Set to Soar

Record performance in 2006, coupled with the likely prospect of tripling

gold production by 2009,

has Agnico-Eagle flying high

By Russell A. Carter, Managing Editor

Gold pour at Agnico-Eagle Mines’ LaRonde mill. (All photos

and diagrams courtesy of Agnico-Eagle Mines Ltd.)

Gold pour at Agnico-Eagle Mines’ LaRonde mill. (All photos

and diagrams courtesy of Agnico-Eagle Mines Ltd.)

During E&MJ’s visit to Agnico-Eagle Mines’ Quebec

operations, one of the company’s managers half-jokingly compared AEM’s

public image to a wellknown description of waterfowl propulsion. “On top,”

he said, “a duck looks calm, serene and moves smoothly across the surface.

Underwater, he’s paddling like crazy.” Substitute “underground”

for “underwater,” and the description becomes surprisingly apt for

this Canadian gold producer. For many years a one-mine company known for its conservative

strategy and decades-long string of dividend payments, Toronto, Ontario-based

AEM has recently applied its extensive underground mining knowledge, bolstered

by a healthy balance sheet and strong metal prices, to quickly and significantly

expand its sphere of activity in Quebec’s famous Cadillac-Bousquet mining

district as well as internationally. AEM currently is developing three new mines

in Quebec and another in Finland, has a $26-million underground exploration program

under way at its Pinos Altos gold property in Mexico and another exploration program

at its Oijärvi prospect in Finland. AEM also has moved to expand its mining

activities to the surface, first acquiring the surface-minable Kittila project

in Finland, and then announcing in mid-February that it had signed an agreement

with Cumberland Resources Ltd. by which AEM will acquire, via a take-over bid,

all the outstanding shares of Cumberland that it does not already own. Cumberland’s

main asset is the Meadowbank gold project in Nunavut, Canada, a high-grade, openpit

gold deposit with announced proven and probable reserves of 21.3 million mt, grading

4.2 g/mt (2.9 million oz). Currently in the construction stage, the mine’s

production is anticipated to begin in early 2010. Annual output is estimated to

average 400,000 oz for the first four years and 350,000 oz per year over the life

of the mine. AEM expects to extract about 850,000 oz from surface mining, and

also believes that the Meadowbank property has significant potential for future

underground development. The Goldex, Kittila and Lapa mines all are scheduled

to begin production in 2008, with the potential capability of tripling AEM’s

gold production to the 750,000-oz/y level by 2009. The addition of Meadowbank,

if AEM’s bid is successful, would further boost production to around 1.3

million oz/y by late 2010. At year end 2006, AEM’s gold reserves totaled

12.5 million oz, a 19% increase from 2005. The largest growth came from the conversion

of 1.8 million oz of resources to reserves at Pinos Altos. The company’s

goal is to increase gold reserves from the existing portfolio of mines and projects

to 14 million–15 million oz in the next 12 months. Assuming the successful

acquisition of Cumberland Resources, the combined gold reserves would jump to

more than 15 million oz. AEM’s overall gold reserve objective would then

increase to 18 million– 20 million oz by the end of 2008. The company also

has significant reserves of byproduct metals, including 105 million oz of silver,

1.6 billion lb zinc, and 250 million lb copper. With a significant portion of

its anticipated future gold reserve increases expected to come from the Pinos

Altos property, AEM has earmarked $26 million for continued exploration and underground

ramp development at the property this year—a significant portion of the

$40-million total 2007 exploration budget. That project is currently in the final

stages of feasibility review and a production decision is expected during the

second quarter of this year. Overall, AEM’s capital expense budget for 2007

is $412 million, a figure that is expected to taper off to about $240 million

in 2009 and down to $91 million in 2010.

Ore from the Goldex deposit will be crushed underground to

-250 mm, then hoisted to a

Ore from the Goldex deposit will be crushed underground to

-250 mm, then hoisted to a

surface mill equipped with grinding, gold gravity recovery,

sulphide flotation, concentrate

handling, and flotation tails disposal circuits.

LaRonde, and Beyond

The three new Canadian mines currently in development include LaRonde II, a deep

extension to the existing LaRonde operation; Goldex, a high-tonnage, relatively

low-grade deposit located near the city of Val d’Or and roughly 56 km east

of LaRonde; and Lapa, a high-grade deposit about 11 km east of LaRonde. In Finland,

construction is under way at the Kittila mine approximately 900 km north of Helsinki.

The mine will start as an open-pit operation, followed by underground mining via

ramp access, and will feed a 3,000 mt/d processing plant. LaRonde, the company’s

flagship mine in northwestern Quebec, is the largest known gold deposit in Canada.

Geologically, the LaRonde property is located in the southern portion of the Archean-age

Abitibi volcanic belt within the Bousquet Formation of the Blake River volcanic

Group. The geology is east-west trending, steeply southward dipping and generally

southward facing. The southernmost unit of the Bousquet Formation, which hosts

significant gold and base metal mineralization on the LaRonde property, varies

in thickness from 150 m to more than 550 m. Goldcopper and zinc-silver mineralization

occur in the form of massive and disseminated sulphide lenses. LaRonde has been

AEM’s sole mineral revenue source since it opened in 1988, and by the end

of 2006, produced more than 6 million oz of gold. In 2006, it generated a mine-level

profit for AEM of $320 million. The LaRonde II project, which is designed to extract

ore from an open-at-depth extension of the mine’s 20 North gold-copper and

zinc-silver zone, will provide proven and probable gold reserves of 35.6 million

mt at 4.5 g/t, or 5.2 million oz. According to AEM management, there will be some

gold production overlap between the existing LaRonde and LaRonde II operations;

however, La- Ronde II’s mission is not to augment production but to extend

it—adding at least 10 years to LaRonde’s mine life after production

commences in 2011. Anticipated average gold production is 320,000 oz/y at total

cash costs of approximately $230/oz. Annual byproduct output when full production

is reached in 2013 is expected to average 670,000 oz of silver, 4,000 mt of copper

and 8,600 mt of zinc.

At LaRonde, all ore is hoisted to the surface via the 2,250-m-deep Penna shaft,

which was commissioned in 2002. This shaft is dimensionally small at 5.5 m diameter

but is able to handle as much as 9,000 mt/d, according to company officials. Direct

access to the LaRonde II ore from the Penna shaft wasn’t possible, and rather

than sinking a 3,000-m shaft from the surface, AEM chose to sink a winze, collared

at the mine’s level 206 and extending to a depth of approximately 2,900

m; that task will begin in the third quarter of this year. A series of ramps will

enable mining down to about 3,100 m. The “Penna winze” will handle

between 5,000 and 6,000 t/d of ore, which will be transferred to the main shaft

for hoisting to the surface. Methods used to mine the LaRonde II ore will be the

same as currently used in LaRonde, predominantly transverse longhole stoping with

delayed cemented backfill. The informal demarcation line between LaRonde and LaRonde

II is at the mine’s 245 level. Along with many other major elements of LaRonde

II development, the new mine’s ventilation system will take advantage of

existing infrastructure wherever possible, but will require some new facilities.

The system will provide 1,350,000 cfm and will employ two ventilation raises—at

6.7 m and 3.4 m diameter—along with expanded capacity at the existing surface

refrigeration plant and a new 4.5 MWR-rated underground plant on mine level 146

to maintain air temperatures in LaRonde II at a level comparable to that which

miners experience in the shallower LaRonde workings.

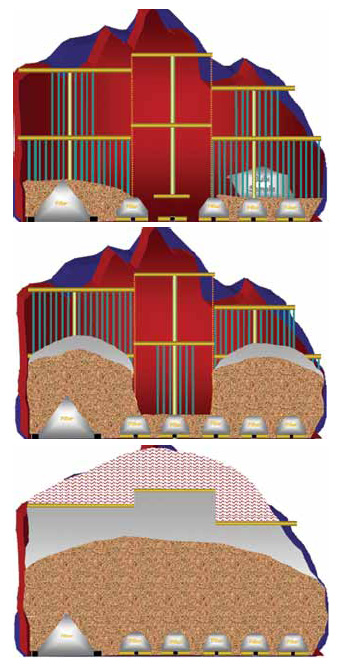

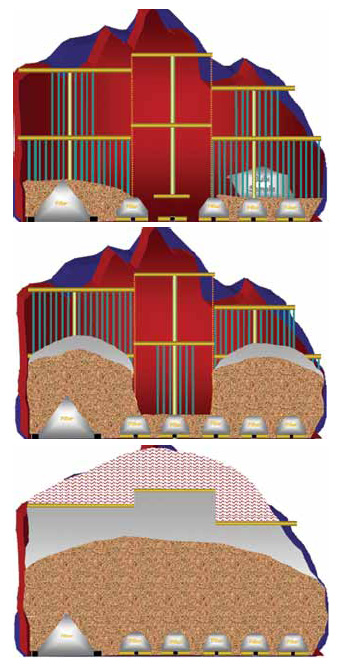

Mining sequence at Goldex, longitudinal view (top to bottom).

Mining sequence at Goldex, longitudinal view (top to bottom).

Developments are Close to Home…

AEM says its $135-million Goldex project in Quebec’s Val d’Or- Bourlamaque

mining district qualifies as the largest undeveloped gold deposit in northwestern

Quebec, with proven and probable gold reserves of 1.7 million oz from 22.9 million

mt grading 2.3 g/mt. Average annual production is pegged at 170,000 oz/yr with

total cash costs of about $225/oz. It is the most advanced project in AEM’s

pipeline and is scheduled to begin production during the second half of 2008.

At the time of E&MJ’s visit, the mine’s surface compressor building,

warehouse, service and mill buildings were completed; while underground, approximately

one-third of the lateral development and more than 50% of the ventilation raising

was completed. The production shaft is currently down to a depth of 336 m, towards

a final planned depth of 857 m, and shaft sinking is advancing at a rate of about

3 m/d. Mine ventilation will require two 500-hp fans, both installed at the 38

level. The mining method will primarily involve longhole open stoping (see figure

at left). As part of its underground fleet, AEM will employ several Caterpillar

Underground R2900 XTRA 12-yd3 LHDs. These 378-hp, 123,000-lb units—among

the largest currently available—are scheduled for delivery in fall 2007.

AEM describes Goldex ore as “metallurgically simple” and highly amenable

to gravity recovery. The Goldex mill will include one 24-ft x 12.25-ft, 4,500-hp

SAG mill; a 16.5 x 27-ft, 4,000- hp ball mill; three 6 x 16-ft vibrating screens;

three 48-in., 60- hp Knelson Concentrators; and three GT-1000 Gemini shaking tables;

along with a flotation circuit comprising one 40-m3- capacity conditioner tank,

six 38-m3-capacity flotation cells; and one 30-m3-capacity column cell. AEM estimates

that between 60% and 65% of the gold will be recovered by the gravity section.

The sulphide concentrate produced by the flotation section will be hauled by truck

to the LaRonde mill for processing. Gold production at Lapa is expected to begin

in the fourth quarter of 2008, drawing upon reserves that are estimated at 1.2

million oz, sufficient to support an estimated annual production of 125,000 oz/y

at total cash costs of approximately $210/oz. A seven-year mine life is expected

with capital costs of approximately $90 million. The Lapa shaft is currently at

a depth of 1,100 m, nearing its ultimate depth of 1,370 m, and averaging 2.7-2.8

m/d advance. Significant shaft station work and lateral development have also

been completed. Once in production, Lapa will employ the “Eureka”

vertical longhole stoping/cemented backfill mining method used at LaRonde. At

the time of E&MJ’s visit, AEM was still weighing its options regarding

construction of an on-site mill to process Lapa ore, or transporting the ore to

the LaRonde mill for treatment. The LaRonde mill is in the final stages of a flotation-circuit

upgrade designed to increase copper and zinc recovery by an estimated 2%–3%.

The mill currently receives about 2.6 million mt/y ore, has a rated capacity of

8,200 mt/d, and operates at an average 95% availability level. Major elements

of the mill include a 24 x 13-ft SAG mill and 14 x 28-ft ball mill in the grinding

section; copper and zinc flotation circuits; concentrate handling and loadout;

cyanidation and CCD circuit; and a Merrill-Crowe precious metals circuit. Addition

of enhanced copper recovery capacity in the flotation section will decrease downstream

cyanide consumption and reduce associated environmental concerns.

…and Further Afield

Jumbo drill rig at Agnico-Eagle’s LaRonde mine.

Jumbo drill rig at Agnico-Eagle’s LaRonde mine.