Source: PricewaterhouseCoopers 2007.

PWC Sizes Up the Booming Mining Industry

A report by PricewaterhouseCoopers (PWC), Mine—Riding the Wave, published June 21, 2007, puts some numbers to the magnitude of the boom that the global mining industry has been experiencing over the past four years. The annual study is the fifth in a series that began in 2003 for financial year 2002. The current study focuses primarily on aggregate 2005–2006 year-toyear comparisons for 40 of the mining industry’s largest companies and also includes a table of five-year trends, showing year-by-year aggregate gains in key industry metrics.

Coming off the bottom of a long period of low metals prices, aggregated net profit of the PWC top 40 companies has risen spectacularly over the past five years, up more than 15 times from $4.4 billion in 2002 to $67 billion in 2006. The year-to-year 2005 to 2006 profit gain totaled 64%, up from $40.8 billion to $67 billion. PWC notes that each of the four largest companies by market capitalization—BHP Billiton, Rio Tinto, Anglo American, and CVRD—recorded a higher net profit in 2006 than the aggregated net profit of the top 40 companies in 2002.

PWC also notes that the top four companies do not rank in the same order in terms of revenues as they do in terms of market capitalization. Leaders by revenue in 2006 were Anglo American ($33.1 billion), BHP Billiton ($32.8 billion), Rio Tinto ($22.5 billion), and CVRD ($19.7 billion). These four companies accounted for 43% of the total revenue of the 40 companies and 47% of the profit before interest and tax. (Editor’s note: PWC’s 40 top mining companies do not include focused aluminum producers Alcoa and Alcan, which recorded 2006 revenues of $30.4 billion and $23.6 billion, respectively.)

PWC’s top five mining companies in terms of 2006 profit margins on earnings before interest, taxes, depreciation, and amortization (EBITDA) were Antofagasta with a margin of 74%; India’s NMDC, a producer of iron ore and diamonds, 72%; Southern Copper, 61%; and Agnico-Eagle and Teck Cominco, each at 58%.

While higher metals prices have keyed renewed prosperity in the mining industry, industry consolidation over the past five years has also contributed to rapidly increasing revenues and profits among the largest companies. Nine companies listed in the 2002 PWC top 40 have been acquired by companies that remain on the list. For this 2006 report, those nine do not include Inco and Phelps Dodge, which remained in the top 40 until they were delisted as publicly traded companies after yearend 2006 as a result of being acquired by CVRD and Freeport-McMoRan, respectively.

“The prospect of takeovers of companies of all sizes means that CEOs must remain focused, both on moving their companies forward and managing their position in the current environment of mega-mergers: hunt or be hunted,” PWC said.

Total revenue by customer location shows continued growth in metals usage in China and India, with each country accounting for 8% of revenues of the PWC top 40 during 2006. Europe and North America continued as the dominant markets, accounting for 37% of total revenues.

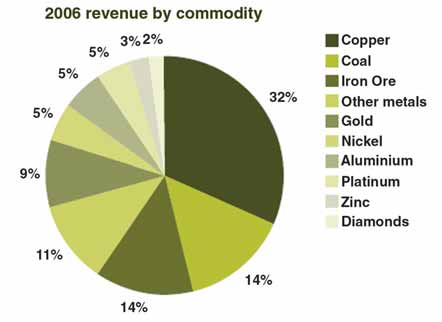

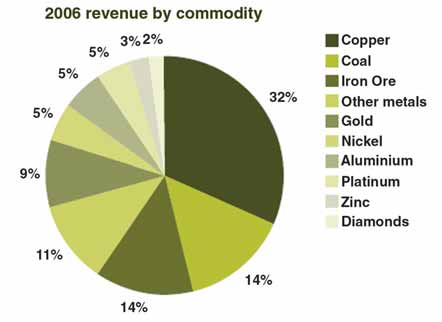

As to revenue by commodity, copper accounted for 32% of revenues for the 40 companies in 2006, followed by coal and iron ore at 14% each (see chart below).

Rising revenues in 2006 were accompanied by an on-going rise in operating expenses, which were up 23% year-onyear. Major contributors to increased operating expenses included higher material, energy, labor, transportation, and contractor costs. Delivery lead-time delays for plant and mobile equipment also had a significant impact on production volumes and operating costs.

“The key message on costs is that companies need strategies to address their cost position,” PWC said. “The relentless focus on cost reduction and efficiency in the late 1990s has eased in recent years as maximizing production has become paramount. Those companies that effectively manage variable and minimize fixed costs will be well placed for any future downturn.”

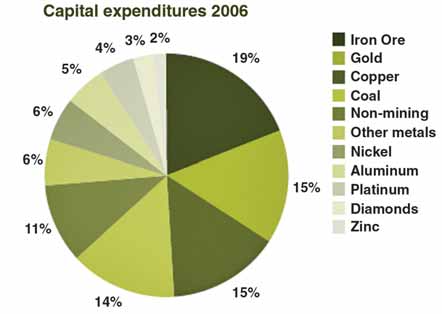

Capital expenditures by the PWC top 40 rose from $28.2 billion in 2005 to $37.2 billion in 2006. The four largest companies accounted for about 49% of capital expenditures, up from 43% in 2005, indicating that the industry’s leaders are investing at a somewhat faster rate than the industry as a whole. By commodity, iron ore projects accounted for 19% of capital investment during 2006. Gold and copper each accounted for 15%, and coal accounted for 14%.

For companies that disclose exploration expenses, such expenses were up 30% in 2006. However, according to PWC, exploration expense reported by the top 40 companies may not necessarily be representative of the industry, given that junior companies are exploring very aggressively.

A lack of quality projects in “safe” areas is leading to exploration and development in jurisdictions that have until recently been considered marginal. PWC noted that: “The possibility of significant changes to legislative regimes that companies operate under, after agreements have been signed, is real, and the political risk exposure has increased accordingly.”

Apart from financial metrics, the PWC report discusses a number of issues currently impacting the mining industry, including the increasing involvement of hedge funds in metal trading activity and the volatility that such trading creates in commodity prices. Hedge fund trading activity makes it difficult to forecast metals prices based solely on conventional analysis of supply, demand, and inventory. However, such forecasts are “an essential consideration in determining project feasibilities and development decisions, let alone day-to-day operations,” PWC said.

Hedge funds have also played an important role in some recent mining industry merger and acquisition activity.

“Total Tax Contribution” (TTC) of mining companies is a subject of special interest to PWC. The company worked with the World Bank during 2006 to develop TTC as an objective, cross-border approach to obtaining accurate comparisons of overall taxation costs (including compliance costs) across 175 jurisdictions. The effort “gained momentum from concerns that stakeholders (including government) adopt a misleading, overly simplistic view of tax, particularly when they focus solely upon the taxes reported below net income in an income tax statement.”

Among the range of taxes paid by mining companies, PWC included ongoing royalty or severance payments; quarantined income tax deductions/ losses resulting from up-front exploration costs, which in many cases can never be utilized; construction and contribution of significant infrastructure, including community infrastructure; land and property taxes; profit sharing with indigenous communities or workers; enforced state of local participation in ownership; and non-recoverable, or slowly recovered, valueadded taxes (VAT) paid on the importation of equipment.

Accurate measurement of above the line, below the line, and in lieu taxes in the resource industry is a challenge, PWC said, “but it must be attempted to gain a clearer picture of the mining industry’s overall contribution to the communities where it operates...From a disclosure point of view, it could be argued that stakeholders must not only be given a clearer understanding of the total tax contributed by mining companies, they should be provided with a yardstick to measure that contribution, thereby facilitating valid comparisons across industries and between mining industry participants. We intend to work with some industry participants in the coming year to tackle this challenge. We intend to publish the results of this work in next year’s edition of Mine.”

PWC’s 100-page Mine—Riding the Wave is available as a free download at:

www.pwc.com/extweb/pwcpublications.nsf/docid/AD4DEFB47A20ED0A852572F9007200C7