By any commonly accepted unit of measurement,

Canada is a mining powerhouse,

with a strong domestic industry and a hefty

global share of mineral exports, international

exploration activity and mining technology

transfer. Canadian mines produce

60 commodities—ranking the nation

among the top 10 global producers for 17

of them—and 60% of all mineral exploration

companies are listed in Canada. It’s

also estimated that about 50% of all mining-

related equity financing takes place

there as well.

Canadian mineral production, including

coal, was valued at $33.6 billion in 2006,

almost 23% higher than the $27.4 billion

reported in 2005. The bulk of the increase

came from metallic mineral production,

which reached $21.2 billion in 2006, an

increase of 45.4% over 2005. The value of

Canadian nickel and copper production, in

particular, rose by a whopping 75.9% and

78.8% respectively, due to rising metal

prices, although the actual increase in production

volume for these two metals was a

modest 17% and 3.1%, respectively. Iron

ore production rose by 12.2% in volume

and 10.5% in value during 2006, while

gold production dropped by 13.5%

although its value gained 8.4% to more

than $2.2 billion.

2007 is on track to be another very

good year for the Canadian industry,

although statistics for the first half indicate

that mine production of some major metals

is running slightly below that of the same

period in 2006.

However, the industry’s record pace in

2006 as well as this year-to-date’s mild

falloff have been overshadowed by two

other factors: the increasing importance

of junior companies in the endless search

for economically recoverable mineral

deposits; and a wave of M&A activity that

resulted in changes of ownership for a

handful of premier Canadian mining and

metals companies, mostly to non-

Canadian entities. Starting in 2006, this

includes:

• Falconbridge Ltd. acquired by Xstrata

plc for $18.2 billion in August.

• Inco Ltd. acquired by CVRD for $18 billion

in November.

• Placer Dome acquired by Barrick Gold

for $10.25 billion in March.

• Also in 2006, Canadian steel producer

Dofasco was bought by Arcelor SA for

$5.3 billion; but in a reversal of the

trend, Canadian producer Goldcorp. Inc.

acquired Glamis Gold, a U.S. company,

for $8.7 billion.

• 2007 began with Ontario-based Kinross

Gold acquiring Vancouver’s Bema Gold

Corp. in late February for $3.1 billion.

More recently, as reported in E&MJ, Rio

Tinto announced on July 12 that it would

buy Canadian aluminum producer Alcan

for $38.1 billion, pending regulatory

approvals.

• In August, U.S. Steel announced it

planned to acquire Stelco of Canada for

$1.1 billion to gain processing capacity

for its excess iron ore. In addition to its

mill assets, Stelco, through its HLE

Mining subsidiary, holds minority ownerships

in several iron ore mines. These

include:

• Hibbing Taconite Co. (14.7%)–Based

in Hibbing, Minnesota, USA, Hibbing

Taconite has total iron taconite

reserves estimated at 158 million

tons of product with an expected

mine life of 19 years. Hibbing’s

rated production capacity amounts to

8.1 million t/y of pellets, of which 1.2

million tons go to Stelco.

• Tilden Mining Co. (15%)–Based in Ishpeming,

Michigan, USA, Tilden produces

from a complex ore body of

hematite ore (35% iron) and magnetite

(24% iron). Total reserves are

estimated at 265 million pellet tons

with an expected mine life of 34 years.

Tilden’s capacity is 7.8 million t/y, of

which Stelco takes delivery of about

1.2 million tons of iron ore pellets.

• Wabush Mines (44.6%)–With mining

operations in Wabush, Labrador, Canada,

and Pointe Noire, Quebec, this

joint-venture company has total reserves

of hematite iron ore estimated

at 51 million tons. Wabush has a

rated production capacity amounting

to 6 million tons annually, of which

Stelco takes delivery of about 2.7 million

tons of iron ore pellets.

In early June 2007, Stelco said that it

had entered into an agreement for the sale

of its interest in Wabush to Consolidated

Thompson for $163.4 million. However, on

August 31, Consolidated Thompson reported

that it would not proceed with the purchase

because Mittal Steel Co., through its

subsidiary Dofasco, notified Consolidated

Thompson that it planned to exercise its

option to purchase the interests of Stelco

and Cleveland Cliffs in Wabush.

Investment Predicted to Increase

Against the backdrop of high prices for

most of its products—including metals,

nonmetallic minerals and crude oil extracted

from its vast oil sands deposits in

Alberta—it’s not surprising that capital

investment in Canadian mining is expected

to remain strong in 2007. The federal

agency Natural Resources Canada (NRC)

predicts that in 2007 domestic mining

investment will increase 30% over 2006,

reaching about $20 billion. This figure represents

almost 40% of total investment in

all Canadian natural resource industries.

However, only about a quarter of

2007’s mining investment total will go

toward conventional hardrock and nonmetallic

projects, while almost $16.1 billion

is earmarked for the oil sands sector.

Even so, investment spending for metals

mining is expected to increase by almost

8% in 2007, including a 60% rise in funding

for gold and silver ore mining, to

$728.7 million; and an increase to $727

million for the nickel-copper sector, compared

with 2006’s $595 million. Because

of the completion of a number of large

projects, investment in copper-zinc projects

is expected to drop by more than 36%

in 2007, to $253.9 million.

NRC also predicts that planned spending

for non-residential construction in mining

(complex development) should increase

by 31% over 2006, totaling about

$13.5 billion; while investment in mining

machinery and equipment will rise by

almost 33% to $6.9 billion.

With Canada’s oil sands containing

more than 13% of the world’s oil

reserves—and located in a stable geopolitical

environment—investment funds continue

to flow into the sector. Current predictions

envisage oil sands production

quadrupling by 2020.

According to Canada’s National Energy

Board (NEB), cost estimates for constructing

all announced oil sands projects from

2006 to 2015 will total $110 billion. This

figure is approximately double that indicated

in NEB’s 2004 report. However, with a

logjam of projects scheduled between

2008-2012, NEB predicts it will be a

challenge for all of them to proceed as originally

scheduled. Some of the major factors

that could affect project development are

natural gas costs, the high light/heavy oil

price differential, management of air emissions

and water usage, and insufficient

labor, infrastructure and services.

But even when looking at its most conservative

future scenario, NEB believes oil

sands project capex will exceed $90 billion

from 2006 to 2015. Currently, there are

about 46 existing and proposed oil sands

projects, with 135 individual project

expansion phases in various stages of execution.

To date, most developments have

been focused on mine-related opportunities

to extract the resource at shallow

depths. However, conventional mining

methods can extract less than 20% of the

identified resource potential, and most of

the high-quality mining leases are already

in various stages of development. Most

new projects will focus on in-situ extraction

methods at greater depths.

Most of the uptick in demand for base

metals, iron ore and aluminum can be

attributed to rapid industrial growth in the

BRIC nations—Brazil, Russia, India and

China—and emerging markets elsewhere,

but recent mine and plant investment at

one of Canada’s leading nonmetallic mineral

producers is proof of the old adage “a rising

tide floats all boats.” Rising demand for

basic commodities extends beyond metals

or energy; agriculture is another basic industry

that requires vast volumes of chemicals

and products to meet rising consumer

expectations, and consequently, even such

a seemingly mundane commodity as potash

is seeing robust market growth. Canada’s

PotashCorp, which claims to be the world’s

largest fertilizer enterprise by capacity,

expects that global demand for potash will

rise 12%-16% in 2007, following a dropoff

in production in 2006 due to extended

price negotiations with offshore customers.

Beyond 2007, PotashCorp sees global

demand potentially reaching 4% per year.

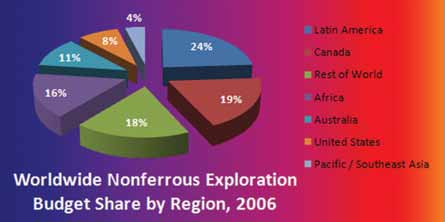

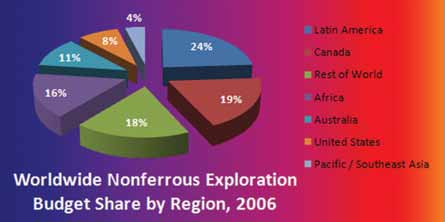

Source: Metals Economics Group, 2007

Source: Metals Economics Group, 2007

In response, PotashCorp is targeting

14.9 million mt of capacity by 2011, up

from the currently available 10.7 million

mt. According to the company, additional

debottlenecking projects in Saskatchewan

could be brought onstream by 2015, or

sooner if the market dictates, bringing total

capacity to 15.7 million mt. Announced

projects include:

• A recently announced $1.6-billion

potash mine and compaction expansion

in New Brunswick (reported elsewhere

in this issue) is the most recent of several

projects implemented to meet the

anticipated increase in world demand

for potash.

• A $346-million debottlenecking and

compaction expansion project at Lanigan,

Saskatchewan, primarily entails refurbishing

a mill that has been idle since

the mid-1980s. New mill structures and

equipment, along with upgraded mine

hoists, skips and other underground

equipment will help support higher

annual production, adding 1.5 million

mt of product, along with 750,000 mt of

additional compaction capacity. Construction

is scheduled for completion

in the second quarter of 2008.

• PotashCorp’s Patience Lake solution

mine, also in Saskatchewn, will add

300,000 mt of annual capacity via 20

new injection wells and the pumping and

piping systems required to serve them.

The project will cost an estimated $92

million, with construction scheduled to

be completed in the first quarter of 2009.

• A $775-million compaction and production

expansion and debottlenecking project

at the Cory, Saskatchewan, facility

will add another 1.2 million mt of production

capacity, with 750,000 mt of

additional compaction capacity, by mid-

2010.

• Previous debottlenecking and compaction

expansion projects have been

completed at PotashCorp’s Allan (2007)

and Rocanville (2005) facilities, both

located in Saskatchewan, at a total cost

of more than $275 million.

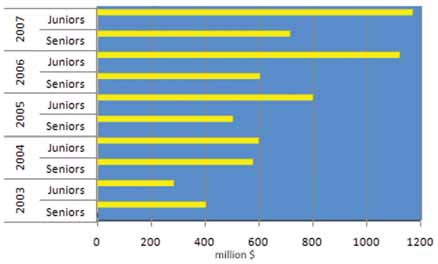

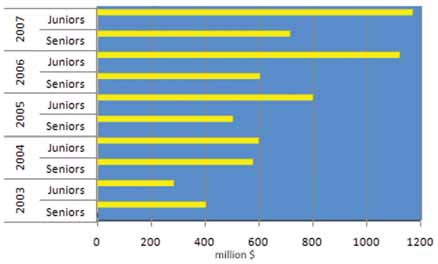

Junior companies have contributed an increasingly larger share of Canadian exploration spending.

Junior companies have contributed an increasingly larger share of Canadian exploration spending.

Exploration— The Billion-Dollar Baby

Exploration funding for Canadian projects

in 2007 is expected to continue at the $1-

billion-plus level for the fourth consecutive

year. A March 2007 federal-provincial-

territorial survey of intended exploration

spending by 734 project operators

predicted a 9% increase over 2006, representing

a total of $1.9 billion compared

with last year’s $1.7 billion and $1.3 billion

in 2005.

The survey pinned these increases primarily

on more off-minesite exploration

activity, which in 2006 represented about

75% of total spending. Off-minesite

appraisal expenditures were also a significant

factor in 2006, exceeding $300 million

for the first time since the tabulation

of these statistics began in 1997. This

trend is expected to continue as more

known deposits are being fast-tracked

toward production decisions.

Although exploration spending on precious

metals is expected to decline slightly

in 2007, intended funding for base metals,

uranium and other assorted mineral

commodities should show strong gains over

2006 levels, with uranium exploration—

encompassing more than 350 active projects—

predicted to reach a level of about

$241 million in 2007, compared with

$190 million in 2006.

The vastly expanded role of junior companies

in the minerals discovery process

becomes apparent when looking at the survey’s

figures for exploration activity split

between junior and senior companies.

Total expenditures for junior project operators

has increased from $141 million in

1999, to almost $1.2 billion in 2007.

Junior companies now account for more

than 60% of total Canadian exploration

and deposit appraisal spending.

PriceWaterhouseCoopers, in a recent

study of trends in the TSX Venture (TSX-V)

Exchange, found that junior mining companies

listed on the exchange had a total market

capitalization of $27.6 billion in

2006—an 86% increase from $14.8 billion

the previous year. The top 100 junior

mining companies had $4 billion in assets

in 2006, $2.6 billion more than in 2005.

Net financial losses among this group rose

to $395.7 million, up from $247 million in

2005, but the report attributed the increase

to the dominance of exploration-stage companies in the sector, reflecting the

current

high level of exploration activity.

All of the companies analyzed in the

report are based in Canada, with the majority

located in British Columbia. Not too

startling was the report’s revelation that 51

of the TSX-V’s top 100 companies studied

were not even in this category in 2005,

confirming the high-risk, high-reward

nature of the business and how company

values can rise and fall substantially in the

course of a year. This is also confirmed by

the fact that, from 2005 to 2006, only one

company was able to retain its ranking

among the top five on the TSX-V in terms

of market valuation. As shown in the table

above, only Northern Dynasty Minerals,

50% owner of the Pebble copper-goldmoly

deposit in southwestern Alaska following

the recently announced $1.425 billion

buy-in by Anglo American, carried over

from one year to the next.

According to the report, at the time of

publication 14 of the top 100 companies

on the TSX-V were at the production stage.

These companies accounted for:

• $3.4 billion in market capitalization

• 12% of the total industry market capitalization

of the industry; and

• 23% of the top 100 market capitalization.

One-third of the top 100 production

and exploration companies on the TSX-V

operate in Canada, followed by the U.S.

(14%) and Mexico (12%). Altogether,

17% operate in South American countries.

In 2006, TSX-V mining companies

spent $409.4 million on mineral properties

and exploration, along with another

$103.9 million on plant and equipment

costs. But perhaps the most impressive

number, according to the PriceWaterhouse-

Coopers report, is the $1.2 billion that

exploration companies were able to raise

through issuing shares during 2006, a

206% gain over 2005.

Juniors Fitting In

Almost by definition as well as by necessity,

the more successful junior mining companies

are staffed “lean and mean,” mostly

with experienced geologists and engineers,

and are generally led by entrepreneurially

aggressive executives. The flexibility

and willingness to take risks afforded

by juniors make them a perfect fit for a

business environment in which industry

consolidation has resulted in fewer but

larger senior companies with scaled-back

exploration staffs and constant pressure to

replenish mineral reserves.

Aerial view of current activity at Minefinders Corp.ís Dolores gold-silver project in Mexico.

Aerial view of current activity at Minefinders Corp.ís Dolores gold-silver project in Mexico.

However, even nimble juniors can be

affected by broad industry trends and problems

such as lack of manpower, time pressure

to bring promising finds to marketable

status, and even long lead times for vital

equipment delivery among juniors intent

upon taking their own projects to the development

and production phases.

In order to gauge the effect of these

factors, E&MJ spoke with the CEOs of two

Canadian companies that presently are on

almost opposite ends of the project development

timeline—one is nearing the start

of production at its flagship project while

the other is heavily involved in exploration

drilling to delineate the extent of mineralization

at properties in Canada and Mexico.

We also talked with the chief executives of

two well-known engineering firms to find

out if, and how, the mining boom and its

associated demands for time and resources

have affected the way in which their companies

conduct business.

Minefinders Corp. is a Vancouver,

British Columbia-based junior with a portfolio

of properties in Mexico and the United

States. Its primary focus currently is on the

impending startup of its Dolores open-pit

gold and silver mine in Chihuahua, Mexico,

which is scheduled to begin operations this

month and to reach commercial production

in the second quarter of 2008. Located in

a historical mining district, early operations

at Dolores were reported in E&MJ early in

the 1900s.

The reserve base at Dolores currently

stands at 2.45 million oz of gold and

127.9 million oz of silver. The reserves,

which were updated in July 2006, are contained

in 100.2 million mt of proven and

probable ore having an average diluted

grade of 0.76 g/mt gold and 39.7 g/mt silver,

using a 0.3-g/mt AuEq cutoff. An

updated resource was reported in June

2007, with Measured and Indicated now

standing at 123.4 million mt containing 3.25 million oz of gold averaging 0.82

g/mt and 154.8 million oz of silver averaging

39 g/mt. A revised pit design is being

completed and updated reserves should be

reported before year end.

Minefinders has done more than

200,000 m of drilling at the site, sinking

more than a 1,000 drillholes. The deposit

will be mined by open-pit methods for 14

years of production, with development of

an underground mine beneath the pit

expected to begin in about three years. The

facilities are designed for production of

18,000 t/d of ore; open-pit mine life will

be 14 years. Output is expected to average

120,000–130,000 oz/y of gold and 4.5

million oz/y silver.

Engineering design work has been

farmed out to a number of firms, including

Golder Associates for leach pad and geotechnical

requirements; Terra Nova

Industries for the crushing and stacking

systems; Lyntek for the mine’s Merrill-

Crowe plant and smelter; and Ausenco for

ancillary systems and tie-in for overall engineering.

Once commercial production is

achieved through the heap-leach and

Merrill Crowe plant facilities, Minefinders

intends to build a mill to handle higher

grade ore from the pit.

“Our original study looked at installation

of the heap leach and the mill at the

start of the mine, but that would have cost

more than $270 million,” Minefinders

President and CEO Mark Bailey said. “We

weren’t going to be able to raise that much

money for our first mine, however.”

Bailey, who has been associated with

the company since 1994, said the biggest

challenge in the critical path of the construction

so far has been timely completion

of earthworks in the mountainous host terrain.

Earthworks for the phase-one leach

pad took longer than expected, because of

higher volumes of material than those estimated

in the feasibility study, the need for

additional blasting, and slow progress during

an unusually wet monsoon season in

July. However, a section of the phase-one

pad will be available for lining in

September and loading in late October, in

conjunction with the commissioning of the

three-stage crushing plant. The village of

Dolores is situated on a portion of the property

to be mined and the company is in the

process of relocating the residents to new

homes built about 5 km away.

Bailey identifies the largest problem

faced by his company—and the industry as

a whole—as being able to find qualified

people. “There are a number of factors

involved,” said Bailey. “We had to look far

and wide to assemble our operational

team, and I know of other operators who

have had to pull guys out of retirement

because there simply wasn’t anyone else

available.

“Engineering and service firms are in

the same boat. They’re overwhelmed by the

amount of work that’s out there, and

they’re having trouble finding good people,

too. During the down-market years in the

1980s and 1990s, a lot of young engineers

and geologists had to look elsewhere

for jobs, and now we’re missing a whole

generation of engineers. Most of our guys

have 20 or 30 years in the industry, but it’s

very hard to find young engineers with any

mining experience.

“Looking forward,” said Bailey, “I don’t

see the high current demand for commodities

changing any time soon. This is good

for juniors and for the industry as a whole,

but it will put tremendous strain on [mining]

resources.”

According to Bailey, another factor that

weighs heavily on junior miners is compliance

with the requirements of the Sarbanes-

Oxley Act of 2002, the U.S. federal law that

expanded financial reporting regulations for public companies and accounting firms.

“As

a junior company, we have essentially the

same reporting requirements as a $60-billion

company, but we don’t have a big staff

of lawyers and accountants to handle the

work,” he said. “We’re spending a tremendous

amount of money on outside auditing

and legal work to comply with the law, and

that’s money that we can’t use to go out and

explore for minerals, which is what we do

best. I don’t think you can legislate honesty

and morality into law. They need to take

another look at Sarbanes-Oxley and try to

make it ‘saner’ for small businesses.”

Bailey doesn’t view new technology as a

major near-term benefit for exploration

companies. “We’ve made our discoveries

by putting geologists on the ground, beating

on rocks. That’s the way it’s been done

for hundreds of years, and I don’t see any

magic black box that’s going to give better

results than an experienced geologist working

in the field.”

Nor does Grant Ewing, president of

Linear Metals Corp., Toronto, Ontario, a

junior company focused on exploration for

base metals and molybdenum. Linear currently

has two “core” projects: the

Kilometer 61 porphyry-type molybdenumcopper

property in Ontario and the Cobre

Grande copper-molybdenum-zinc-silver

skarn deposit in Oaxaca State, deep in

southern Mexico. Linear is in the early

stages of drilling at both properties, collecting

data needed to conduct initial

resource evaluations during 2008.

Linear’s exploration staff includes several

senior-level geologists with years of prior

service at large Canadian base metals producers,

but Ewing is very aware of the

industry’s manpower problems. “It’s very

difficult to find experienced geologists

these days to expand a technical staff. I’m

sure that any good geologist who wants to

work already has a job.” And he doesn’t see

any technology on the horizon that will

replace field experience. “We’ll consider

any geophysical or geochemical method

that would help us explore the ground we

hold, of course, but we depend primarily on

the experience of our exploration team to

develop our exploration programs.”

Linear recently announced encouraging

results at the KM61 site, where it was able

to evaluate samples from a core drilling

program conducted by Noranda and

Falconbridge when the property was

optioned in 2004-2005. Much of the drill

core generated during those programs was

left unsampled because the companies

were targeting copper mineralization.

Results from Linear’s analysis of the

unsampled core included 143.2 m of

0.068% Mo, 0.14% Cu and 6.1 g/mt Ag;

and 193.6 m of 0.052% Mo, 0.11% Cu

and 7.1 g/mt Ag. “These results indicate

that what was previously thought to be two

distinct, and relatively narrow zones, may

instead be one broad stockwork zone. This

increased total width of mineralization has

clearly increased the size potential of

KM61 at grades that appear comparable to

that of other large molybdenum projects

currently under development,” Ewing said.

The Cobre Grande property also has

produced some impressive core samples,

including 130 m of 1.62% copper, 0.51%

zinc, 0.01% molybdenum, and 29 g/mt

silver starting at 48 m; and 7 m of 0.91%

copper, 0.05% zinc, 0.01% molybdenum,

and 19.14 g/mt silver, beginning at 188

m. For a company at Linear’s stage of

prospect development, dependable drilling

service is a critical factor. “There’s certainly

a difference between drilling contractors

in terms of production rate, and I’d attribute

that difference mostly to quality of

manpower and equipment. Contractors Ateams,—

the crews that consistently produce

large quantities of core with good recoveries—are in extremely high demand

by mining companies,” said Ewing.

Installation of a three-stage crushing facility at Minefindersí Dolores project is progressing

Installation of a three-stage crushing facility at Minefindersí Dolores project is progressing

on schedule to handle

startup of mining in September and commencement of production in

the second quarter of 2008.

Engineering Meets the Rush to Development

On the flip side of the coin, the consulting

engineering and design firms that provide

critical preliminary assessments, bankable

feasibility studies and various other projectrelated

assignments for both junior and

senior companies also are affected by

boom-linked issues. Andy Barrett, group

CEO and president of North American practice

for SRK Consulting, said that in today’s

robust business environment competition

between firms has shifted more toward a

hunt for skilled, experienced people and

away from skirmishing with each other for

actual work. Along with that trend, Barrett

notes that higher salaries for experienced

mining specialists and a drift toward more

sole-source work and fewer competitive-bid

opportunities are also part of the boom’s

good-news/bad news package.

SRK—whose client list ranges from

CVRD, Centerra Gold and DeBeers to iron

ore producer MMX, NovaGold, Teck

Cominco and includes many others—has

been in the somewhat painful position,

along with other major firms in its sector, of

having to decline or delay requests for work

because of the overall volume of activity

and shortage of experienced people. Along

with that, notes Barrett, comes a higher

degree of selectivity in accepting projects

and much greater emphasis on human

resource management.

“In this business,” explained Barrett,

“you’re only as good as the people you have

on the ground, and we realize that our

competitors are looking for the same kind

of people that we are. This has resulted in

upward pressure on salaries and has

required us to search farther afield to find

the people that we need.

“From the start of this boom we’ve also

recognized that we need to be very careful

to manage the quality aspects of our

work,” Said Barrett. “With the current

high volume of work we’re experiencing,

we can’t afford to allow things to slip, and

we’ve ratcheted up our formal review procedures

accordingly, to prevent the kind of

mistakes that can happen when people are

working long, hard hours.”

When asked how the mining boom has

affected the type, locale, makeup or focus

of SRK’s overall mining project portfolio,

Barrett quickly ticked off several distinct

trends. These include:

• Re-opening of old projects (gold and

base metals) with hopes of getting them

back into production.

• Increased demand for NI 43-101 reports

that allow companies to announce results

from new properties/projects and raise

money, or to get listed on the stock

exchange.

• Increased confidential due diligence

reviews for acquisitions and assistance

with defense against hostile takeovers.

• Increased assistance to foreign companies

seeking Canadian listings.

• Increased involvement in existing operations

to fill technical skills gaps.

• Substantially more uranium work.

• Projects in Brazil, China and Russia/FSU

becoming increasingly prominent.

• Emergence of private equity firms in the

sector.

Vancouver, B.C.-based Wardrop Engineering

has been in business since 1955

and has been serving mining clients since

the early 1960s. It offers a full range of

services including project scoping, pre-feasibility

and feasibility studies, EPCM and

ongoing technical support. Recent project

involvement includes EPCM services for

Baja Mining Corp.’s Boleo copper-cobalt

project in Baja California Sur, Mexico; and engineering and procurement for Redcorp

Ventures’ Tulsequah polymetallic project in

British Columbia. Wardrop also conducted

the feasibility study for the Tulsequah project.

Other work ranges from resource evaluations

for Western Copper Corp.’s

Carmacks copper project and an optimized

feasibility study for development of Yukon

Zinc Corp.’s Wolverine underground mine;

to various assignments for Teck Cominco,

Xstrata, CVRD Inco and Cameco.

Brent Thompson, president of Wardrop,

said the industry’s rush to get mineral assets

into development, coupled with manpower,

materials and equipment shortages, adds

another degree of pressure to the scheduling

process. “For many of these projects now

nearing the construction phase, availability

of the required materials and equipment is

constrained. When it comes to doing capital

cost estimates and construction scheduling,

we have to keep very close tabs on equipment

lead times. In fact, we now tend to fasttrack

the longer lead-time items. When we

perform EPCM services for project development

we’ll actually start working on the engineering

and procurement for long-lead items

as we complete the feasibility study. It’s the

only way to make sure we can keep projects

moving forward in a logical fashion.”

However, Thompson noted that his

biggest challenge at the moment is effectively

managing and maintaining the company’s

talent pool—and he envisages future

consequences for mining that might not

become apparent until the current boom

runs its course. “The mining industry’s

demographics are working against it,” he

said. “Older professionals with 30 or more

years in the industry will be retiring in five

years or so. I think there are enough experienced

workers around now to get us through

this boom, but when it eventually tails off

and then picks up again in the future, the

mining industry is going to be very different

from the way it is today. It’s likely there won’t

be a lot of people around with the experience

needed to move projects forward.”