 having

previously worked with Xstrata Technology’s

ISAMills at McArthur River in

Australia. He explained the new process

system and the plant modifications

required to restart the operation, which

closed in 1994. Eurozinc’s particular

objective was to maximize zinc output

and the plant upgrade was designed to

allow processing of a consistent 1.8 million

mt/y ore (rather than the 1.3 to 1.5

million mt/y put through the original

plant) to recover a zinc and a lead concentrate.

Feasibility studies provided

basic engineering for flowsheet modification.

Last year’s final design, drawing on

the latest of these flowsheets but further

modified in the light of experience, was

used to develop tender documents for the

work and equipment required. The original

buildings have been extended and

the roof heightened to house new treatment

circuits and new fire control systems installed. Effectively, said Strohmayr,

no part of the plant has been left

alone. Experienced labor is in short supply,

so Pirites will be doing a lot of training,

he added.

Ore mined at the new Feitais underground mine will be crushed for transport underground through the existing Moinho working to the process plant where a second crushing station and covered ore storage is being built. The ore will be fed via an existing conveyor to the grinding circuit which comprises the two original Morgårdshammar mills with their 2.1-MW ABB drives and new cyclone clusters. Originally operated as a SAG mill circuit, these will now be used as primary and secondary ball mills and are being fitted with new liners and grates.

The secondary mill cyclone product, at 60-micron size, is fed to two 75-m3 lead rougher conditioner tanks prior to the lead rougher flotation stage. Two banks of nine existing OK-16 cells will be used as lead roughers and 15 OK16 cells as cleaners, configured with nine for first cleaner and three for each of the second and third cleaner stages. All these cells have been completely overhauled. Krebs 6-in. cyclones will classify the lead rougher concentrate prior to grinding in two SMD regrind mills.

The tail from lead flotation will go to the new zinc circuit which comprises five OK- 100 cells for roughing, four OK-50 cells and one OK-30 for primary cleaning, and five OK-30 units for second and third cleaning. All these new cells were fabricated in Portugal and fitted with Outotec mechanisms. Pirites will use conventional reagents. Krebs 6-in. cyclones treat the zinc rougher concentrate to extract coarse particles for treatment in the other four regrind mills.

Two original Sala Lamella thickeners will be used for the lead concentrate with another on standby, while a fourth will be used to clarify water in the water treatment circuit. The zinc concentrate will be thickened in a new Dorr-Oliver Eimco thickener. The concentrates will be filtered by two existing Sala VPA1040 pressure filters plus a new VPA1530 filter. The products will be loaded to containers for road haulage to the rail terminal already used by Somincor to ship Neves-Corvo concentrates and will be railed to the port of Setubal, south of Lisbon.

Miguel Santos, Metso Minerals’ sales manager at the Mining BL—SSO office in Lisbon, explained that Pirites placed an order with Metso in the fourth quarter of 2006 covering new proprietary equipment for delivery by December 2007 as well as related installation work and the refurbishing of Metso equipment in the existing plant. Total value is approximately €16 million.

Working with contractors, Metso Minerals is responsible for the project and installing the new underground and surface crushing stations, the 2-km underground conveyor linking them via the Moinho mine, two screens and the covered ore stockpile. The underground station at Feitais mine has a C-160 primary jaw crusher and GP- 300S secondary cone crusher from the factory in Tampere that will reduce the ore to minus 85-mm for the conveyor.

The zinc ore feed for crushing goes first to a triple-deck TS 5.3 screen from Macon. The minus 12.5-mm undersize is routed to the ore stockpile; the first and second deck feed to either of the 50-m3 surge bins above the two tertiary cone crushers built in Macon, these being the HP4 model that Metso introduced at Intermat in 2006. A gate valve is used to direct the material to one or the other surge bin. One HP4 is equipped with an extra coarse chamber, the other with a fine crushing chamber. Both surge bins and wear points will be lined with Metso’s composite Polycer material.

The two upper decks of the TS 5.3 feed to the bin above the extra coarse crusher. Both crushers feed product to a TS 5.2 (two-deck) screen which directs minus 12.5-mm product to the conveyor loading the covered ore stockpile. The oversize from the two decks recirculates to either of the crushers. The screens differ from the previous TS 503 and 502 models mainly in the flatter configuration of the decks, which are fitted with the rubber version of the LS modular screen system recently introduced by Metso Minerals Trellex Screening Media in Trelleborg, Sweden. All work on the covered ore storage structure, which has a live capacity of approximately 10,000 mt, is being done by Metso Minerals and a local contractor. Ore discharges via feeders to a tunnel conveyor delivering to the mills.

Metso’s involvement within the concentrator is not similarly comprehensive but is nonetheless significant. Metso Wear Materials has supplied new Skega liners and grates for the two mills from Ersmark, Sweden, the primary mill having a Poly- Met liner and the secondary a rubber liner. The crucial six SMD 355 stirred media detritors for regrinding come from Metso Minerals York, USA. Last but not least, the new VPA 1530-40 pressure filter for dewatering concentrates and 68 new slurry pumps will come from the Metso Minerals Sala plant in Sweden.

Metso Minerals is also providing engineering, erection and commissioning services for this equipment, using staff from the local and various other Metso offices and Portuguese contractors. The company’s Portuguese service team is also refurbishing 95% of the plant’s existing Metso slurry pumps. Metso is also supplying pumps for water supply from dams. In addition Pirites has bought two Larox peristaltic pumps for the lead concentrate thickener underflow plus pumps from non- Nordic suppliers.

The Somincor Neves Corvo mine, 42 km from Aljustrel, which Lundin Mining also acquired when it merged with Eurozinc, is of course an established producer. However here, as at Aljustrel, an existing plant was also modified to yield a zinc concentrate and Metso Minerals also supplied equipment for this program. Mark Fordham, who started at the plant 17 years ago and is the mill technical superintendent, explained the copper concentrator has undergone virtually continuous improvement, raising flotation throughput from 180 mt/h to 240 mt/h with fewer cells and one less regrind mill. On the other hand, the tin plant ceased continuous operation in 2003 due to the lack of feed. When EDM and Rio Tinto agreed to sell Somincor the additional zinc potential was a further selling point, especially for Eurozinc who had already acquired Pirites.

Outotec: OKTOP at Cobre Las Cruces

At another project in the Iberian pyrite belt, in this case in Spain,

Outotec is similarly supplying a broad range of process technology

equipment. The greenfield Cobre Las Cruces (CLC) project is

located approximately 20 km north northwest of Sevilla and 6 km

south of the small town of Gerena where CLC is headquartered.

The mine site lies immediately to the west of the A66 highway, the

route of which was realigned to the east prior to construction to

avoid sterilizing part of what is one of the richest un-mined copper

orebodies in the world, with 17.6 million mt grading 6.2% Cu.

The Las Cruces deposit was discovered by the Rio Tinto subsidiary

Riomin Exploraciones, S.A. in 1994. In 1999, Cobre Las

Cruces, a fully owned subsidiary of MK Gold (later renamed MK

Resources), took over the project. In 2005, minority shareholders

of MK Resources were bought out by majority shareholder

Leucadia National, who subsequently sold 70% of CLC to Inmet

Mining Corp. that same year. CLC is headed by Managing Director

François Fleury.

The farmstead (cortijo) where Riomin set up shop is still used— with portable extensions—by the mining and technical services group led by Bill Williams. The mine and plant are separated by the small river Garnacha and the process project construction team led by J. Alejandro Sepúlveda, is housed in a new office building next to the process plant. So, temporarily, are the EPCM staffs from SNC-Lavalin and the International Project Service project manager Timo Nivala and his team of three who are supervising equipment installation for Outotec. IPS, which is a wholly owned subsidiary of Outotec, also drafts in specialists to help with specific units: for example during E&MJ’s visit an engineer from the grinding mill unit in Sweden and a thickener specialist from the St. Petersburg, Russia office. All the other CLC personnel will move to this office when SNC Lavalin completes its contract.

The mineralization consists of massive and stockwork sulphides consisting mainly of pyrite. The copper minerals are chalcocite, covellite and bornite (95 %), and chalcopyrite and enargite (5%). Extensive test work was performed from 1996 to 1998, focusing on a pressure leach process, which is the conventional method to leach similar ore types, and a feasibility study based on this process and then solvent extraction and electrowinning (SXEW) was carried out for MK Resources from 2000 to 2002. However, the complicated flow sheet and high cost due to pressure leaching prompted CLC to seek an alternative leaching process and in 2003 Outotec, (Outokumpu Technology) was contracted to help revise the feasibility study, working with the German firms DMTMontan Consulting and Lurgi Metallurgie (now part of Outotec).

Outotec suggested an alternative project configuration, based on atmospheric leaching using its proprietary OKTOP Vertical Fast Flow (VFF) reactors followed by SX-EW. Outotec said the main differentiating features of the OKTOP VFF atmospheric leaching reactor compared with other types of reactor are in fluid dynamics, affecting the suspension of particles and utilization of oxygen. The distribution of mixing energy favors reaction kinetics. OKTOP VFF provides high recovery rates, high oxygen utilization and fully suspended material at low mixing energy levels. It is used, for example, for nickel processing at the Harjavalta facility in Finland, now owned by Norilsk Nickel, but Las Cruces will see the first application of OKTOP VFF in chalcocite ores.

The outcome of the detailed design exercise as far as Outotec is concerned is a delivery program that is exceptionally broad in scope. In addition to the OKTOP leaching technology, the company is supplying grinding and thickening equipment and technology, the complete solvent extraction system and the electrowinning tankhouse. Besides the process equipment, Outotec is providing engineering and supervisory services. The value of the contract is approximately €45 million.

Timo Nivala took E&MJ on a tour of the site. A primary jaw crusher and two secondary cones procured by SNC Lavalin (See above) will deliver fine ore to a bin ahead of the 3.2-MW ball mill from the Outotec factory in Smedjebacken, Sweden. Cyclones procured by SNC Lavalin will feed the 26 m diameter Supaflo high compression grind thickener supplied by Outotec’s Supaflo operation in South Africa. This in turn, will supply the OKTOP reactor series. The rake for the thickener, fabricated from SAF 2 507 duplex steel, is from the Outotec factory at Turula, Finland.

The atmospheric leaching section has eight 350-m3 OKTOP reactors. The rubberlined concrete structures built by Acciona have acid-proof brick at the top, supplied by Outotec. The agitator in each reactor, supplied from Finland together with the baffles and other internals, is powered by a 500-kW ABB motor via a gearbox built by the Finnish firm Kumera. Some of the internals are carbon steel but components subject to erosion are duplex steel. Utilizing a supply of oxygen and steam the reactors will work in series and seven can provide sufficient capacity to maintain throughput, so that any one unit can be taken out of service for maintenance.

The leach solution will be thickened in a second 26-m-diameter high-rate Outotec thickener, then cooled before discharge to the relatively small pregnant leach solution (PLS) storage pond, which is lined with HDPE. The thickener underflow will be vacuum belt filtered prior to stockpiling. The process oxygen will come from an onsite plant being installed by Air Liquide.

The solvent extraction process will be carried out using the Vertical Smooth Flow (VSF) OutoCompact SX concept which, said Outotec, requires less piping, fewer excavations and a smaller fire protection area than conventional solvent extraction technologies. The system was recently installed at Minera Escondida in Chile. Fire protection will be provided wherever organic material is present by the Finnish Marioff HI-FOG water mist firefighting system that Outotec first used at Sepon in Laos. Pregnant leach solution will be withdrawn from the pond for clarification before SX processing.

There are three mixer-settlers for primary extraction, two for stripping and one for washing, plus a loaded organics tank. Each unit has an Outotec DOP unit fabricated in Poland and a mixer tank from Latvia fitted with Outotec’s proprietary Spirok agitator and a drive. The settlers are 2 m deep, 18 m wide and have a settling length of 17 m plus 4 m space for the launders. The fences are the Outotec trademarked DDG design, one a shallow V and the others straight. These are made in Finland as are, somewhat surprisingly, the concrete pillars of the SX settlers: prefabrication and shipping from Finland proved to be cheaper than manufacture in Spain. Other structural materials, including fiber-reinforced plastic (FRP) and the recirculation piping come from China, where they were manufactured under Outotec supervision. A new feature of the settler design is the cover, which is designed as a platform. This provides all the access to the settler required for sampling, maintenance etc and there are no entries to the inside of the settler.

Raffinate will be stored in another small HDPE-lined pond and can be withdrawn for heating in heat exchangers for recycling to the OKTOP reactors. Raffinate bleed is led together with some other low grade solutions into pre-neutralization where the solution is neutralized with lime slurry. The precipitated gypsum will be thickened in a 10-mdiameter conventional Outotec thickener and recycled back into the leaching process.

The overflow from this unit will go via clarifiers to the smaller secondary solvent extraction mixer-settlers. The secondary SX raffinate will also be treated with lime in agitated reactors and the gypsum will be thickened, filtered and stockpiled. All the stockpile solids will be trucked to disposal. The tank farm, procured by SNC Lavalin, includes some internal piping and coalescing fences from Outotec.

The electrolyte product from the solvent extraction circuit will be filtered prior to electrowinning. Other than the frame and cladding, the tankhouse will use largely Outotec proprietary technology. It is equipped with an automatic crane, Outotec permanent cathodes and a Full Deposit Stripping Machine. The 144 9-mlong jumbo cells are equipped with double contact bus bars and the Outotec Acid Mist Capturing system. The Acid Mist Capturing hoods discharge to two scrubbers and the system fulfills and exceeds environmental legislation requirements. The control room for the whole process will be housed in a building adjacent to the OKTOP reactors and overlooking the two rows of mixer-settlers. The whole plant is designed to withstand a fairly high earthquake factor.

The cathodes will be shipped to port by road and the solid waste will go to an innovative impoundment on the mine, but that is another story.

Cobre Las Cruces Turns to Sandvik, Larox

SNC-Lavalin Chile S.A. ordered the crushing

and screening system for the Las

Cruces plant from Sandvik and the key filtration

equipment from Larox.

The crushing circuit includes a primary Jawmaster 1108 crusher, LF-1230-D screen, 300-hp Hydrocone H-4800-EC crusher, and an LF-2460-D screen. This screen separates 230 mt/h of 13-mm ore for the stockpile and recycles the oversize to a second 300-hp Hydrocone.

The filtration package includes a large Larox PF vertical filter, Pannevis RB horizontal belt filters and Scheibler polishing filters for various applications in the leaching, solvent extraction and electrowinning processes, together with a large package of ancillaries.