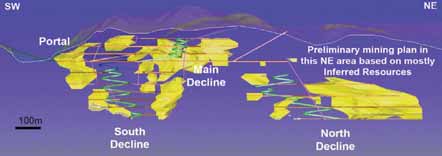

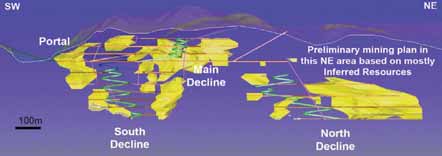

Underground mine plan for Sino Gold’s White Mountain gold project in northern China.

Sino Approves White Mountain Gold Development

Project development capital costs are estimated to total $55 million (including contingency). According to the company, there is potential to reduce this capital cost estimate if contract mining proves to more competitive than owner mining. Sino Gold owns 95% of White Mountain and is responsible for funding the local joint-venture partner through development.

The White Mountain operation is designed to produce approximately 70,000 oz/y of gold at full production with approximately 60,000 oz produced in startup year 2009 at cash operating costs of less than $250/oz. Head grade is 4.2 g/t Au, and mill throughput will be approximately 650,000 mt/y. Gold recoveries are estimated to average 80% from a processing plant of a standard Chinese design, with a simple grinding/ CIL flowsheet.

Planned work to be undertaken during the remainder of 2007 included mine portal and decline construction by a contractor; and processing-plant earthworks and foundations construction prior to winter with detailed design continuing through winter.

The mine will be accessed by a standard 5.5-m by 5.5-m decline with the mining method being predominantly a combination of bench stoping and cut-and-fill stoping. The current mine design is illustrated in the diagram below.

According to Sino, the mine production schedule includes mining of some inferred resources. Drilling planned to be undertaken during 2007 is aimed at upgrading the category of these resources to reserves. The initial White Mountain ore reserve estimate totals 3.2 million mt at 4.2 g/t gold, containing 434,000 oz. Proved reserves comprise 55% of the total Ore Reserve.

The company noted that significant potential remains to increase this resource, particularly to the northeast and at depth.

Sino Gold has been active in China since 1996. The company owns 82% of the Jinfeng gold mine in Guizhou Province, southern China, which has mineral resources containing 4.6 million oz and ore reserves containing 3.2 million oz. Jinfeng will reportedly be the one of the largest gold mines in China when the project achieves planned initial production of 180,000 oz/y.

Shortly after the White Mountain announcement, Sino Gold entered into an agreement regarding a proposed offer by Sino Gold for all of the outstanding common shares of Golden China, a gold exploration and production company listed on the Toronto Stock Exchange and Australian Securities Exchange whose principal asset is the Beyinhar exploration project located in Inner Mongolia, People’s Republic of China.